The Daily Dish

May 1, 2025

Not Much Pomp and Circumstance for Grads Entering the Labor Market

Graduation season is only a few weeks away, but transitioning from the classroom to the labor force may be a sobering experience for many new grads as a weakening labor market sours the pomp and circumstance that customarily marks the occasion.

Data from the Bureau of Labor Statistics showed that there were 1.2 million fewer job openings in March 2025 than there were in January 2024. In the first three months of 2025, the number of job openings plunged by 570,000, and the ratio of the number of job openings per unemployed person halved from 2.0 in March 2022 to 1.0 in March 2025.

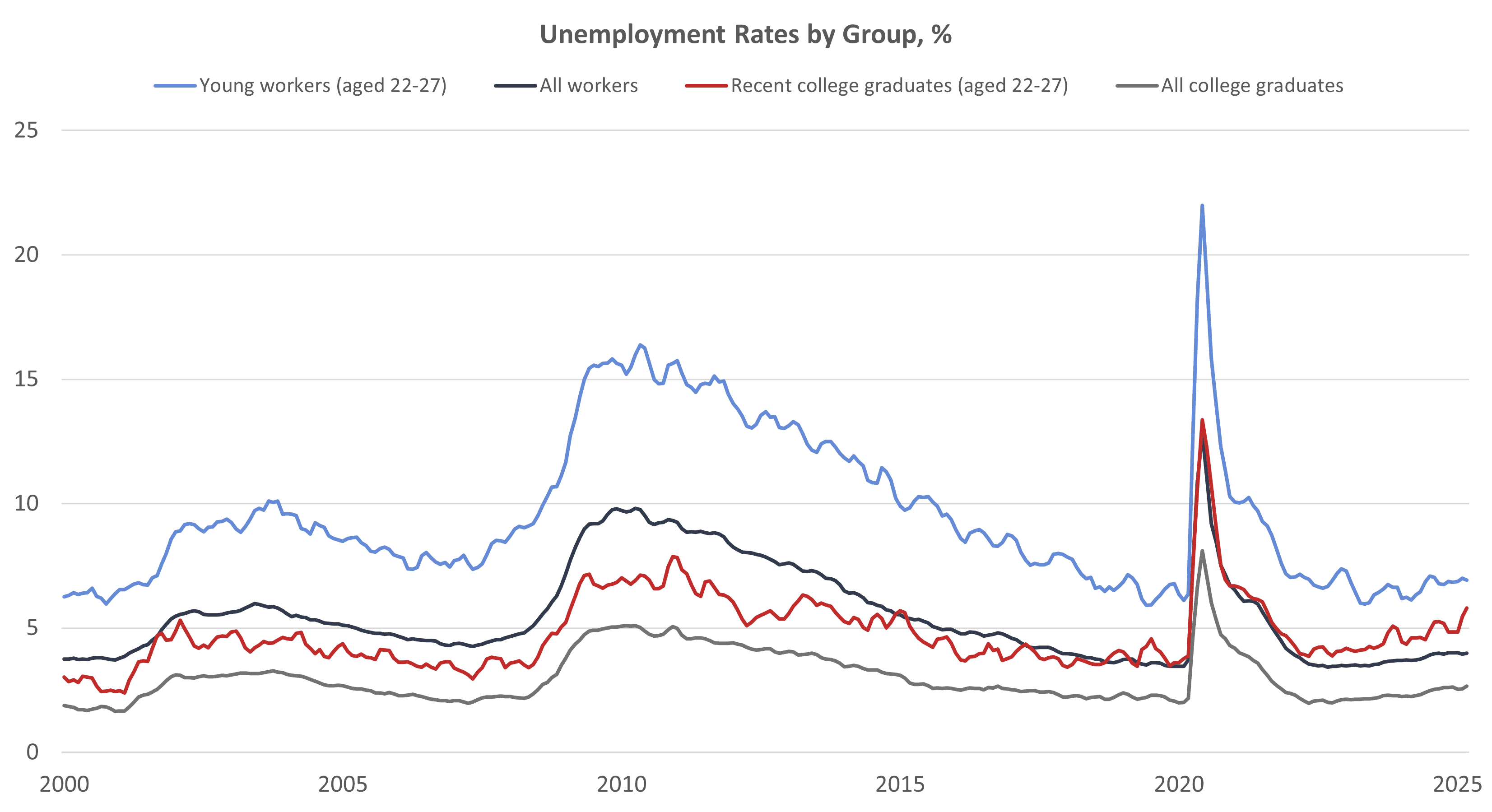

Data compiled by the Federal Reserve Bank of New York added to the dreary outlook for recent college graduates. The data in the graph below show that the unemployment rate for recent college graduates steadily climbed from 4.4 percent in January 2024 to 5.8 percent in March 2025, higher than the unemployment rate for all college graduates and the overall unemployment rate. The rate of change in the recent college grad unemployment rate has outpaced that of the other categories. Excluding the COVID-19 pandemic period, the unemployment rate for recent college graduates was the highest since October 2013.

The New York Fed also reported that even after receiving that shiny new diploma, recent college graduates are largely unable to find a job that requires one. The level of underemployment reached 41.2 percent in March. In other words, about two-in-five recent college graduates have a job that typically does not require a college degree. The underemployment rate was the highest since early 2022 and nearly 8 percentage points higher than all college graduates.

As parents descend to college towns across the country, they may need to rethink that home office or in-home gym that replaced Junior’s bedroom when he went off to college. As the job market is expected to slow further, he may need that old room.

Freddy’s Forecast: April Jobs

The March jobs report showed employers added 228,000 new hires to their payroll, much stronger than markets expected. The unemployment rate ticked up a tenth of a percentage point to 4.2 percent, matching the upper bound of the narrow range of 4.0 percent to 4.2 percent where it has been since May 2024. Average hourly earnings increased 0.3 percent during the month for an annual gain of 3.8 percent.

Much has happened since the last employment report: Liberation Day, a pause of Liberation Day, suggestions that more tariffs may be on the horizon, and hints of potential deals with major trading partners. The magnitude and breadth of tariffs immediately roiled financial markets and sent stocks, bonds, and the U.S. dollar lower. The rapid pace of change has led to the highest level of economic policy uncertainty since the COVID-19 pandemic.

Consumer and business survey data have since deteriorated and are slowly showing up in the hard data. The advanced reading of Q1 GDP showed negative growth for the quarter as businesses and consumers ramped up imports ahead of tariffs. Also dragging on GDP growth was a meaningful weakening in consumer spending, which fell to 1.8 percent in Q1 from 4.0 percent in the final quarter of 2024. The dip in spending suggests consumers may be starting to tighten their belts as they anticipate higher prices and slower economic growth.

Data from payroll processor ADP could be the first sign that the uncertain business environment is weighing on hiring decisions, as private employers added just 62,000 workers in April. What had been a leader for much of the post-COVID recovery, the education and health services sector shed 23,000 jobs during the month.

High frequency data from the Labor Department showed that initial claims jumped by 18,000 in the week ending April 26 to 241,000. It was the highest level of initial claims since the week ending February 22.

Challenger, Gray & Christmas reported that announced layoffs dropped 62 percent in April from March but showed that layoffs were broader based. The report indicated that employers were slowing hiring plans amid policy uncertainty.

The survey week for the April employment report was the week immediately following President Trump’s Liberation Day tariff announcement. The market volatility and heightened economic uncertainty could have a negative effect on the topline number as many firms likely adopted a “wait-and-see” approach. Expect payrolls to expand by 95,000 during the month while the unemployment rate breaks out of its narrow range, ticking up to 4.3 percent. Growth in average hourly earnings will hold steady at 0.3 percent.