The Daily Dish

May 15, 2019

One Cheer for Social Security 2100

Eakinomics: One Cheer for Social Security 2100

Eakinomics regularly decries the continued inaction on the fiscal outlook, in general, and entitlements, in particular. So I would be remiss if I did not acknowledge a very serious effort, the Social Security 2100 Act, by Congressman John Larson of Connecticut.

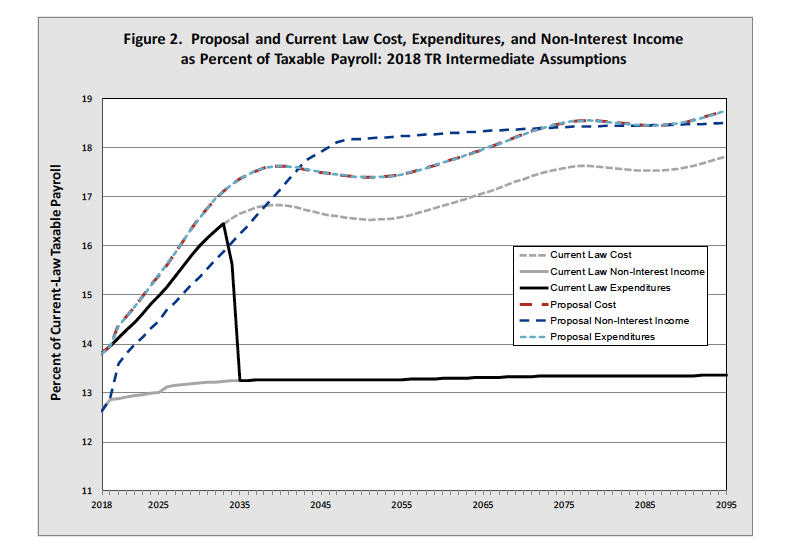

The essence of the Social Security problem is outlined in the chart below (reproduced from the Social Security Actuary’s report on the proposed legislation). Under current law, “current law cost” (the cost of promised benefits and program administration) and “current law expenditures” (the cost of payable benefits and program administration) rise above “current law non-interest income” (payroll taxes) steadily. The gap, measured as a fraction of taxable payroll, is a bit over 3 percentage points in the early 2030s. It is filled by cashing in bonds in the Social Security Trust Fund.

When the trust fund is exhausted in 2035, however, benefits have to be cut back to the level of payroll tax revenues. This is an approximately 20-percent, across-the-board cut in benefits for people who are already in retirement, independent of their economic affluence. The big divergence between “current law cost” and “current law expenditures” in the chart reflects this dynamic. This outcome is a disgraceful way to run a pension system, and it transforms Social Security from a source of income security to a locus of income insecurity. Congressman Larson sets out to rectify this problem, and he deserves applause and credit for his effort.

Unfortunately, I’m not as wild about his proposed solution as I am about his steadfast willingness to pursue it. The essence of my reservations is the blue and red line for the proposal’s cost and expenditures. Notice that beginning immediately and for as far as the eye can see (or the printer can graph, or something), Social Security 2100 promises much richer benefits than the current system.

Defenders of the proposal will be quick to note that this is not another progressive scheme to promise the world but not put in place the revenue to meet that promise. No. As the “Proposal Non-Interest Income” line shows, payroll taxes get raised as much (and sometimes more) than benefits.

I have two objections to this strategy. First, the basic notion of addressing overpromising by promising even more is silly on the face of it. Imagine what the budget would look like if this strategy were replicated for Medicare, Medicaid, the Affordable Care Act, and other entitlements!

Second, the idea of sharp increases in payroll taxes is problematic. I’m not arguing for some doctrinaire “no new taxes” position. Instead, it is a matter of common economic sense to keep any tax increases as small as possible. And it may be the case that some other areas of the budget will need a portion of the revenue increase (e.g., Medicare). Why devote it all to Social Security?

Larson’s bill is a serious proposal that stands in sharp contrast to the pure politics of most legislation and the budget fantasyland of the presidential primary. But it is not the right way to go. One cheer for Social Security 2100.

Fact of the Day

Mandatory spending will account for 65 percent of the federal budget in 2029.