The Daily Dish

January 13, 2017

People are Policy; FSOC Edition

On Wednesday the House of Representatives passed the Regulatory Accountability Act which aims to reign in the powers of federal agencies. The bill would give Congress more control over federal agencies by putting a ceiling on regulatory costs. Regulatory reform is a key goal of the new Congress and is a key part of President-elect Trump’s economic agenda.

Yesterday the American Action Forum (@AAF) released a new primer on the U.S.’s nuclear waste disposal policies. AAF notes that the U.S. has close to 70,000 metric tons of spent nuclear fuel, and that the incoming administration has an opportunity to determine how it is disposed of. AAF finds that by resuming the licensing process for Yucca Mountain the U.S. would be able to reduce government nuclear waste liabilities, which may currently range between $29 and $97 billion.

Eakinomics: People are Policy; FSOC Edition

The Financial Stability Oversight Council (FSOC) is a policy disaster. Part of the Dodd-Frank (D-F) reforms, it is the U.S. version of a “macroprudential regulator” devoted to controlling systemic risk. As a matter of principle, there is no single, simple way to measure systemic risk, so it is a difficult task to evaluate FSOC’s job performance.

Moreover, since the economic cost of eliminating systemic risk entirely is prohibitive, the goal will be to get the “right” amount of systemic risk. FSOC can’t measure progress and doesn’t know its target – two good reasons that the U.S. may wish it left macroprudential regulation in the land of academic theories.

In practice, its real failure has been the designation of non-bank Systemically Important Financial Institutions (SIFIs). The FSOC process for designating a non-bank SIFI needs an improved analytic foundation, an infusion of quantitative analysis, a respect for other regulators, concern for upsetting the competitive balance in financial products, and a clear path to remove a SIFI designation.

The FSOC began with banks, moved to designating insurance companies (AIG, Prudential and MetLife) and was seemingly poised to march on the asset managers. This institution-by-institution approach missed the key issue: what specific activities or practices generate systemic risk? Activities-based regulation is more comprehensive as it will identify all of the market participants engaged in an activity that could pose a threat to stability. This is better than singling out one or a few large firms or funds for designation.

FSOC also relies too much on hypothetical inquiries and improbable scenarios in its designation process. The focus instead should be shifted toward those risks that have transpired historically and should be informed by their historic size and frequency.

Finally, a SIFI designation cannot be a mandatory, lifetime sentence with no chance for parole. The FSOC must create a process that would permit a firm to address risks to avoid designation. In addition, SIFIs should have a way to “de-risk” after designation, allowing an exit ramp from SIFI status.

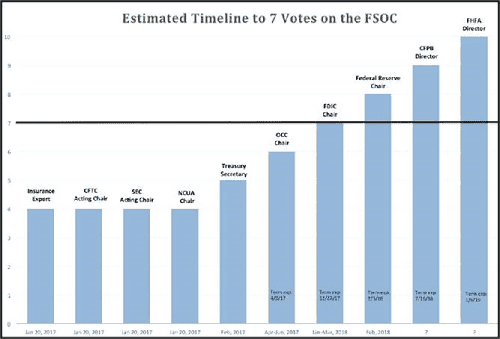

For all of these reasons (and more), I have hoped that Dodd-Frank might be repealed or reformed. However, there may be another route forward: the appointments process. The FSOC is composed of 10 voting members, and 7 votes are needed to carry an issue. As shown below, it will be possible for the incoming administration to reach the critical 7 vote threshold by the end of 2017.

This suggests that attitudes toward FSOC should be an important criteria for presidential appointees. It also suggests that a newly-constituted FSOC could change the way it operates to deliver better policy outcomes even in the absence of reforms.

Fact of the Day

Removing all undocumented immigrants would shrink the economy by nearly 6 percent or $1.6 trillion