The Daily Dish

June 14, 2021

Recent Trends in Productivity and Costs

Eakinomics: Recent Trends in Productivity and Costs

The recent attention on inflation pressures and the inability of firms to hire intersect at the phenomenon of labor productivity. Faster productivity growth would permit firms to offset the presence of fewer workers, while maintaining growth in output and sales. Similarly, productivity growth can somewhat offset rising input costs and ease inflation pressures. Of course, over the longer term productivity growth is the foundation of rising real wages and increases in standards of living.

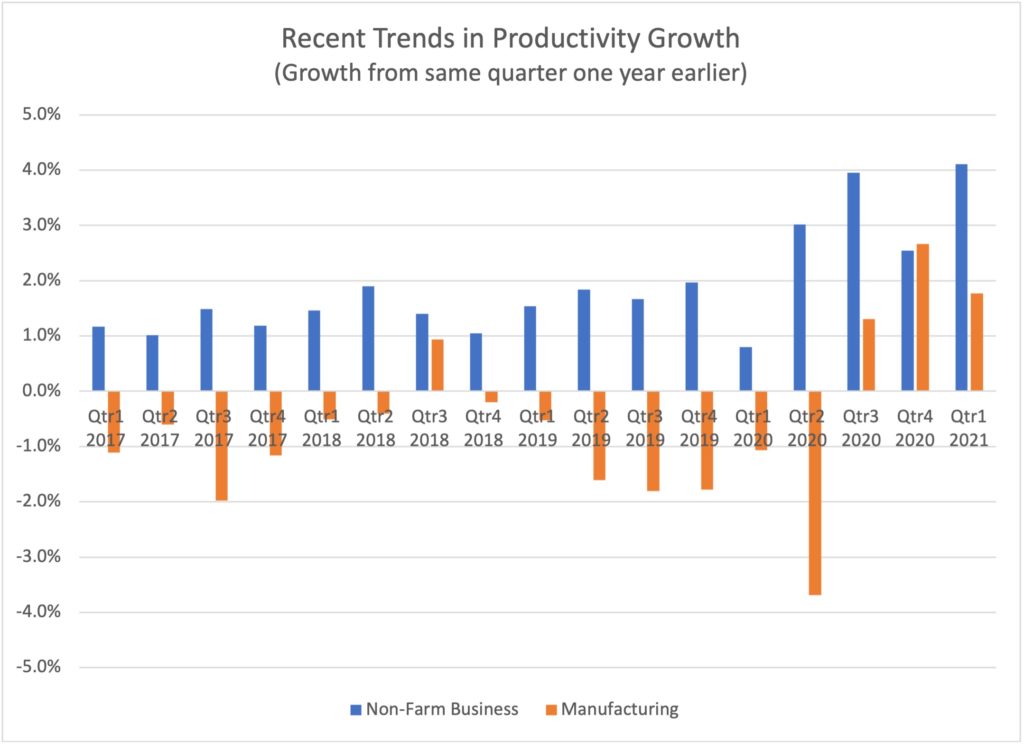

The chart below shows productivity growth since 2017 in the broad non-farm business sector (blue bars) and the manufacturing sector (orange bars). There are three striking patterns. First, non-farm productivity appears to have up-shifted from 2 percent or slower to 3 percent or above in the past year. Second, and even more striking, manufacturing productivity was consistently sub-zero until the past three quarters. Finally, the patterns of higher productivity growth over 2020 stand out.

Productivity growth is notoriously procyclical, which would lead one to expect a big decline in the 2nd quarter of 2020 and a recovery as the economy rebounded. This is exactly the pattern one sees in the manufacturing data. The larger non-farm sector (which includes the hard-hit service sector) shows no such cyclicality.

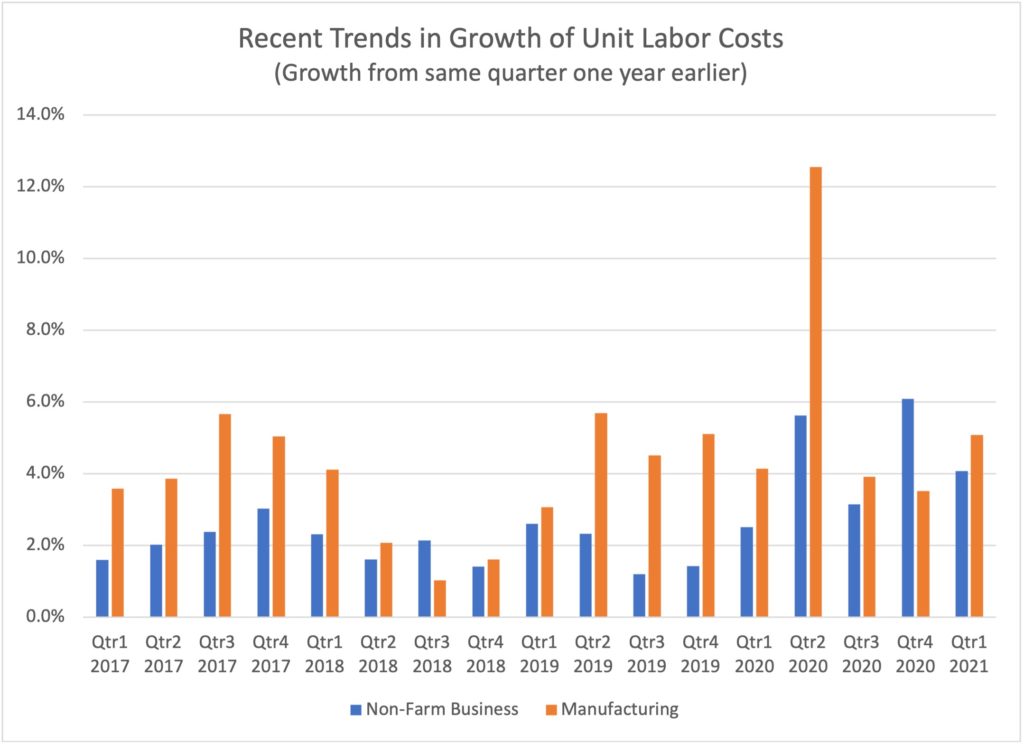

The relatively strong recent growth in productivity raises the hope that recent price pressures in the supply chain will not raise overall costs and produce consumer price inflation. The next chart (below) provides little comfort on this front. Over the longer period there is a noticeable uptick in the growth of unit labor costs, especially in the past year. Meanwhile, the more procyclical manufacturing sector saw a spike in the growth of unit labor costs in the 2nd quarter of 2020, on top of a steady pressures over the past five years.

The bottom line is that the recent growth in productivity is good news. But it is not enough good news to remove concerns about the near-term path of inflation.

Fact of the Day

As of June 2, the Federal Reserve’s assets stand at $7.9 trillion.