The Daily Dish

December 10, 2018

Recession Warning from Residential Housing?

Eakinomics: Recession Warning from Residential Housing?

The housing sector has traditionally been a good leading indicator of the near-term path of the economy. The sequence that goes into building delivers a fair amount of information during the time to sales: (a) get a permit to build, (b) start building, (c) undertake the construction, and (d) sell the unit. Not only does looking at permits and starts tell a bit about future construction, it also gives an insight into future manufacturing of heating and cooling systems, appliances, carpeting, fixtures, and the like. In short, housing has been a useful shortcut for gauging the outlook for the goods economy.

So the recent data on housing permits and starts is a bit disconcerting. Permits are down 6 percent from one year ago. The decline has been especially large in the West region, while only the South (up 0.2 percent) has grown in the past year. Housing starts tell a similar story, down nearly 3 percent from a year ago. This decline, however, is concentrated in the Northeast (down a sobering 40 percent), and South (down a bit over 3 percent). This is hardly the kind of performance one would like, especially in the midst of a strong economy with future rate hikes baked in the cake.

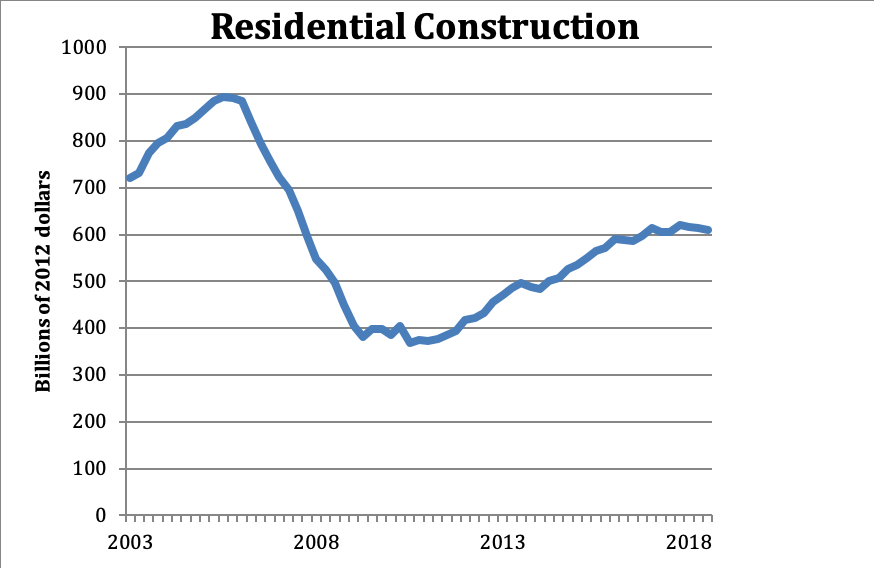

That is the bad news. The good news is that it might not matter as much anymore. As jumps out in the chart (below), residential construction looks nothing like it did in the past. The level of construction activity has recovered from the worst of the Great Recession, but it still remains one-third below the peak of the housing bubble frenzy.

Moreover, the sector is a much smaller part of the consumer economy than in the past. A slowdown in housing simply means less – but not zero – compared to the past.

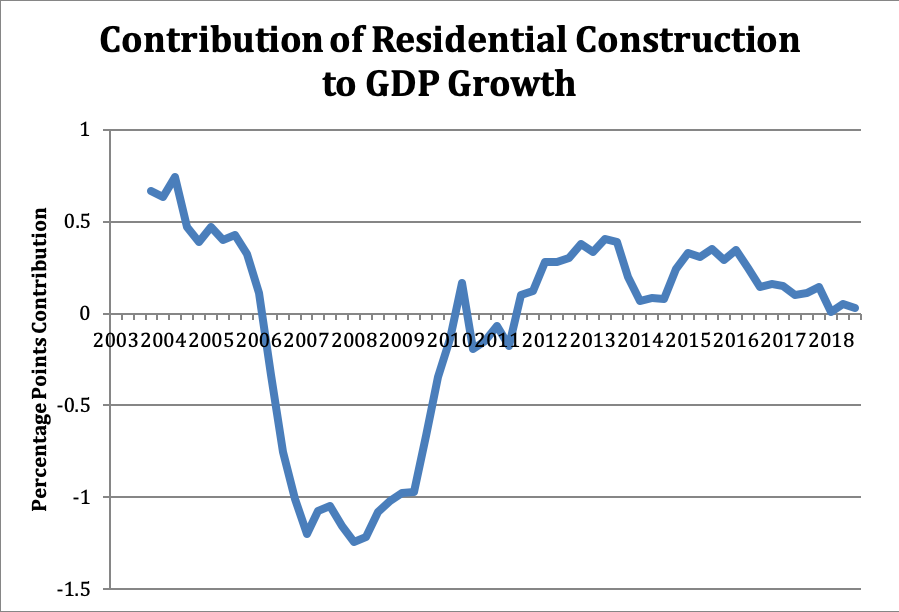

Another way to see this is shown below. The graph displays the contribution of residential construction to overall growth in gross domestic product (GDP). During the heady days of the housing bubble, home building added over 0.5 percentage points of growth – at present it is hovering near zero. But even at the post-recession peak, the housing sector constituted a much smaller engine of growth – during the post 2009 recovery, it contributed 0.12 percentage points on average.

The upshot is that the housing sector is struggling. But the economy continues to grow strongly nevertheless and, in the absence of other headwinds, will probably continue to do so.

Fact of the Day

Premiums for benchmark plans from 2018 that are still offered in 2019, even if not as the benchmark, rose by an average of 5 percent—the lowest average increase since the ACA marketplaces began operating.