The Daily Dish

November 23, 2021

Should You Fear Fiscal Drag?

The federal government has done a lot recently to support near-term economic growth – the CARES Act in March 2020, the Consolidated Appropriations Act in December 2020, and the American Rescue Plan (ARP) in March 2021, to be specific. Indeed, since the $1.9 trillion ARP contributed enormously to the current inflation dilemma, the federal government has done too much recently to support near-term growth.

Nevertheless, the newest drumbeat from the White House and observers holds that somehow getting off the stimulus kick will lead to recession risks in 2022. Notice that this logic implies that the government must do perpetually more and more, or the economy will not continue to grow. (As an aside, a characteristic of progressives is that they have no faith in private enterprise; the government is the source of all desirable economic outcomes.) Is this right?

No.

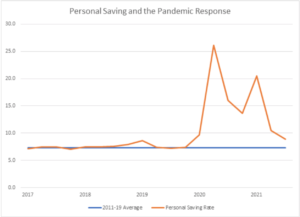

First, using the budgetary outlays from the pandemic response gives a very misleading image of the impact of fiscal policy on total demand. The graph at the bottom compares recent moves in the personal saving rate (orange line) to the average saving rate over the 2011-2019 period (blue line). As the graph clearly displays, with the arrival of the large-scale federal response to the pandemic, the saving rate soared from its average of 7.3 percent to over 25 percent. It remains elevated through the third quarter of this year.

If one defines the “excess saving” as the saving above the normal rate, the cumulative excess saving in 2020 and 2021 totals $2.4 trillion – nearly the combined $2.8 trillion size of the Consolidated Appropriations Act and ARP. As a result, much of the fiscal impulse will be shifted into 2022 (and perhaps beyond). There is no reason to fear fiscal drag when the household sector has the wherewithal to support demand.

And it will get even more support from the strong labor market. Thus far in 2021, the index of weekly payrolls has grown at an annual rate of 9.7 percent. That is, the aggregate labor income due to a rising number of workers, additional hours per worker, and rising average hourly earnings is growing at a nearly 10 percent clip. This will generate more than a trillion dollars in new wages and salaries over 2022. This is precisely the mechanism by which the private sector generates growth in the economy.

Finally, although a bit harder to quantify, is that state and local governments are flush with cash from the federal support and strong revenue growth.

The economy is well-positioned to continue to grow next year. The federal government did (and overdid) fiscal policy in the past two years. It is time to hand the baton to the private sector.

Fact of the Day

Across all rulemakings this past week, agencies published $6.5 billion in total net costs and added 1.4 million annual paperwork burden hours.