The Daily Dish

September 18, 2023

Strength of the Consumer Spending

This past Thursday the Census Bureau released the retail sales report for August. Retail sales rose 0.6 percent from July to August, a seemingly robust 7.4 percent annual rate. But sales were only up 2.5 percent from August 2022, a period over which the Consumer Price Index (CPI) rose 3.7 percent.

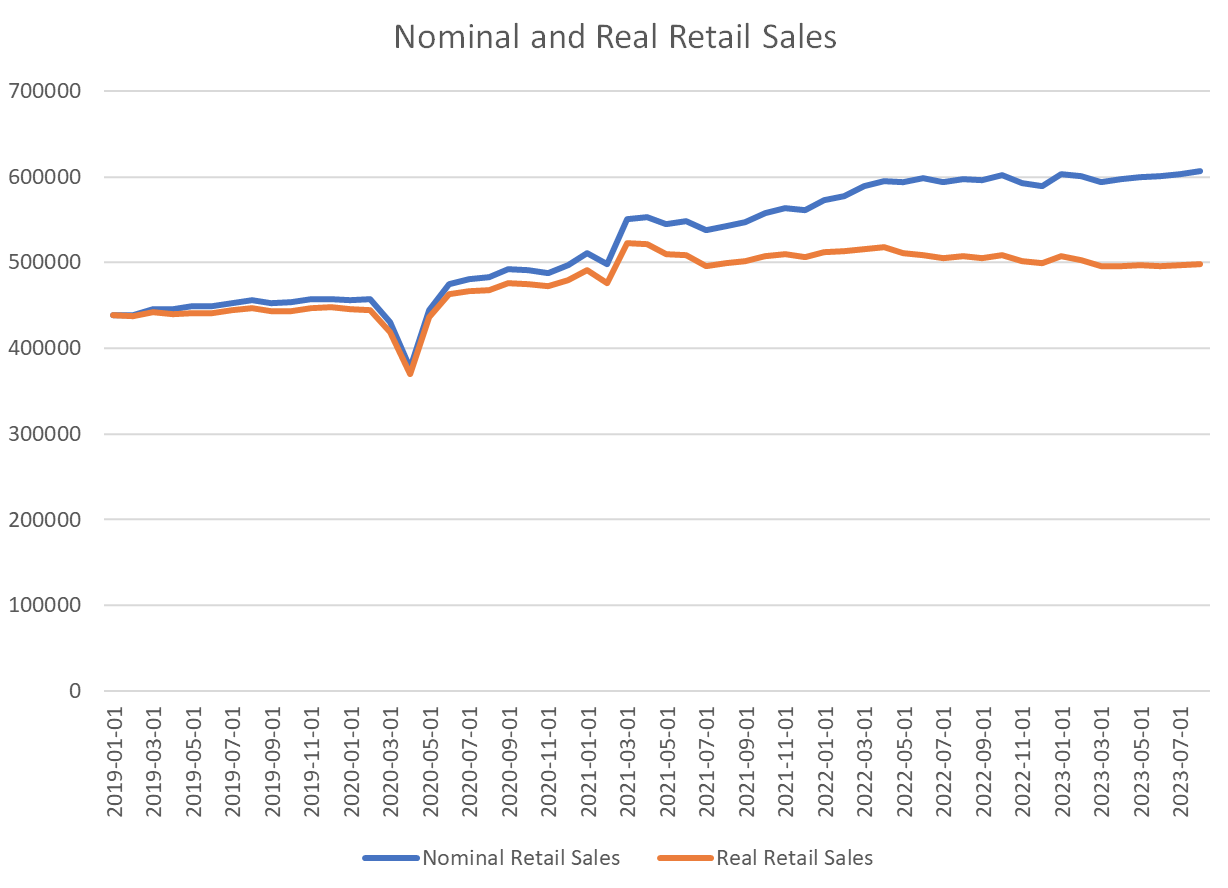

This pattern holds more generally. The graph below compares nominal retail sales (blue line) with real, inflation-adjusted retail sales (orange line) since the start of 2019. Viewed in isolation, the level of retail sales is roughly in line with trends extrapolated prior to the pandemic.

Unfortunately, the real story of the post-pandemic period is inflation. As the orange line vividly demonstrates, the higher level of retail sales in the blue line is simply paying for the same level (or less) of real retail sales.

This chart is a reminder of the importance of business investment spending to the near-term economic outlet. Why business spending? First, in every post-war recession except the pandemic recession, the downturn has been led by a decline in business fixed investment, with household spending following with a lag of a quarter or two. Second, right now the household sector is managing to keep spending, but only by steadily lowering its savings rate. If businesses start pulling back, it could easily pull down the earnings and spending in the household sector.

The Federal Reserve’s Open Market Committee meets Tuesday and Wednesday. While it is a foregone conclusion that it will leave the stance of monetary policy unchanged, there will be a lively discussion of just how fragile the U.S. economy remains.

Fact of the Day

Department of Labor estimates its proposed rule raising the income threshold for overtime pay will cost employers roughly $6.5 billion.