The Daily Dish

December 7, 2022

Surveying the Housing Market

As Eakinomics has discussed previously, Federal Reserve anti-inflation efforts run through the housing markets. In the most recent report on the Consumer Price Index, year-over-year shelter inflation rang in at 6.9 percent and has been up every month since early 2021. More generally, slowing the demand for houses and apartments is a sure-fire way to reduce the construction of houses and apartments – and reduce the demand for furnaces, ovens, carpeting, and everything else that goes into a new house or apartment.

Conveniently, Thomas Wade has released the most recent version of his Housing Chartbook – an easy way to keep up with housing market developments.

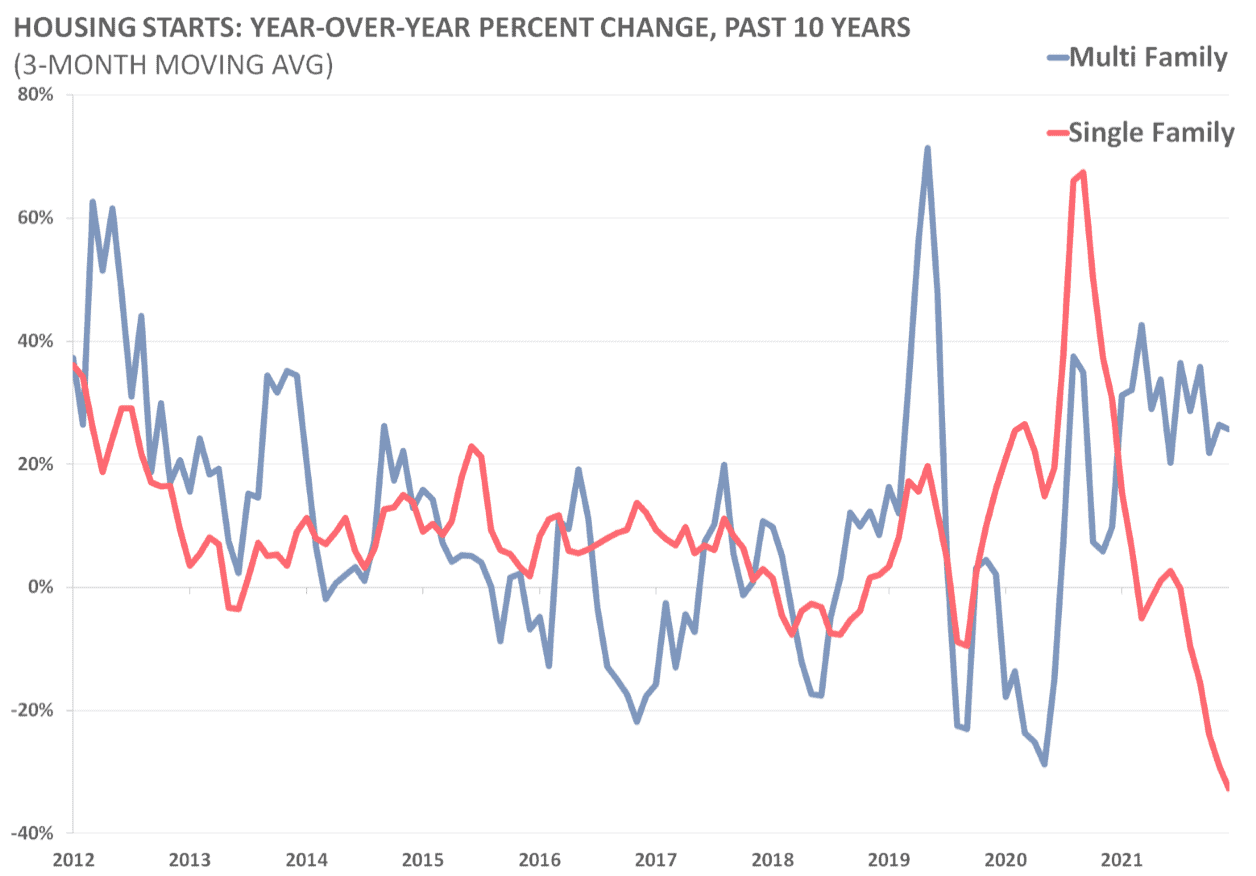

The Fed has moved its target range from 0 to 4 percent in 2022 (and is widely expected to go further north at its December meeting). What has the impact been? Obviously, mortgage rates are up sharply. As expected, this has fed through to the incentives for new construction; housing starts have dipped sharply, especially for single-family homes.

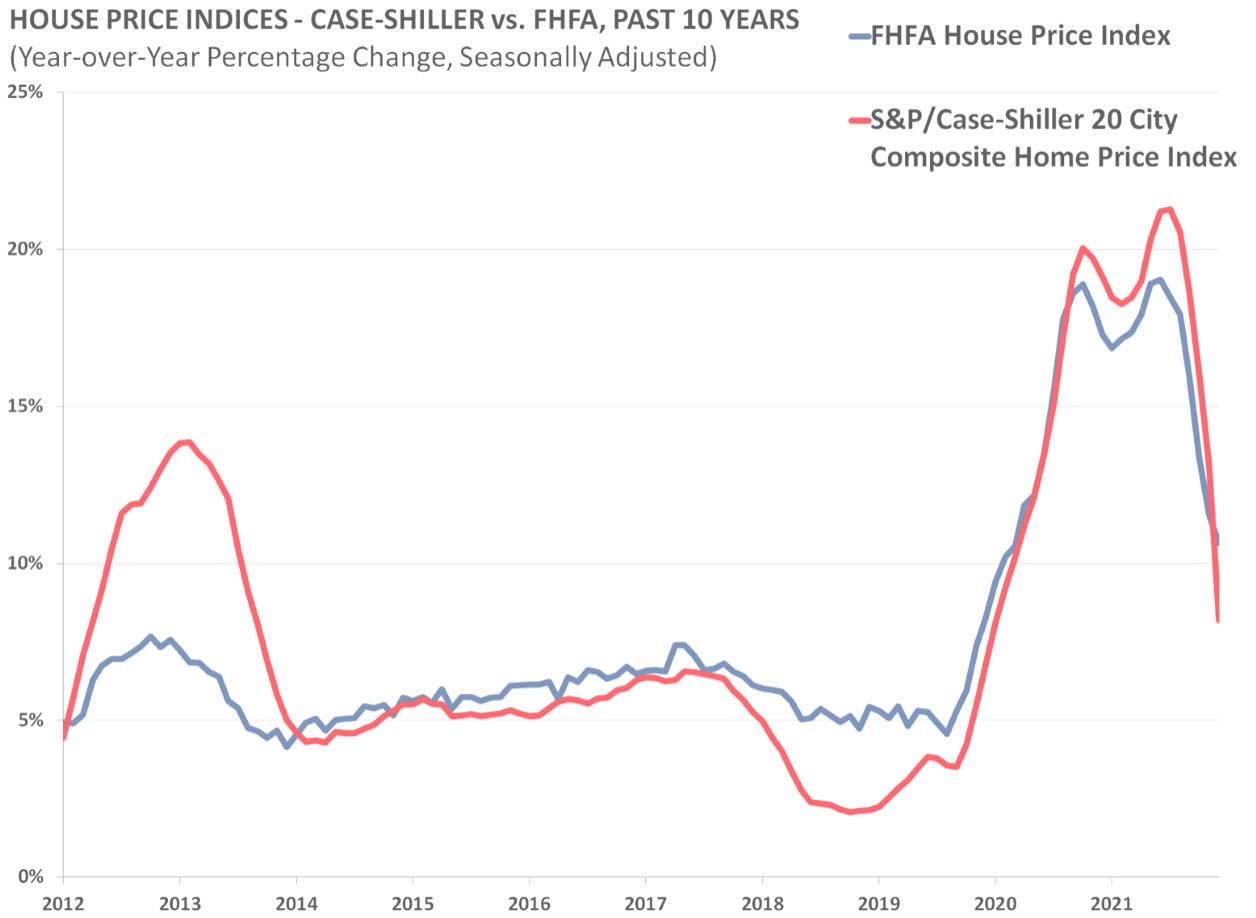

This has coincided with a reversal of the pace of year-over-yar increases in home prices across the country. For the past three months, the overall measures of house prices have actually fallen.

In short, the Fed’s painful medicine has “worked” and the surge in demand for housing appears to have been reversed. This is very different than the previous housing correction, which featured widespread damage to household finances. In this case, delinquencies remain low. This suggests that existing homeowners are well positioned to survive any short-turn duress that the tightening cycle might bring.

The final, yet-to-be-seen step in this process will be falling shelter inflation. Because leases are an annual event, moderation of rent increases shows up with a lag. One should expect this component to change its trajectory in the first half of 2023, adding to the broader moderation in goods-price inflation that appears to be underway, and showing up as noticeable success in the Fed efforts to bring down inflation.

Fact of the Day

Under the proposed Joint Employer Standard and the Employee or Independent Contractor Classification rules, franchisors would face an additional $4.9 million per hour in combined employment costs.