The Daily Dish

March 28, 2024

Tax Rate Games

The Washington Post reports that the Biden campaign is planning to tout its efforts to levy new taxes on America’s most affluent. One way to sell such proposals is to make it appear as if the affluent are undertaxed (or evading taxes). In his State of the Union speech, the president asserted: “I’m a capitalist. If you want to make or can make a million or millions of bucks, that’s great. Just pay your fair share in taxes. No billionaire should pay a lower federal tax rate than a teacher, a sanitation worker or a nurse.”

This followed on the heels of the president asserting that there are “a thousand billionaires now and you know what their average tax rate is? 8%.” PolitiFact reviewed this assertion and concluded: “we rate Biden’s statement False.”

What is going on? How can one decide whether to believe a tax rate claim? As it turns out, there are three related concepts that get mixed, matched, and mutilated: the average tax rate, the marginal tax rate, and the tax share. Let’s look at these in turn.

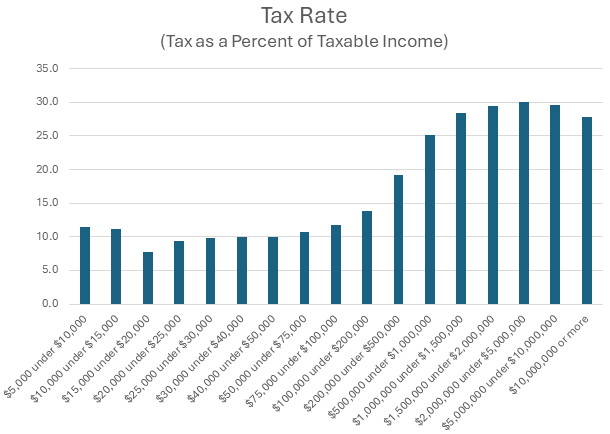

To begin, the average tax rate is simply the total taxes paid divided by the taxable income – the tax base. The chart below shows Treasury data from tax year 2021 on average tax rates classified by adjusted gross income (AGI). For taxpayers as a whole, the average tax rate was 19.2 percent. As the figure indicates, average tax rates varied from just below 10 percent to 30 percent.

And the affluent have (on average, if not perfectly) higher, not lower, average tax rates.

So, how does the president’s team get to 8 percent? The key is to mix the actual tax payments in the numerator but put an imaginary tax base in the denominator. In his case, the denominator includes the value of unrealized capital gains. This has (at least) four flaws: 1) The income tax applies only to realized capital gains, so it is not current law and has nothing to do with current law tax rates; 2) it is the total value of unrealized gains, which is a wealth concept and mixing income and wealth taxation is an analytic rookie error (or deception); 3) it may not be constitutional to tax wealth; and 4) wealth accumulates over time, so this is mixing a single year’s tax payments with many years of resource flows.

There are many variations on this theme, typically cherry-picked to get the answer someone is looking for.

The second type of tax rate is a marginal tax rate. It is the answer to the question: “If I earn an additional $1, how much more will I pay in tax?” For the federal income tax in 2023, the marginal tax rates run from 10 percent for low-income individuals to 37 percent for higher-income individuals. Marginal tax rates can also vary a lot, especially by source of income. But the key is that while fairness is the focus of average tax rates, economic incentives are the focus of marginal tax rates. Confiscatory marginal tax rates are a good way to shut down economic activity.

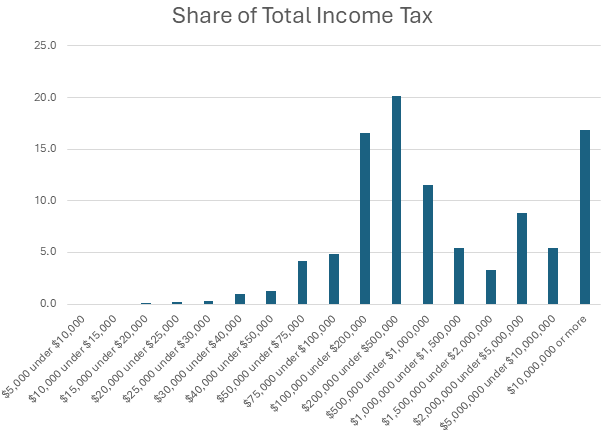

The final concept is tax shares. This is simply the taxes paid by an individual (or group) as a share of total taxes paid. Tax shares for the income tax are shown below. Looked at in this way, the U.S. income tax is highly progressive, with a relative handful at the top paying nearly 20 percent of the taxes and those above $500,000 paying more than 50 percent of the tax.

With this primer, Eakinomics readers are now prepared for an election season full of fallacious tax “facts.”

Fact of the Day

Borrowing from the public would increase as a share of the economy under the President’s Budget, rising from 97.3 percent of GDP in FY2023 to 105.6 percent of GDP in 2034.