The Daily Dish

November 29, 2017

Tax Reform and the Standard of Living

Eakinomics: Tax Reform and the Standard of Living

Among the most contentious issues surrounding tax reform is its impact on the middle class. Too much of this discussion has centered on specific provisions in the tax reform itself – child credits, standard deductions, tax brackets, and so forth.

Instead, the real promise of tax reform for the middle class is the pro-growth incentives. Those incentives – embedded in the corporate and pass-through entity reforms – are intended to shift tax-based incentives to favor innovating, investing, hiring, and paying better in the United States.

The basic notion is simple: Better incentives (lower tax rates, the ability to write off investments, taxation only on earnings in the United States) increase the accumulation of tangible and intangible capital in the United States. These provisions lower the cost of capital for firms. As my co-authors and I argued in the Wall Street Journal, “There is some uncertainty about just how much additional investment is induced by reductions in the cost of capital, but based on an extensive body of scholarly research, many economists believe that a 10% reduction in the cost of capital would lead to a 10% increase in the amount of investment. Simultaneously reducing the corporate tax rate to 20% and moving to immediate expensing of equipment and intangible investment would reduce the user cost by an average of 15%, which would increase the demand for capital by 15%.”

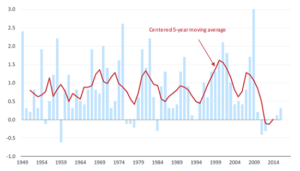

Step two in the argument is that more capital raises productivity. Here the recent performance of the economy has been dismal. Figure 1 (reproduced from Figure 2 from the Council of Economic Advisers) shows the contribution of “capital deepening” – having more and better capital – to productivity growth. Since 2011, the contribution has hovered around zero. A goal of tax reform is to revert to the norms prior to 2009 and raise productivity substantially.

Figure 1. Contribution of Capital Investment to Productivity Growth

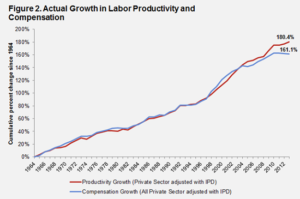

The final step is that faster productivity growth will translate into more compensation – wages and benefits – for workers. This tight historical relationship is shown in Figure 2. Recently, this proposition has somehow become controversial. AAF’s Ben Gitis artfully debunks claims to the contrary (and is also the source of Figure 2).

Capital accumulation, productivity growth, and living better: That is the case for tax reform. It would be an easier sell if there was a straight line from the policy to the prosperity (which is why the left prefers programs that write checks). But the logic is sound, the evidence conclusive, and the case for tax reform helping the middle class impeccable.

Fact of the Day

After the first 13 years of the 340B Drug Pricing Program, only 583 hospital organizations participated. The repeated eligibility expansions resulted in the number of participating hospitals growing to more than 2,000 by 2014, accounting for more than 45 percent of all acute care hospitals.