The Daily Dish

April 12, 2024

The Corporate Rate Cut and Revenues

As Eakinomics has previously noted, next year is important for tax policy as the vast majority of the 2017 Tax Cuts and Jobs Act (TCJA) sunsets at the end of 2025. Among the provisions that do not sunset is the 21 percent corporation income tax rate.

Opponents of the TCJA regularly demonize the rate cut from 35 to 21 percent as a fatal flaw and point to it as a source of the fiscal policy woes facing the United States. In contrast, one will hear some backers of TCJA go so far as to say that the rate cut “paid for itself.” How should one think about this issue?

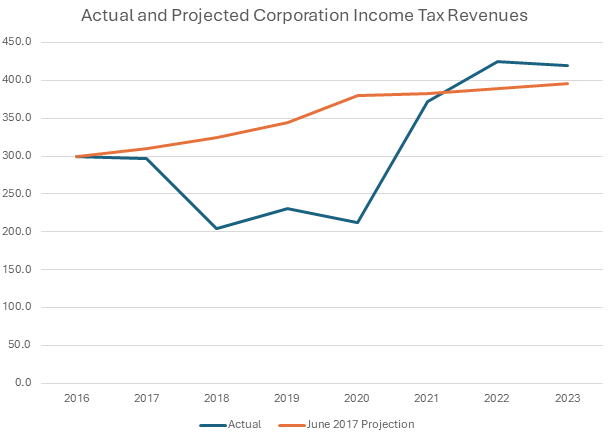

The situation is outlined in the graph below. The orange line is the Congressional Budget Office (CBO) projection of corporation income tax revenue in June of 2017 (its final projection before passage of the bill). The blue line is actual receipts of corporation income taxes.

Two features of the graph immediately jump out. First, there is a sharp falloff of revenue in 2018, immediately after the rate cut. Second, however, revenue in 2022 and 2023 is above the amount projected by CBO even though the rate is lower.

The latter fact indicates that one does not need the 35 percent rate to generate the revenues that were raised in 2017. In this sense, one might argue the rate cut paid for itself. Yet it is fair to note that revenues were below the projection from 2018 to 2021 – in part because of the arrival of the pandemic in 2020 – and the cumulative shortfall from 2018 to 2023 is $353 billion. In this sense, the cut did not pay for itself.

At least not yet. But corporate revenues would have to grow at an average annual rate of 8 percent from 2023 to 2027 to eliminate the shortfall entirely, a pace that seems quite unlikely in an economy tending toward nominal income growth of 4 percent or less. (CBO assumed a growth rate of 3.6 percent in its projection.)

The bottom line is that the corporate rate cut is neither a non-starter nor a freebie, but rather simply one more aspect of the trade-offs central to real tax reform. In the eyes of Eakinomics, the gains from removing tax-base distortions to location, investment, and finance decisions in the corporate sector are sufficient to offset the near-term revenue loss.

Fact of the Day

Since January 1, the federal government has published rules that imposed $67.2 billion in total net costs and 33.5 million hours of net annual paperwork burden increases.