The Daily Dish

January 13, 2023

The December CPI

Yesterday the Bureau of Labor Statistics released its report on the December Consumer Price Index (CPI). Viewed in isolation, the data were quite striking. In the month from November to December, the topline CPI fell at a 3.6 percent annual rate, even though food prices rose at a 3.8 percent rate and shelter prices spiked at a 9.2 percent annual rate. What drove this seeming magic? Energy prices were in free fall, declining at a 53.3 percent annual rate.

That is why it is dangerous to view any single month’s data in isolation. Stepping back and looking at year-over-year changes from December 2021, CPI inflation was 6.5 percent and core (non-food, non-energy) inflation was 5.7 percent. This represents modest progress, as they were down from 7.1 percent and 6.0 percent in November, respectively. Clearly, 2022’s fiscal strategy – commit serial budgetary misdemeanors but avoid felonious American Rescue Plan-style stimulus – and monetary tightening are having an impact.

But you might not notice the improvement on the ground. The bundle of necessities – food, energy, and shelter – rose at an 8.9 percent year-over-year rate in December – unchanged from November. And shelter inflation continues to rise. It was 7.5 percent year-over-year, up from 7.1 percent in November and showing no evidence yet of peaking. Numerically, the Fed’s problem is that with shelter inflation at 7.5 percent, all other inflation must be -0.75 percent in order to hit a 2 percent target.

The bottom line is that the report may produce a bias toward smaller rate increases but is not evidence that the Fed should stop or reverse course. Since rental leases are typically signed once a year, it takes a while for the newer, less-inflationary lease arrangements to show up in the data. It is reasonable, then, to expect shelter inflation to moderate going forward. That is the good news. The bad news is that it would be unwise to count on continued energy-price deflation.

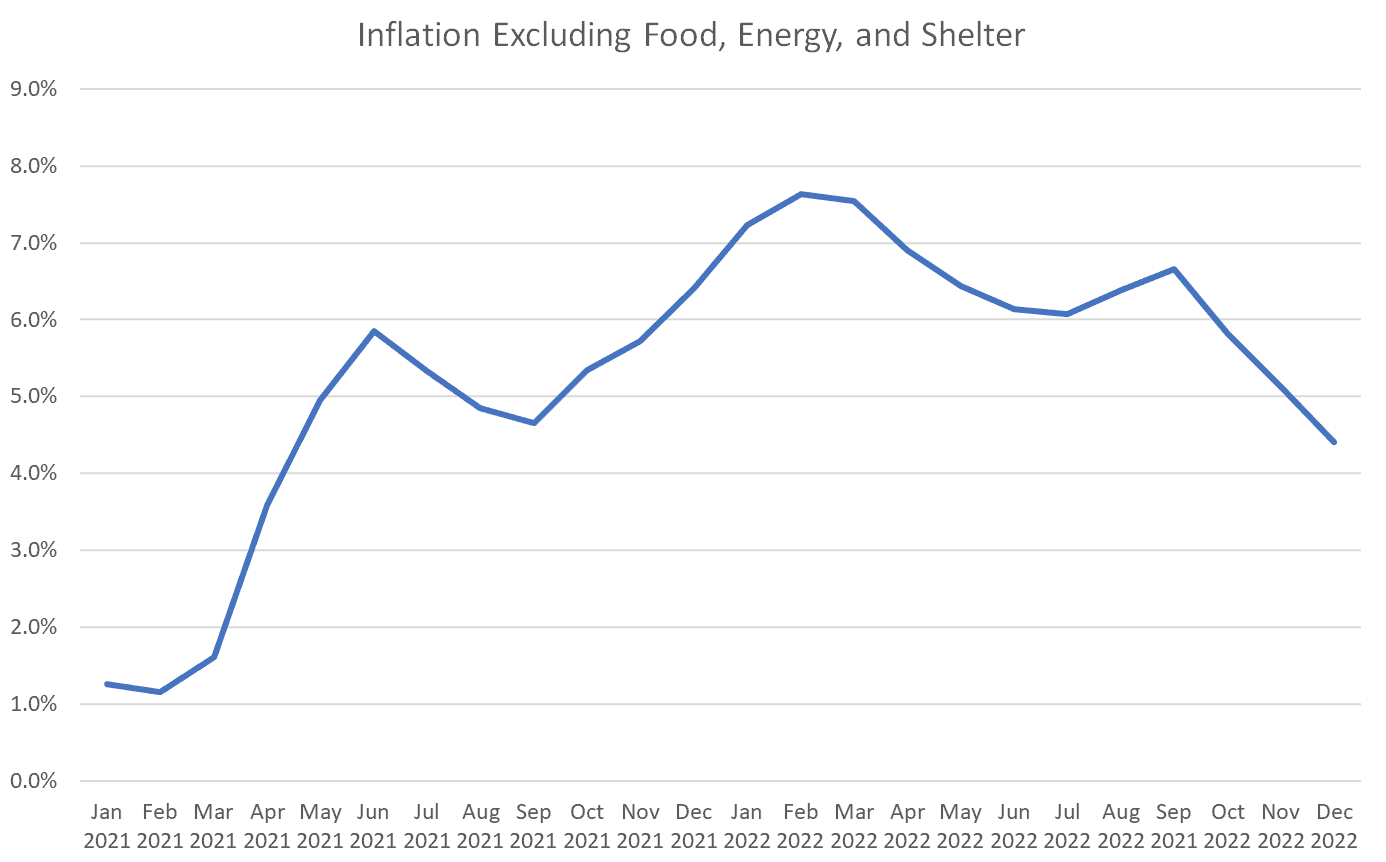

To eliminate the special factors, toss out food, energy, and shelter. This shows that the remaining “really, really core” inflation (shown in the graph below) is currently running at a 4.4 percent annual rate. That is over twice the Fed’s target, and roughly where that inflation was in the 3rd quarter of 2021. This inflation will be the Fed’s main problem over the next 18 to 24 months.

Fact of the Day

Since January 1, the federal government has published rules that imposed $4.3 billion in total net costs and 2.8 million hours of net annual paperwork burden increases.