The Daily Dish

August 1, 2023

The Fed and the Labor Market

It is expected to be a quiet week in the nation’s capital. Congress has scattered to the 50 states, four winds, or multi-continental CODELs; the president is in Delaware; and no major agency activity is anticipated. That leaves Friday’s Bureau of Labor Statistics (BLS) employment report for July as the focal point of the economic discussion.

A key component of that report will be the growth of average hourly earnings, which is pictured below for production and nonsupervisory workers. As the graph indicates, wage inflation has descended from 7 percent (year-over-year) to 5 percent, even as unemployment has remained low. This pattern is mirrored in an array of inflation indicators and measures of real economic activity. It is also responsible for a boom in “soft-landing” predictions in which the economy avoids a recession and continues to disinflate until the Fed has achieved its 2 percent target.

All of that discussion is familiar by now. But a second part of the story is less familiar. While the public is broadly familiar with the Fed’s campaign of interest-rate hikes, it is important to recognize that this is not its only policy instrument. At the same time, the Fed has been seeking to reduce its balance sheet, thereby pulling out some of the $5 trillion that was injected into financial markets during 2020 and 2021. Moreover, higher rates and a smaller balance sheet are not the ultimate goals. That goal is tighter financial markets that reduce aggregate demand in the economy.

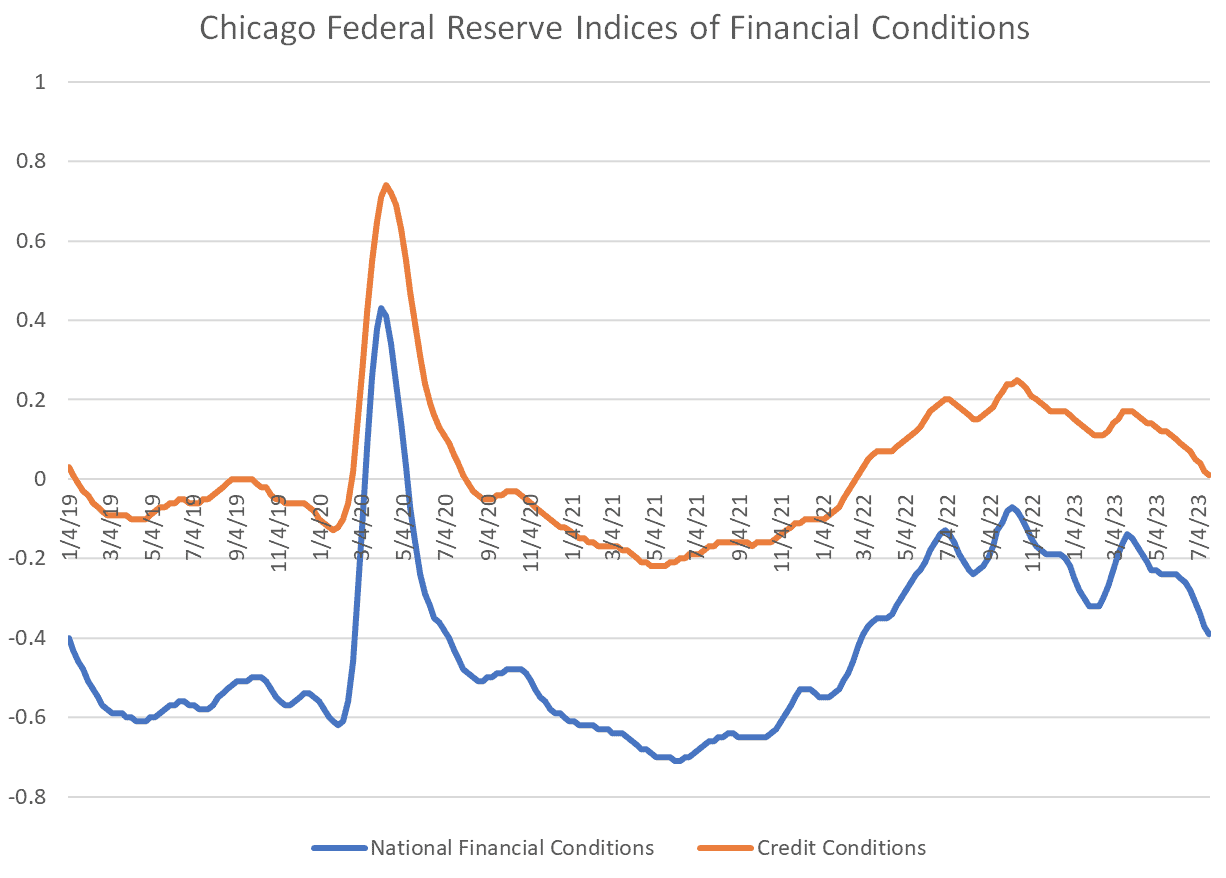

With that in mind, consider the graph below, which shows the Federal Reserve Bank of Chicago’s indices for overall financial conditions and credit conditions. (In each case, a more positive number indicates tighter conditions.) Overall financial conditions will reflect not only Fed policy, but also equity markets and other factors. The strong stock market will make equity financing of real investment more feasible, blunting the impact of higher rates.

Indeed, by this measure, financial conditions are noticeably tighter than in April 2022 – the Fed policy has had an impact – but have been easing since October of this past year. A look at credit conditions – which reflect bank lending standards as well as Fed policy – tells a similar story. The Fed’s actions have tightened credit conditions, but they have been easing over the past half-year or so.

This raises a troubling possibility. Yes, it may be the case that economic growth is stronger and the economy will avoid a recession. But perhaps this reflects softer financial conditions that, with the usual long lags, will lean less against inflation pressures, and progress toward 2 percent will falter.

It is worth watching. Getting my Twizzlers, coffee, and other data-watching supplies lined up. See you Friday.

Fact of the Day

Across all rulemakings this past week, agencies published $19.3 billion in total costs and added 4.4 million annual paperwork burden hours.