The Daily Dish

March 24, 2023

The Federal Spending Challenge

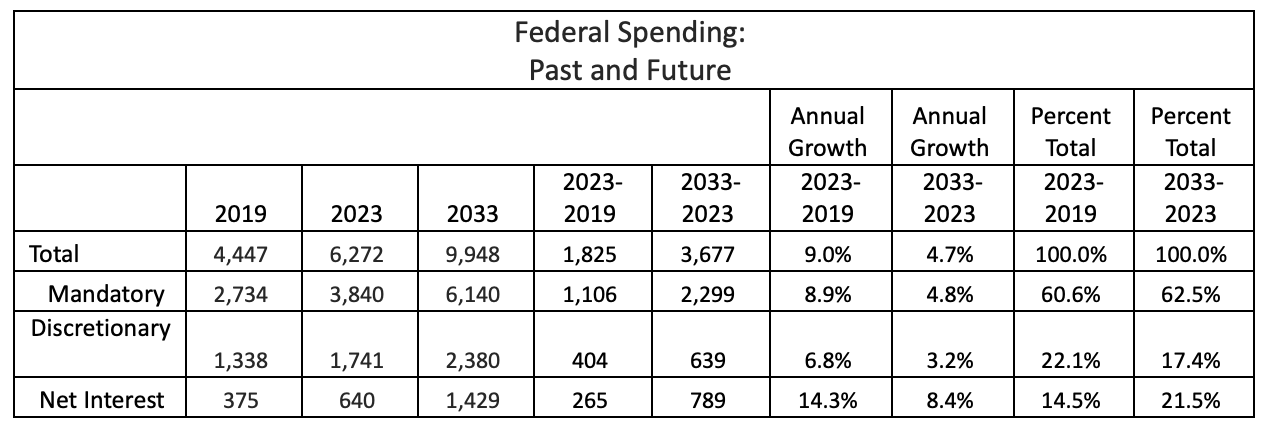

Federal spending has unquestionably exploded recently. As shown in the table below, overall spending rose from $4.4 trillion to $6.7 trillion – over 50 percent – between 2019 and 2023 (2019 was the last “normal” year prior to the pandemic and spending response). As the table also makes clear, every kind of spending grew rapidly. Top-line growth was 9.0 percent annually, while the annualized growth of mandatory, discretionary, and net interest was 8.9 percent, 6.8 percent, and 14.3 percent, respectively (column 7).

Another way to slice the increase is in column 9. It shows that mandatory spending was 60.6 percent of the increase, discretionary spending 22.1 percent, and net interest 14.5 percent. This is interesting but may be misleading when thinking about controlling future federal spending.

In the Congressional Budget Office baseline, overall spending is expected to grow at an annualized rate of 4.7 percent. Mandatory spending looks roughly the same, while discretionary spending is a more modest 3.2 percent. Shockingly, however, net interest spending hits double-digit, 14.5 percent growth. For that reason, net interest constitutes 21.5 percent of the overall increase in spending.

Unfortunately, Congress cannot simply cut interest costs; it has to cut spending and reduce the growth of debt. And the table also makes clear that discretionary spending is a relatively small part of the future spending problem, and much smaller than the recent past. That leaves mandatory spending as the place to focus. Any strategy that relies on discretionary spending caps or cuts will be doomed to failure.

The numbers in the mandatory spending projections are daunting. Medicare spending is projected to average annual growth of 7.2 percent over the next 10 years, while Social Security spending rises at 6.0 percent annually. Those two programs constitute two-thirds of mandatory spending.

There is no revenue source that will grow at 6-7 percent rates annually, so any strategy that relies on raising revenue will temporarily buy a little less debt growth but will ultimately fail.

The president has chosen to make Social Security and Medicare political footballs. Whatever. Just remember that the rock-solid policy truth behind this game is that those programs have to be at the center of any serious attempt to put the federal budget in order.

Fact of the Day

Since January 1, the federal government has published rules that impose $75.1 billion in total net costs and 10.2 million hours of net annual paperwork burden increases.