The Daily Dish

November 23, 2022

The Outlook for Business Investment Spending

‘Tis the season of Thanksgiving, and we have much for which to be thankful. AAF thanks its supporters and readers for their continued interest. I thank the fabulous AAF staff for their continued excellence. And we once again thank our forefathers for the Constitution, our economic, personal, and political freedoms, and the Pittsburgh Steelers.

But let’s face it. The thing we are most grateful for is that the statistical agencies have colluded to dump everything – durable goods orders, core capital equipment orders, initial jobless claims, continuing jobless claims, S&P U.S. Manufacturing Purchasing Managers Index, S&P U.S. Services Purchasing Managers Index, University of Michigan consumer sentiment index, University of Michigan 5-year inflation expectations, new home sales, and the Federal Open Market Committee (“Fed”) minutes – on Wednesday and spare us a holiday devoted to data mining. Whew!

Of these many data, Eakinomics would argue that new orders for core (non-defense, excluding aircraft) capital goods is the most important. Why? At the moment, the entire policy community is on recession watch, looking for evidence that the Fed’s tightening cycle has slowed growth in aggregate demand past the tipping point.

For most people, this means putting a spotlight on the household sector and holding a vigil for the demise of the American consumer. As I argued previously, however, this puts too much weight on the experience of the pandemic recession. In every other postwar recession, the downturn was presaged by a decline in business investment spending (“non-residential fixed investment” that consists of structures, equipment, and intellectual property goods).

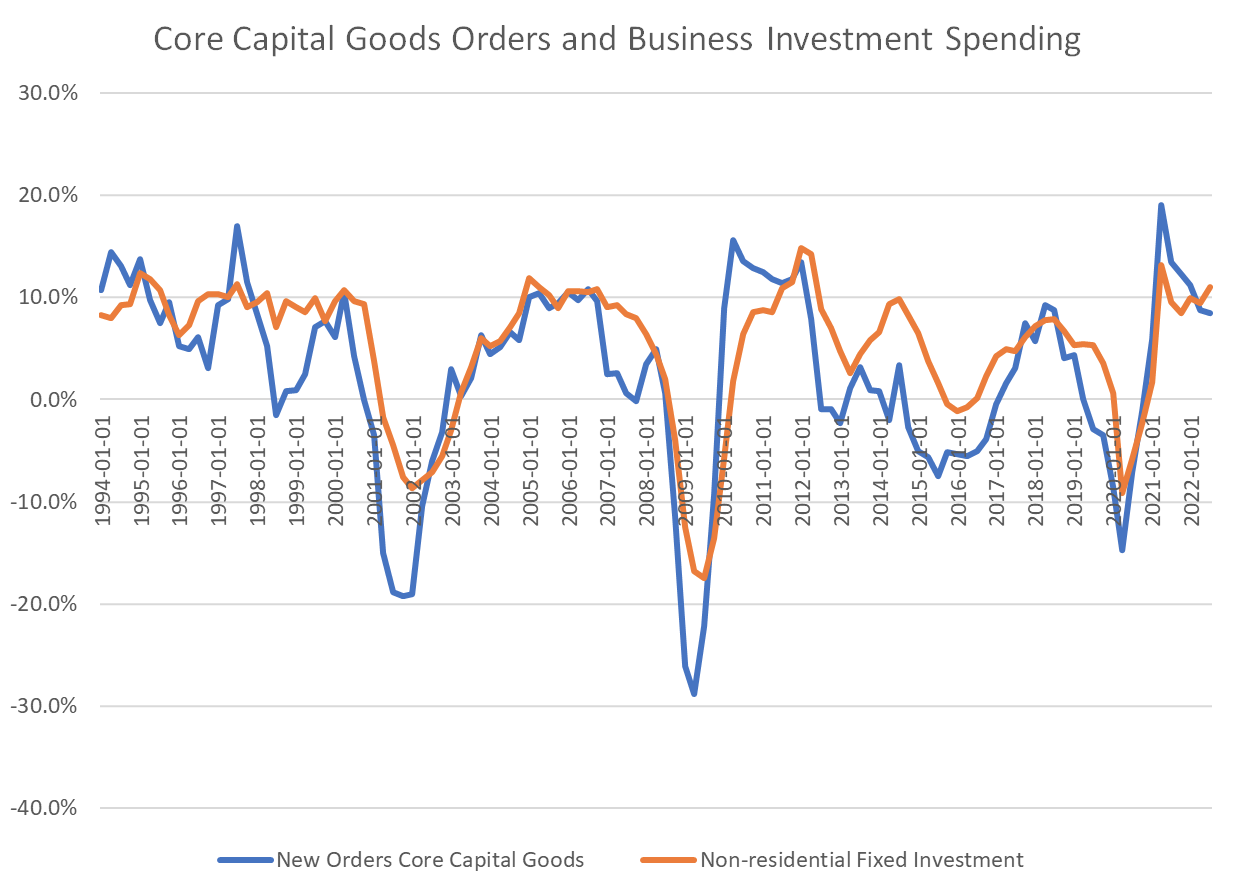

And what is the best, single predictor of business investment spending? You guessed it: new orders for core capital goods. In the chart below, the blue line represents quarterly, year-over-year growth in new orders, while the red line represents the corresponding growth in business investment spending. The graph shows clearly that when entering recessions, the downturn in orders nicely predicts the fall in investment.

So, check out the data at 8:30 am, update your recession probabilities, and get ready to enjoy the holiday.

Fact of the Day

Since January 1, the federal government has published rules that imposed $247.6 billion in total net costs and 151 million hours of net annual paperwork burden increases.