The Daily Dish

June 15, 2017

Treasury Delivers on Financial Regulation Review

Earlier this week the House passed the Accountability and Whistleblower Protection Act by a vote of 368-55. The bill will allow the Veterans Affairs (VA) Secretary to fire and rescind the bonuses of any employee convicted of a “job-related felony.” The bill comes as scandals continue to plague the VA, and passed the Senate by voice vote last week. During the 2016 campaign, then candidate Trump promised to take on the failings of the VA and fix the ailing institution. The bill now moves on to President Trump who is expected to sign it into law.

Yesterday the Federal Reserve announced that they have decided to raise interest rates for the second time in 2017. The Fed argued they must begin slowly raising rates otherwise their ability to address a future financial crisis would be hindered. The Fed said they will increase interest rates by a “range between 1 percent and 1.25 percent.”

Eakinomics: Treasury Delivers on Financial Regulation Review

When President Trump signed Executive Order 13772 on February 3 to begin a review of federal financial regulation, Eakinomics was pretty dismissive: “Aside from the outsized promotion of all things done by the Trump administration and the corresponding outsized reaction to non-events, this is a pretty big nothingburger — at least to date.” Thank goodness for the caveat. Treasury has delivered a surprisingly strong report.

This is the beginning, not the end, of the process. The report released on February 12 is focused on banks and other depository institutions. There will be future reports on the capital markets, the asset management and insurance industries, and non-bank financial institutions. As a result of two related executive orders, there will also be reports on resolving insolvent banks and the Financial Stability Oversight Council (FSOC).

A nice thing about the report is that it furthers the policy process. In stark contrast to other initiatives – the tax reform 1-pager or the vaporware infrastructure proposal – the report describes the shortcomings in financial regulation, and proposes about 80 specific policy recommendations. These are identified as either administrative or statutory in nature (see Appendix B) and could easily become the fodder of Congressional hearings and statutory language, or rulemaking where appropriate.

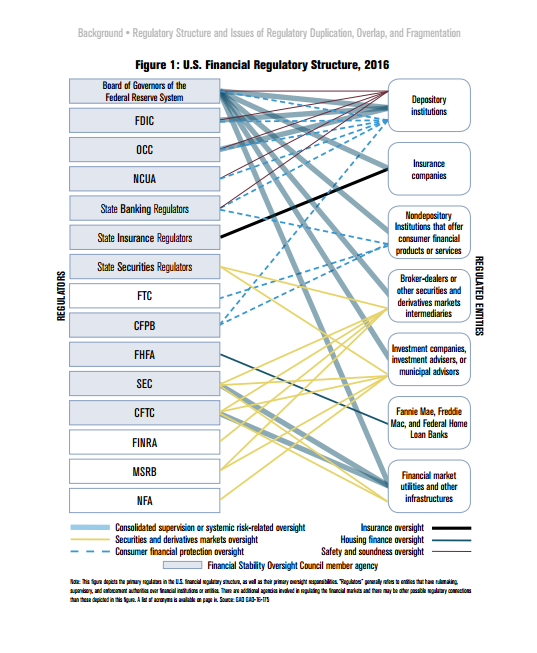

A potential drawback in the eyes of some is that it is a collection of fairly pragmatic proposals. It is, as a result, a far cry from large-scale reforms like the CHOICE Act that recently passed the House of Representatives. While this may result in some hope of bipartisan legislation – for example, in relieving the regulatory burden on community and other smaller banks – the very first exhibit in the report (reproduced below) suggests a byzantine system that might be more aggressively rationalized and simplified.

There are a lot of demands on the time of Congress and Administration: health care reform, tax reform, the debt ceiling, funding the government, and more. These may crowd out financial regulatory reforms. But if not, the Treasury report shows that there are a lot of improvements that can be made and it is a model for kicking off a policy process.

Fact of the Day

President Trump signed a record 14 Congressional Review Act (CRA) “resolutions of disapproval” into law, repealing $3.7 billion worth of regulatory costs.