The Daily Dish

May 19, 2023

Will the Fed Pause?

Throughout the current tightening cycle, there has been continual tension between the Federal Reserve and Wall Street. The Fed repeatedly signaled the need for, and its intention to, raise rates, while the financial market participants urged the Fed to pause or even cut rates.

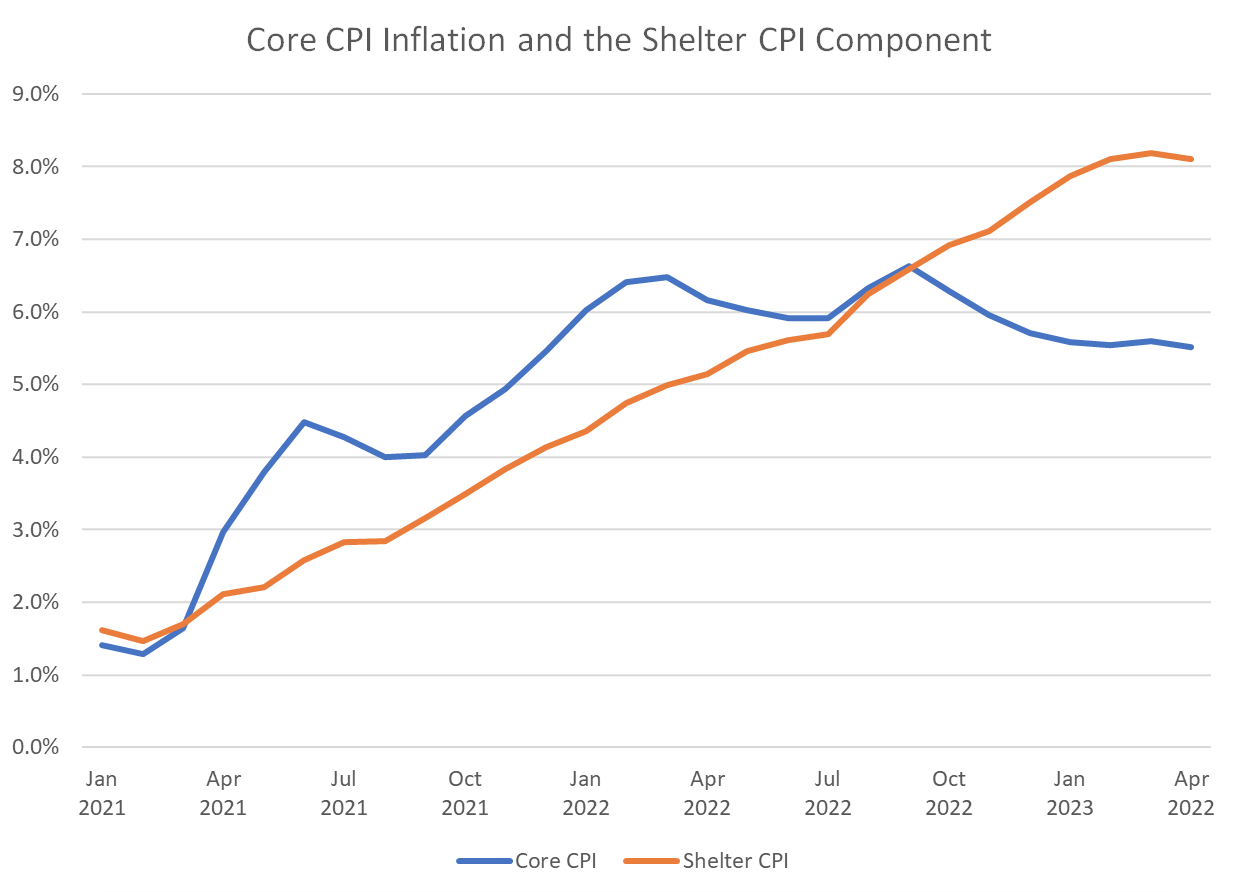

The case for continuing to tighten financial conditions is easy to see in the chart below. Core Consumer Price Index (CPI) inflation was 6.6 percent year over year in September 2022. Despite the Fed’s efforts, it had fallen only to 5.6 percent in January and has since plateaued. A major reason for this stubborn inflation has been the shelter component of the CPI, which has risen steadily through 2021 and 2022 to reach 8.2 percent.

But notice that the year-over-year shelter inflation declined from 8.2 to 8.1 percent in the April report. This is an important development and may give the Fed the signal to pause.

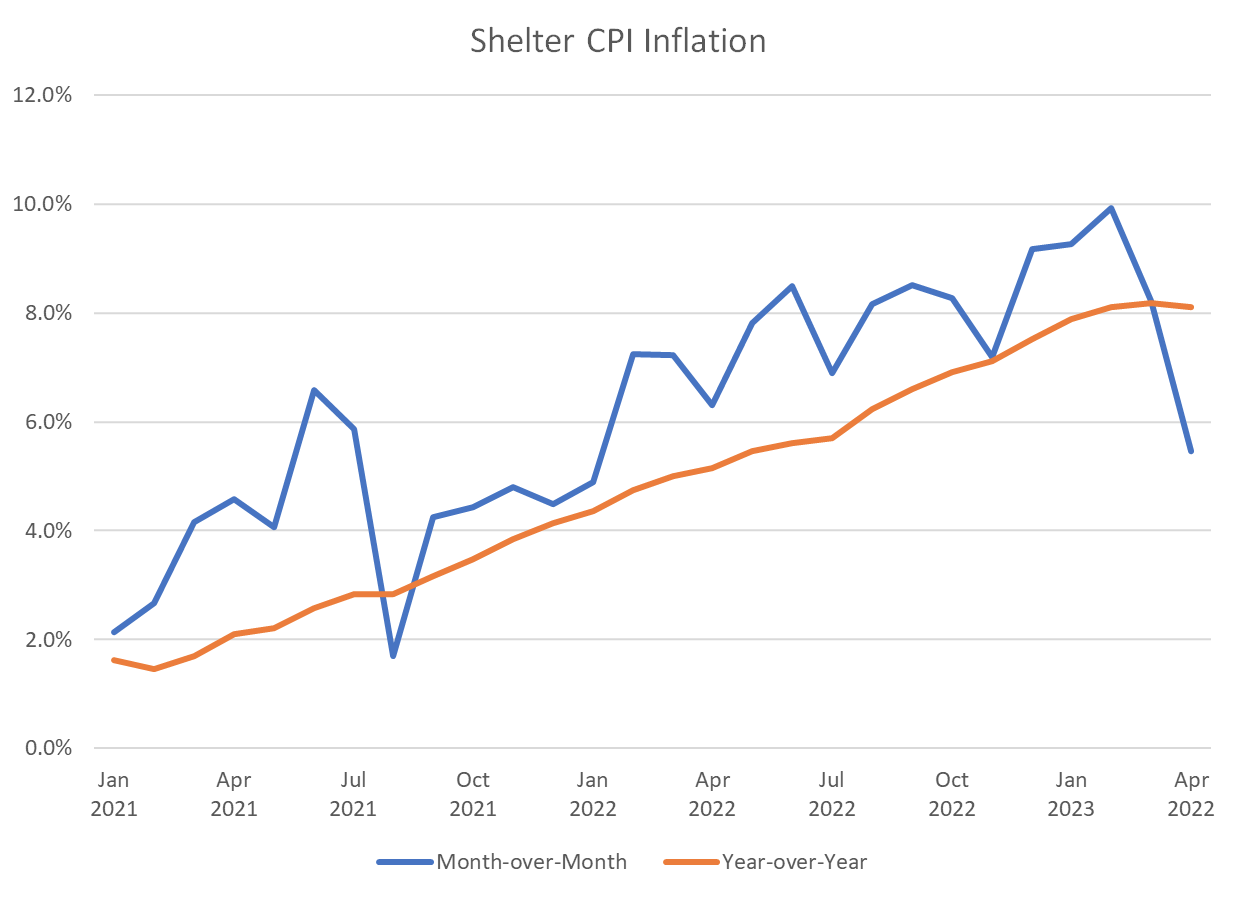

The shelter component measures the actual rents being paid by apartment dwellers. If rent inflation eases, it will take up to a year for some residents to sign new leases and reflect this softening in the CPI. Thus, one would expect the year-over-year shelter measure to change direction slowly. The chart below compares year-over-year inflation with month-to-month shelter inflation. The latter fell from 9.9 percent in February to 5.5 percent in April. This is consistent with other evidence available on the rental market. It raises the specter that the long-awaited softening of shelter inflation is at hand, and that core inflation will move down more rapidly in the months to come.

For the Fed, this may provide observable evidence to support a pause (and there will be another CPI report just before the June meeting).

In light of this, it is interesting that two regional Federal Reserve Bank presidents clearly opposed a pause this week. On Wednesday, Cleveland Fed President Loretta Mester opined, “When we get the policy to that rate, I think we’re going to be holding for a while in order to make sure that the interest rate is coming back down. So I don’t put it in terms of a pause, I put it in terms of a hold. Have we gotten to that rate yet? At this point, given the data we’ve gotten so far, I would say no.”

The next day, Dallas Fed President Lorie Logan seconded the viewpoint, saying “The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet.”

To date, Fed Chairman Jerome Powell has kept the Federal Open Market Committee united, and no recent decision has elicited a dissenting vote. Will the unanimity continue in June?

Fact of the Day

Since January 1, the federal government has published rules that imposed $330.7 billion in total net costs and 51.5 million hours of net annual paperwork burden increases.