Housing Chart Book

September 11, 2023

Mortgages

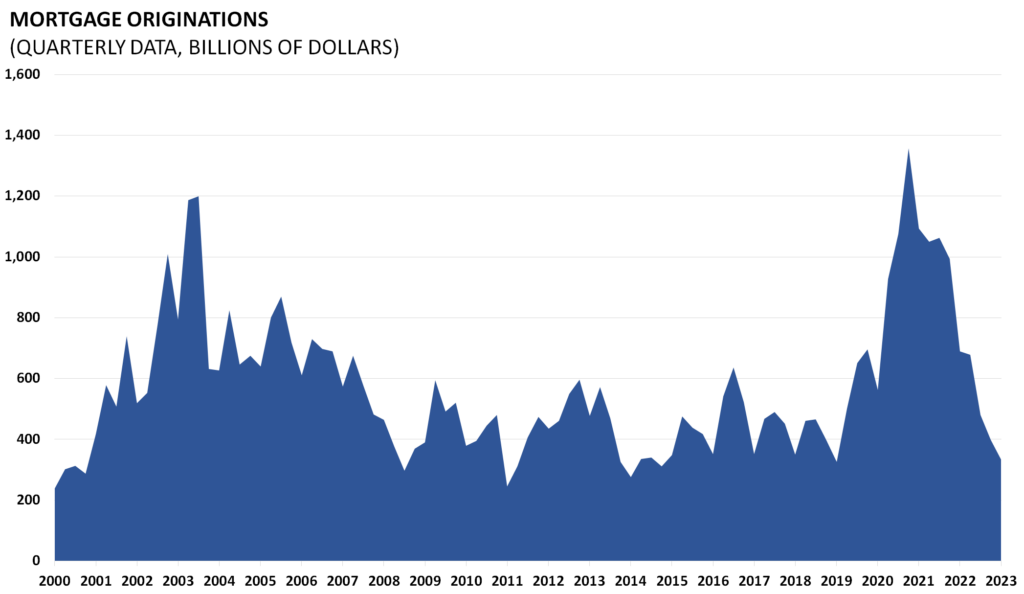

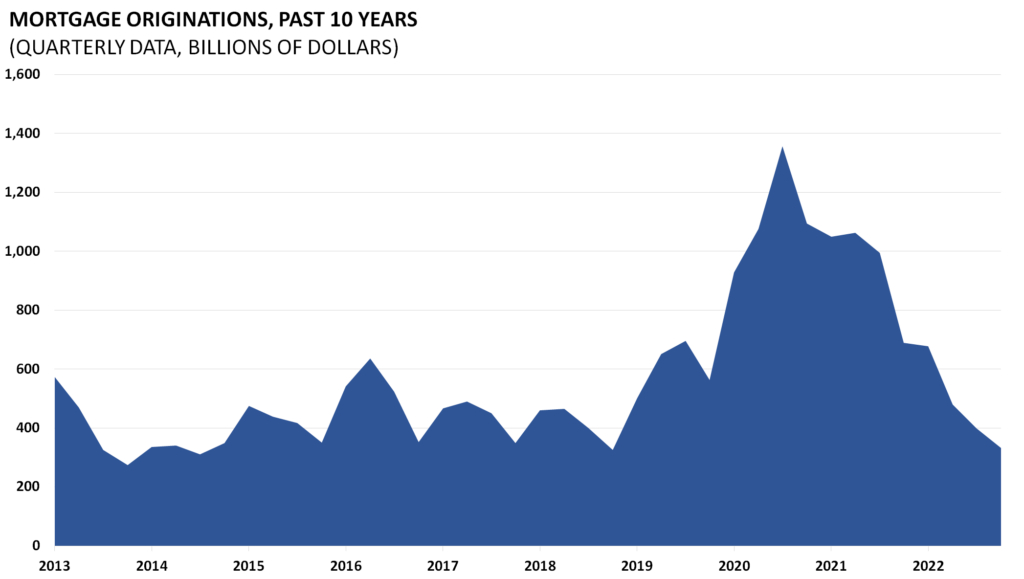

Insofar as home ownership is a key contributing factor to the health of the US economy, the mortgages that back home loans are a positive indicator of the strength of the housing market.

Source: https://ycharts.com/indicators/mortgage_originations

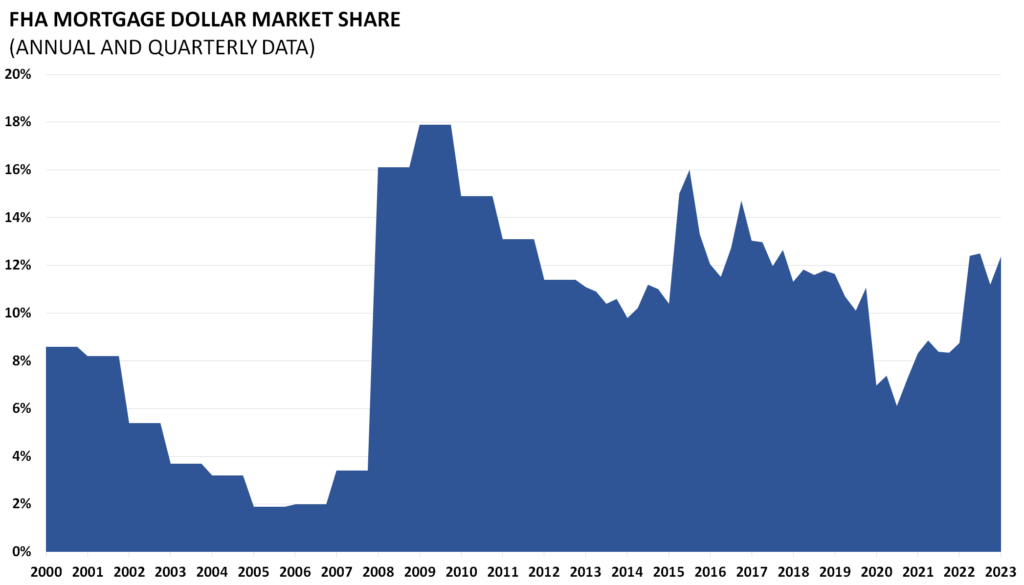

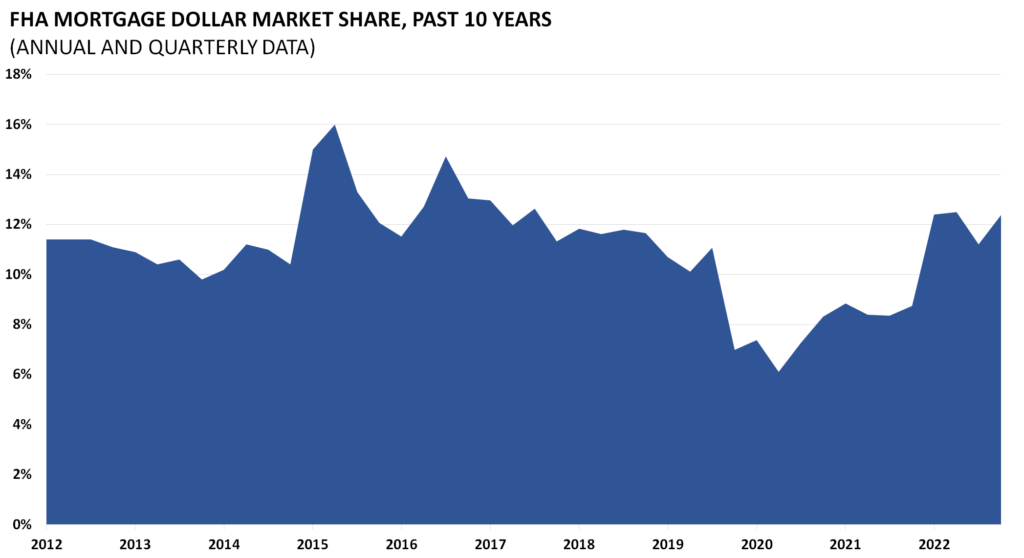

The Federal Housing Administration insures private mortgage lenders against the possibility of default. FHA insured loans are a form of federal assistance. The FHA market share therefore indicates the strength of private versus public mortgage insurance.

Source: http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/rmra/oe/rpts/fhamktsh/fhamktqtrly

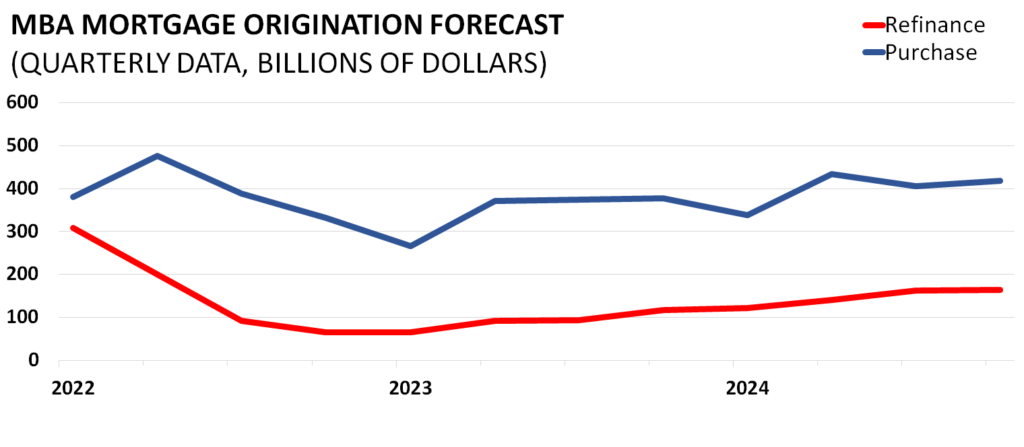

The Mortgage Bankers Association releases data on the number of mortgages that they forecast will be originated each quarter. Mortgages originations, shown in dollars, indicates the level of market activity. Divided here between original purchases and refinances provides even greater insight into the types of originations and the condition of the market recovery.

Data Release: http://www.mbaa.org/ResearchandForecasts/ForecastsandCommentary

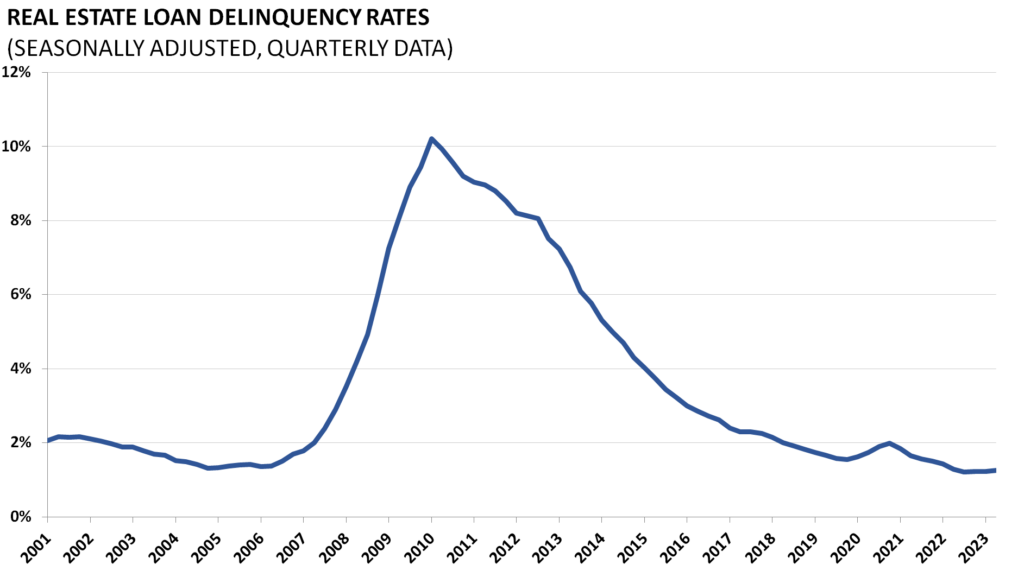

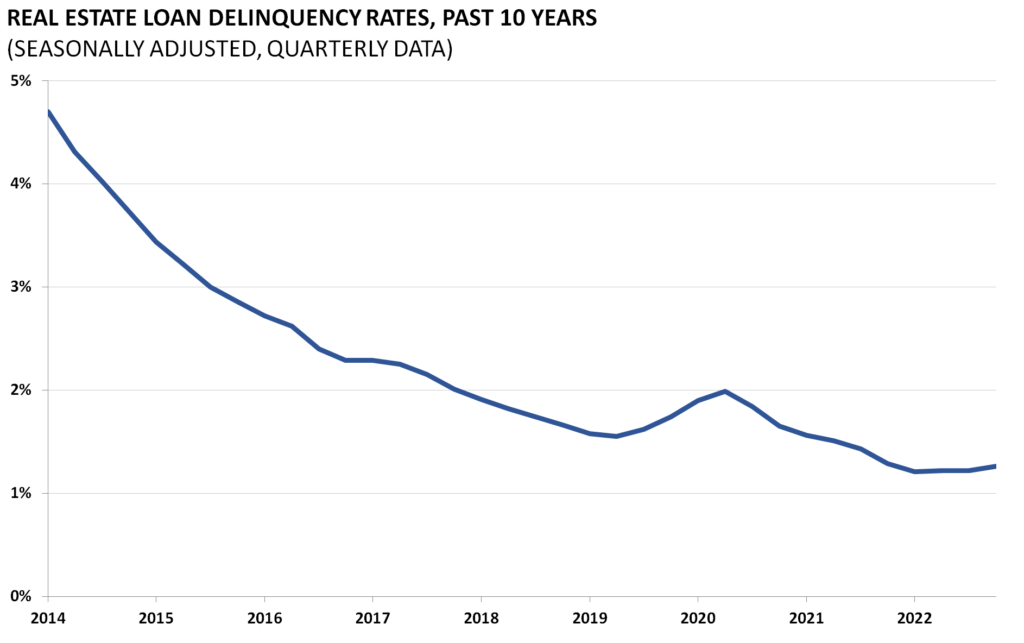

Delinquency rates on all loans secured by real estate and commercial banks are released by the Board of Governors of the Federal Reserve. Seasonally adjusted, the measure indicates the percentage of borrowers who have been unable to make timely payments on their loans. This measure is reflective of the overall economy and macroeconomic factors like unemployment. This data is released quarterly with the Fed report on “Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks.”

Source: http://research.stlouisfed.org/fred2/series/DRSREACBS

Data Release: http://www.federalreserve.gov/releases/chargeoff/default.htm