Infographic

November 17, 2017

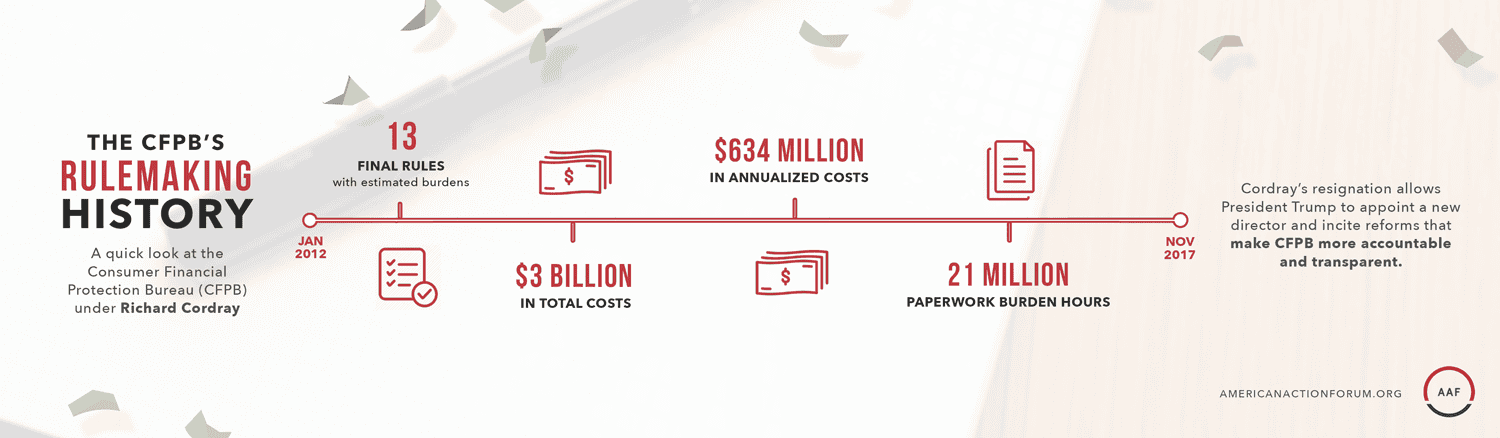

By the Numbers: The CFPB under Cordray

Consumer Financial Protection Bureau (CFPB) director Richard Cordray announced Wednesday that he would step down at the end of the month. His resignation marks the end of a near six-year as tenure as the head of the controversial agency created in the Dodd-Frank Wall Street Reform and Consumer Protection Act.

American Action Forum tracked regulatory action at CFPB under his leadership. Including his time as a recess appointee, the agency issued 13 final rules with estimated burdens that accounted for:

- $3 billion in total costs

- $634 million in annualized costs

- 21 million hours of paperwork

The costliest of these rules is the Integrated Mortgage Disclosures rule finalized in 2013 that accounted for nearly half of total costs at $1.4 billion. Coming in a close second is a 2015 Home Mortgage Disclosure rule at $1.3 billion. Third is the controversial arbitration rule that added $380 million in costs.

The arbitration rule is notable because on November 1 it became the 15th regulation negated by the Congressional Review Act in 2017, and the 16th overall under that process. The passage of this resolution illustrated the intense opposition among Republicans to CFPB’s direction under Cordray.

His resignation allows President Trump to appoint a new director that more closely aligns with his – and Congressional Republicans’ – view of the agency’s role. The prospect of a Trump-appointed director may also make Democrats more likely to consider reforms that give Congress more oversight over CFPB.