Insight

April 23, 2019

Primer: Social Security Retirement Benefits

Executive Summary

- Social Security is a critical anti-poverty and income security program for retirees.

- The benefit formula for Social Security is a three-step calculation that considers work history, earnings, and the year in which a beneficiary elects to receive benefits.

- The benefit formula is progressive, replacing a higher share of past earnings for lower-income retirees than it does for higher-income retirees.

Introduction

When policymakers discuss Social Security or more properly, the Old-Age, Survivors and Disability Insurance program (OASDI), the conversation often focuses on the program’s sustainability, its budgetary effects, and its political salience. Social Security is two programs, the Old-Age and Survivors Insurance (OASI) program and the Disability Insurance (DI) program, which cover a diverse cohort of beneficiaries. But for many Americans, the most relevant part of Social Security is its benefit for retirees – the principal element of the OASI program. In general, the operation of the program is straightforward: over the course of their working lives, a portion of their worker earnings are taxed to finance some proportional replacement of those earnings in retirement. But the specific operation of this program is less well understood by both the public and policymakers. It is these details that must be understood for any discussion of the program’s sustainability and budgetary effects, as well as the reforms needed to ensure its lasting solvency for future generations.

Basic Eligibility

OASI provides monthly payments to retirees, as well as to qualifying spouses and survivors of eligible beneficiaries.[1] The amount of a workers’ retirement benefits is a function of work and earnings history and the age at which a worker retires.

The first consideration in this determination is whether a worker is “insured” under OASI. To qualify as an insured worker, individuals accrue quarters of coverage or “QCs” for each period in which their earnings exceeded a minimum amount. Note that QCs are not calculated on a quarterly basis (the nomenclature is an anachronism of an older formula), but individuals may not earn more than four QCs in a given year, which would otherwise occur for higher earners. The minimum amount is calculated by multiplying the 1978 minimum quarterly threshold of $250 by the ratio of the national average wage index (AWI) for the qualifying year to the AWI for 1976, which equaled $9,226.48. This calculation is done prospectively, meaning that for determining threshold amounts for QCs in 2019, the 2017 national average wage index is used for this calculation. The law also specifies that the final QC amount is rounded to the nearest $10. Thus for 2019, workers must earn at least $1,360 per QC, as the calculation below shows.

Figure 1: Calculating the QC Amount for 2019

Full-time workers easily meet this threshold. Workers are eligible to receive retirement benefits if they have accrued at least six QCs and at least one QC for every calendar year after the age of 21 and at least one QC in either the year before retirement or death. If workers earn 40 QCs, they are permanently insured and do not need to have earned a QC in the year before their retirement or death.[2] 79 percent of insured workers are permanently insured. Most workers easily exceed this initial eligibility criterion during their working lifetime.

The Benefit Formula

Determining a retiree’s monthly benefit amount requires a three-step calculation. First, the Social Security Administration (SSA) collects and adjusts a retiree’s earnings history for wage growth, providing a contemporary average of the worker’s past wages. The second step applies a progressive formula to this earnings figure to replace a percentage of those past earnings in retirement through Social Security benefits. Last, these benefits are adjusted based on what age a beneficiary elects to begin receiving benefits.

Step 1: Determining Average Indexed Monthly Earnings

First, the SSA calculates what is known as the averaged indexed monthly earnings (AIME) for a given worker. To calculate a retiree’s AIME, the SSA examines that retiree’s earnings history. The value of a dollar today, however, is less than it was in the past, so SSA first has to plus-up past earnings to capture their past value in present dollars. SSA also limits past earnings to the taxable maximum for a given year. SSA indexes past years’ earnings using the same index, the AWI, as it uses as part of its eligibility test. This index inflates past earnings to keep pace with wage growth, not price growth. To the extent that wages tend to grow faster than prices, the use of wage growth to index past earnings has the effect of increasing the real (inflation-adjusted) benefit over time. The SSA indexes a retiree’s annual earnings for all years up to two years before the year in which they are first eligible to receive benefits (retirees can first receive benefits the year they turn 62). SSA uses a beneficiary’s nominal earnings for all years thereafter. The AIME is calculated by taking the average of these indexed annual earnings, specifically the highest 35 years of indexed earnings, and dividing by 12 to derive a monthly figure.[3]

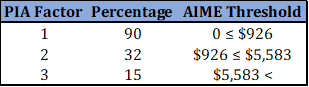

Step 2: PIA Factors

The second step in determining a beneficiary’s monthly benefit is the calculation of the Primary Insurance Amount (PIA). The PIA is the monthly benefit an eligible retiree will receive if they retire at normal retirement age and is the sum of three separate calculations based on what are known as PIA factors or “bend points.” There are three PIA factors – set at 90 percent, 32 percent, and 15 percent – which are designed to provide a gradually smaller percentage of a retiree’s AIME. The dollar thresholds at which these decking PIA factors apply are based off of the 1979 bend points but updated for wage growth using the same AWI index that informs other indexed values used in calculating Social Security benefits. For a beneficiary who becomes eligible for Social Security in 2019, the applicable PIA factors are 90 percent of the first $926 of their AIME, 32 percent of their AIME over $926 and up to and including through $5,583, and 15 percent of their AIME over $5,583.[4] SSA rounds the PIA down to the nearest 10-cent multiple.

Figure 2: 2019 PIA Factors

For example, assume a beneficiary turns 62 in 2019 and has an earnings history such that their AIME is $7,000. Their PIA would be determined as follows:

PIA= $926 X (.90) + $4,657 X (.32) + $1,417 X (.15) = $2536.10

Social Security is progressive in that it provides a decreasing share of one’s past income. So, in general, individuals with higher lifetime earnings will have a larger AIME than those with lower lifetime earnings but will receive a smaller percentage of those earnings back through Social Security. Put another way, Social Security replaces a higher share, all else equal, of past earnings for lower-income retirees than it does for higher-income retirees.

Step 3: Early, Normal, or Delayed Benefits

The third calculation necessary to determine a recipient’s monthly benefit is based on the age at which they elect to receive benefits. The PIA is the amount that a recipient would receive if they elected to receive benefits at their “normal” or “full” retirement age (FRA). This age is set in statute and varies by age cohort. For individuals born before 1935, the FRA is 65, and this age progressively increases by year of birth to the current maximum FRA of 67 for anyone born after 1943.[5] If a beneficiary elects to begin receiving early (the earliest age is 62), then their PIA will be reduced according to a formula. Benefits are reduced by 5/9 of one percent for each month before normal retirement age, up to 36 months, and 5/12 of one percent per month for each month after 36 months. The practical effect of this is a maximum benefit reduction of 30 percent for a worker with an FRA of 67 who elects to receive benefits at the earliest opportunity at 62.[6]

For the example above, the retiree’s monthly benefit would be 70 percent of their PIA, which equals $1775 (monthly benefits are rounded down to the nearest dollar).

Conversely, beneficiaries who delay retirement receive a delayed retirement credit that increases their monthly benefit based on how many months they forgo claiming benefits. Annual delayed retirement credit percentage varies from 3 percent to 8 percent by year of birth.[7] Workers can claim delayed retirement credits up to the age of 70, at which point workers born in 1943 or afterward would receive a maximum retirement credit of 24 percent.[8] For example, a beneficiary with a PIA of $2536.10 who delays retirement until 70 would receive a monthly benefit of $3,144.

Conclusion

Social Security is an important anti-poverty program for retirees and other vulnerable populations. The program presently faces structural deficits that endanger the program’s financial wherewithal. Most Americans do not typically grapple with these issues, however, and are understandably concerned with how their lifetime of paying payroll taxes will translate into income security in retirement. The Social Security program is designed to provide a progressive income replacement regime for eligible recipients based on work and earnings history, but changing demographics will require reforms to the program to ensure these benefits are available for future retirees.

[1]This primer focuses on retiree benefits. For details on additional beneficiaries, see: https://www.ssa.gov/oact/ProgData/types.html

[2] https://www.ssa.gov/oact/ProgData/insured.html

[3] https://www.ssa.gov/oact/cola/Benefits.html

[4] https://www.ssa.gov/oact/cola/piaformula.html

[5] https://www.ssa.gov/OACT/ProgData/nra.html

[6] https://www.ssa.gov/OACT/quickcalc/early_late.html

[7] https://www.ssa.gov/OACT/quickcalc/early_late.html#calculator