Insight

April 11, 2025

CBO’s Updated Estimate of a Permanent TCJA

Executive Summary

- In a recent letter, the Congressional Budget Office analyzed the long-term budgetary and economic impact of an alternative scenario that assumes a permanent, unpaid-for extension of the Tax Cuts and Jobs Act of 2017 and lower revenue collections.

- The scenario would increase budget deficits by $51.6 trillion through fiscal year (FY) 2055 and as a result debt would rise to 220 percent of gross domestic product (GDP) by the end of FY 2055, the budget deficit would total 12.0 percent of GDP, and interest payments would total 8.3 percent of GDP.

- In FY 2055, economic output would be 2.4 percent smaller, the average interest rate on federal debt would be 30 basis points higher, and income per person $4,375 lower.

Introduction

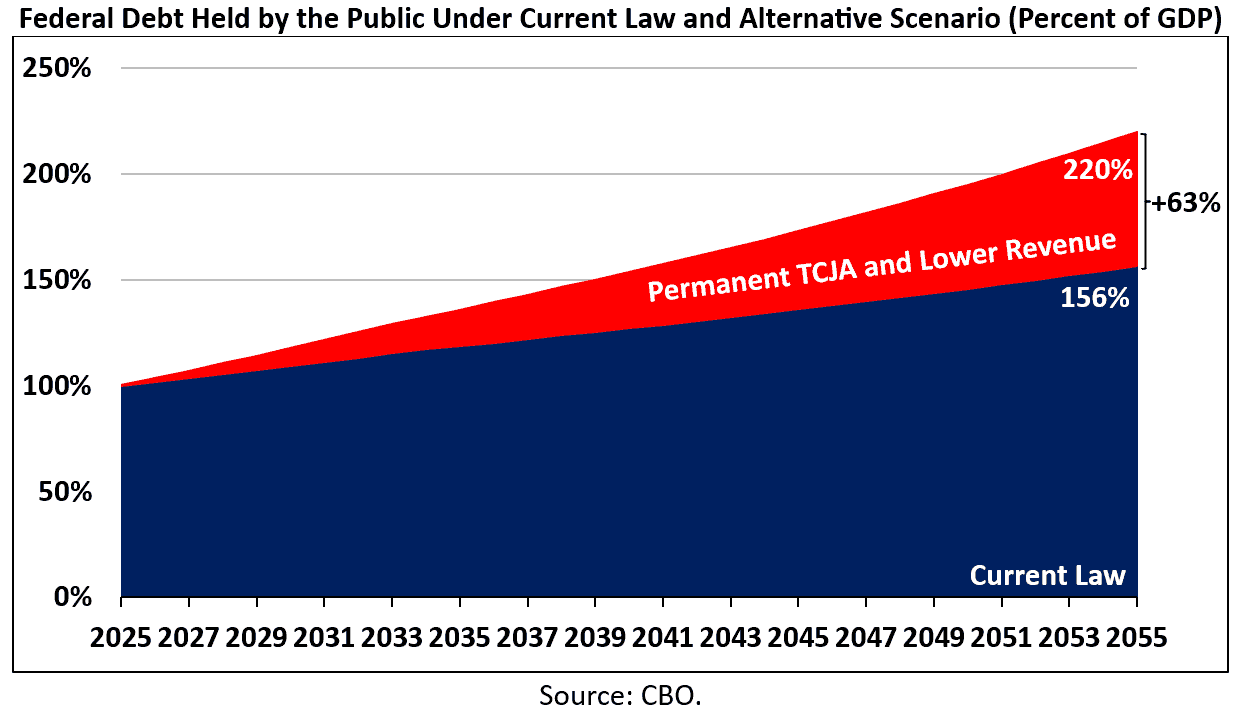

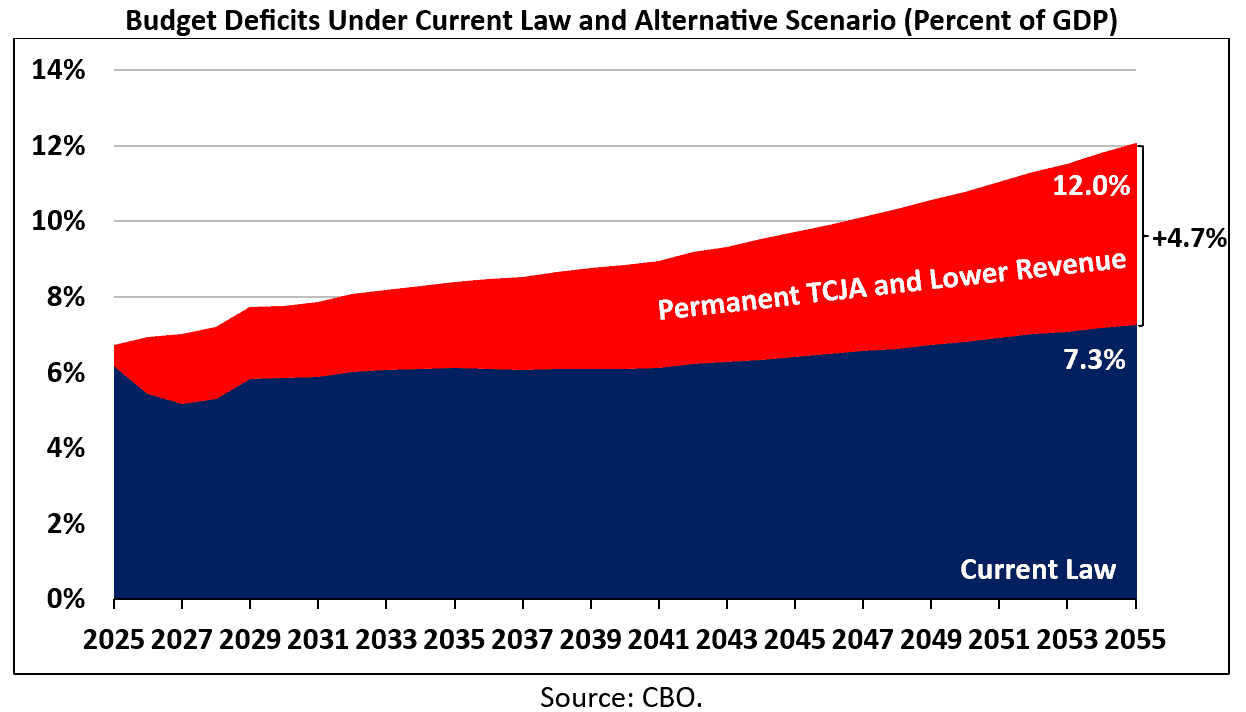

The Congressional Budget Office’s (CBO) March 2025 Long-term Budget Outlook projects that federal debt held by the public will rise from 100 percent of gross domestic product (GDP) at the end of fiscal year (FY) 2025 to 156 percent of GDP by the end of 2055 under current law. Meanwhile, the budget deficit will grow from 6.2 percent of GDP ($1.9 trillion) to 7.3 percent of GDP ($6.4 trillion) and interest payments on the national debt will climb from 3.2 percent of GDP ($952 billion) to 5.4 percent of GDP ($4.8 trillion). In a recent letter, CBO analyzed the long-term budgetary and economic impact of an alternative scenario that assumes a permanent, unpaid-for extension of the Tax Cuts and Jobs Act of 2017 (TCJA) and lower federal revenue collections than projected under current law. The scenario would increase debt, deficits, and interest costs substantially relative to current law. The average interest rate on federal debt would be higher while economic output and income per person would be smaller.

The Long-term Budgetary Impact

The TCJA made significant changes to the federal tax code by lowering individual and corporate income tax rates, increasing the standard deduction, doubling the child tax credit, and reforming the international tax regime, among other tax reforms. To mask the true cost of these changes and fit them within cost limits, a majority of the TCJA’s individual income and estate tax provisions are set to expire on December 31, 2025. CBO analyzed the long-term fiscal impact of a permanent, unpaid-for extension of the TCJA’s individual and estate tax provisions coupled with lower revenue collections. Under the scenario, CBO also assumed revenues would be $150 billion lower per year through FY 2035 and 1.5 percent of GDP smaller per year over the FY 2036–2055 period. CBO assumed the revenue losses would come from a uniform refundable tax credit.

CBO estimates this scenario would increase budget deficits by $51.6 trillion through FY 2055. This is the net effect of a $28.4-trillion increase in primary (non-interest) budget deficits and $23.1 trillion of higher interest costs. As a result, federal debt held by the public would rise to 220 percent of GDP by the end of FY 2055, the budget deficit would total 12.0 percent of GDP ($10.4 trillion), and interest costs would total 8.3 percent of GDP ($7.1 trillion).

Relative to current law, debt in FY 2055 would be 63 percentage points of GDP higher, the budget deficit would be 4.7 percentage points of GDP ($3.9 trillion) higher, and interest costs would be 2.8 percentage points of GDP ($2.3 trillion) higher.

The Long-term Economic Impact

On the economic front, tax cuts can stimulate the economy by increasing demand for goods and services and increasing incentives to work, save, and invest. Yet higher debt can weaken economic growth by pushing up interest rates, which crowds out private investment and thus reduces potential output. In the scenario CBO analyzed, it finds that “economic growth would be faster in the first several years after the extension of the tax provisions, primarily because of the increase in the overall demand for goods and services. It would be slower in the longer term….” This trend would materialize as the harm of unpaid-for tax cuts starts to outweigh the benefits of the tax cuts themselves.

CBO estimates that economic output would be above baseline levels through 2031 but would shrink starting in FY 2032 and beyond. By FY 2043, CBO estimates the economy would be 1 percent smaller than it would have been without the tax cuts and lower revenue, and by FY 2055 it would be 2.3 percent smaller.

The added debt from the unpaid-for TCJA extension and lower revenue collections would increase interest rates, making it more difficult for households and businesses to borrow money and make investments. As the amount of government debt increases, investors will raise the amount they charge the government to hold that debt. Thus, rising debt “crowds out” the government funding that could go to private debtors, thereby increasing the interest rate individuals and private businesses must pay for creditors to hold their debt. CBO estimates the average interest rate on federal debt would be above baseline levels through FY 2055; the rate in FY 2055 would be 0.3-percentage points above the baseline.

Moreover, CBO estimates that the growth in average income per person – as measured by Gross National Product per capita – would slow with higher debt. Under current law, CBO estimates average income in FY inflation-adjusted dollars will increase by $41,900, from $89,900 in FY 2025 to $131,800 in FY 2055. With the higher debt from unpaid-for tax cuts and lower revenue, income would increase by $37,500, from $89,900 in FY 2025 to $127,400 in FY 2055. Put different, rising debt would lower income growth by 10 percent and reduce total income in FY 2055 by 3 percent.

Conclusion

CBO shows that while tax cuts can stimulate economic growth, debt-financing them can cause harms that may outweigh the benefits of the tax cuts themselves. As policymakers work to craft the reconciliation legislation to address the TCJA extension and other domestic priorities, they should aim to enact a pro-growth tax package that is offset with spending reductions.