Insight

November 19, 2020

Clean Energy Development in Eastern Europe

Executive Summary

- Eastern Europe has both renewable energy targets and the conditions necessary for successful implementation of renewable resources.

- Wise policies and market formation are necessary to create conditions attractive for foreign investment.

- U.S. participation in the development of renewable energy sources in this region will ensure that this transformative period in eastern European energy addresses the needs of each country and not simply the political or economic desires of Russia or China.

Introduction

Countries in eastern Europe, both those that belong to the European Union (EU) as well as those that do not, have committed to ensuring a larger part of their power generation mix comes from renewable resources in the coming decades. In order to accomplish this goal, each country will not only need to expand existing energy infrastructure, but also modernize antiquated regulatory schemes and markets.

The installation of clean energy technology will require each country to evaluate its available resources in order to determine how to best address implementation. The success of these efforts, however, also depends on regional cooperation and foreign investment. In terms of regional cooperation, eastern European countries have formed various joint initiatives to address their need for improved infrastructure and establish parity with western Europe.

In terms of foreign support and investment, the United States has embraced these initiatives in pursuit of clean energy as well. The development of the clean energy sector in eastern Europe will not only increase security and resilience of their energy supply but also provide an opportunity for investment and the adoption of innovative technologies from the United States.

Eastern European Energy

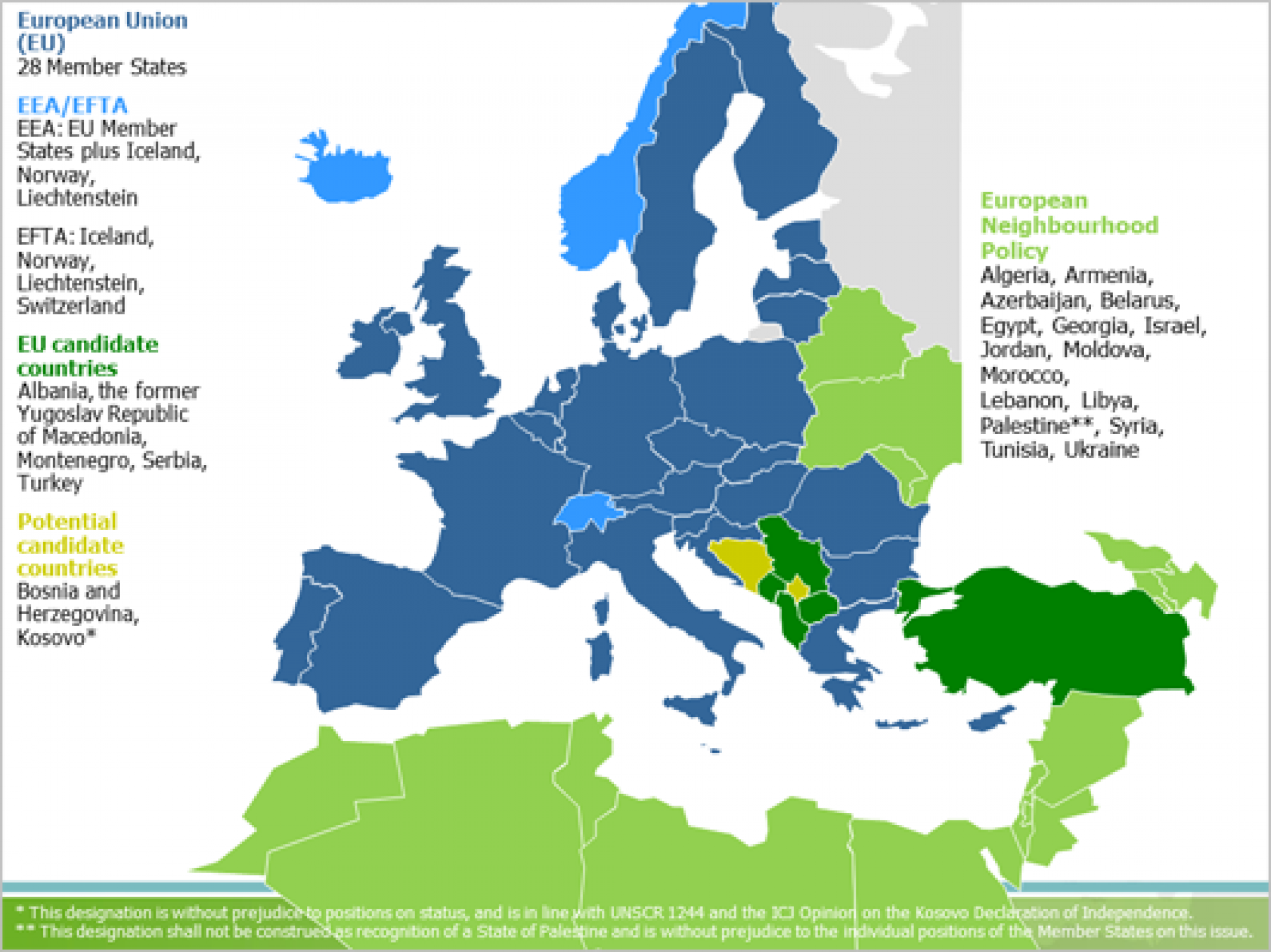

Eastern Europe includes both EU and non-EU member countries, although the economic growth in the region has allowed a number of non-EU members to meet the requirements to join the bloc. EU members include Slovenia, Romania, Bulgaria, Croatia, Poland, Czech Republic, and Slovakia. Official candidates for accession to the EU include Montenegro, Serbia, Albania, and North Macedonia. Potential candidates include Bosnia and Herzegovina, and Kosovo. These countries span from the Baltic Sea to the Adriatic Sea and have varied geography and weather conditions, making for varied potential in the use of clean energy technology, particularly renewable resources. Southeastern Europe, in particular, has conditions most conducive to the development of renewable energy resources.

Source: European Commission

The mix of existing sources of power generation varies from country to country in eastern and southeastern Europe. There are, however, some more general trends. Coal generation remains a significant portion of the power mix. In some countries, such as Bulgaria and Serbia, it is the largest source of power.[1] The use of biomass, predominantly firewood, to generate residential heat is also common.[2] Hydropower is the most prevalent source of renewable energy but may only provide power during portions of the year. In Albania, for example, hydropower can account for as much as 97 percent of domestically generated power but is reliable during less than half the year. During the remainder of the year, Albania imports coal generated power.[3] The installation of renewable generation throughout the region, such as solar photovoltaics or wind turbines, is limited. And substantial energy efficiency gains can be made to reduce demand.[4]

The conditions in southeastern Europe present a particularly strong case for the development of wind energy. Onshore wind projects commissioned in 2018 had a weighted average levelized cost of energy (LCOE) of $0.069/kilowatt hour. LCOE is the average revenue per unit of electricity generated required to recover the costs of building and operating a facility during an assumed lifetime.[5] When compared to 2010 weighted-average LCOE in southeastern Europe, the price fell by 43 percent. And when compared to the values for projects in other European countries in 2018, those in southeastern Europe were 4 percent lower. The LCOE for onshore wind in southeastern Europe demonstrates not only the increasing cost-effectiveness of installing wind resources in the region but also compared to the rest of Europe.[6] Similarly, conditions in southeastern Europe are more suitable for the installation of solar photovoltaics than in northeastern Europe.[7] While the installation of any new generation must be considered in combination with the cost of expanding transmission and distribution infrastructure to ensure the reliable delivery of power, the region presents opportunities for expansion.

Policies

The countries of eastern Europe that belong to the EU introduced renewable energy targets for power generation and saw development of the sector sooner than their non-EU member neighbors. In southeastern Europe, investment in renewable energy resources was highest between 2008 and 2014. The increase in investments was driven by development in Romania and Bulgaria, both EU members. Romania was the first country to achieve EU renewable generation targets in 2015, well ahead of the 2020 target date. Romania has excellent potential for wind development and saw dramatic growth in its wind power generation from 3 gigawatt hours (GWh) in 2007 to over 7,000 GWh in 2014.[8]

The non-EU member countries that have also instituted renewable energy targets have failed to attract the same level of investment.[9] Historically, the development of energy infrastructure in developing economies has been dominated by state-backed companies and schemes.[10] This pattern is the case in much of central and eastern Europe, where there are 52,000 state-owned enterprises (meaning the state has a stake of at least 20 percent) across various sectors such as banking, energy, and transportation, with a majority in Russia.[11]

As a result, non-EU member countries will need to institute policies that attract foreign developers and investment. This is especially important following the COVID-19 pandemic. State-backed energy companies may be experiencing declines in revenue while facing foreign debt obligations. In this weakened position they are likely to seek government support rather than expand their asset base. In addition, throughout 2020 project finance transactions have declined dramatically from over $80 billion globally in 2019 to about $15 billion in the first four months of 2020, suggesting that there is a smaller pool of funds available.[12]

The implementation of policies must also prove to be consistent in the long term. Romania, for example, saw the development of renewable resources due to the creation of incentives in the form of ”green certificates” awarded to renewables operators. The policy, however, was amended throughout the course of its legally established timeline, altering the green certificate program. As a result, investment in Romania has slowed in recent years.[13] Consistent policies that consider long-term implications from the outset are important to maintain investor confidence as the work of reshaping the power sector in response to climate change will take several decades.

U.S. Participation in Eastern Europe

The Three Seas Initiative (TSI) was founded by the presidents of Poland and Croatia and includes 12 members spanning from the Baltic to the Black and Adriatic Seas. The United States has chosen to partner, as well. TSI aims to improve the transportation, energy, and digital infrastructure in eastern Europe, which lags behind the infrastructure in western Europe. With average economic growth in the TSI countries at 3.5 percent from 2015-2019 compared to 2.1 percent in the EU, TSI hopes to appear attractive and “eliminate the shortfall in investments.” TSI’s efforts are supported in part by the TSI Investment Fund.[14]

The United States International Development Finance Corporation (DFC) is providing up to $1 billion in investment for Eastern European energy development as part of the TSI.[15] In October 2020, the United States provided $300 million. Secretary of State Mike Pompeo explained that the United States would provide the remaining funds should the investment fund continue to grow, demonstrating that the United States has a vested interest in the region’s success.[16]

Similarly, in November, the United States Agency for International Development (USAID) established the U.S.-Europe Energy Bridge Initiative to continue its support of Europe’s energy development efforts. Rather than focusing on providing funding for infrastructure projects, the program will coordinate the efforts of countries in eastern Europe that do not belong to the EU in developing their energy policies and markets. The program will simultaneously highlight opportunities for American expertise to assist the region in developing self-reliant energy systems. As a result, increased investment may follow the resulting demonstrated political stability and thoughtful approach to energy development.[17]

Benefits

By increasing renewable generation capacity, countries in eastern Europe will reduce their dependency on imported fossil fuels. The reduction of imports of coal, fuel oil, and natural gas will increase energy independence and thus protect the countries from undue influence. Fossil fuels, particularly natural gas supplied by Russia, have proven to be a means for the United States’ geopolitical rivals to exert influence.

Under its Belt and Road Initiative, China has invested in infrastructure projects throughout the world, especially in developing economies where China is the lender of last resort for fossil fuel projects, such as coal power plants. China’s investments are counter to its own commitment—as well as the global commitment—to reduce greenhouse gas emissions. Like Russia, Chinese investment in infrastructure projects around the world have proven to be a means of geopolitical influence and allow China to practice its authoritarian rule abroad.

The result of U.S. engagement in the development of energy infrastructure will prove valuable for the countries involved as well as the United States. The positive impact that the United States is having in the region is reflected by the fact that countries that no longer qualify for USAID assistance continue to engage with new programs, such as the Energy Bridge Initiative. Efforts to coordinate regional dialogue and introduce new sources of investment ensure that the needs of the countries involved remain at the forefront rather than the political or economic needs of Russia and China.

Conclusion

The adoption of clean energy technology and the modernization of energy infrastructure in eastern Europe are dependent on the creation of markets and policies that attract investment. Recognizing the gaps in infrastructure and creating regional initiatives to address them is only the first step. U.S. engagement in the development of eastern European clean energy technology will help ensure that as these countries’ energy infrastructure develops, their autonomy and self-reliance is promoted.

[1]https://balkaninsight.com/2020/04/15/no-limits-serbia-fails-to-rein-in-coal-fired-polluters/; https://balkangreenenergynews.com/bulgaria-to-continue-to-use-coal-power-plants-at-least-until-2030/

[2] https://balkangreenenergynews.com/bulgaria-to-continue-to-use-coal-power-plants-at-least-until-2030/

[3] https://balkaninsight.com/2019/06/26/why-isnt-albania-cashing-in-on-renewable-energy/

[4] https://www.unece.org/info/media/presscurrent-press-h/sustainable-energy/2019/unece-issues-recommendations-to-accelerate-energy-efficiency-and-renewable-energy-shift-in-eastern-and-south-eastern-europe-central-asia-and-russian-federation/doc.html

[5] https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

[6] https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Dec/IRENA_Market_Analysis_SEE_2019.pdf

[7] https://www.sciencedirect.com/science/article/pii/S0301421515301324

[8] https://www.iea.org/data-and-statistics?country=ROMANIA&fuel=Renewables%20and%20waste&indicator=WindGen

[9] https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Dec/IRENA_Market_Analysis_SEE_2019.pdf

[10] World Energy Investment 2020 https://webstore.iea.org/download/direct/3003

[11] https://www.ft.com/content/3e86a05e-be1a-11e9-b350-db00d509634e

[12] https://webstore.iea.org/download/direct/3003

[13] https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Dec/IRENA_Market_Analysis_SEE_2019.pdf

[14] https://3seas.eu/about/threeseasstory

[15] https://www.dfc.gov/our-work/eastern-europe-and-eurasia

[16] https://www.atlanticcouncil.org/news/press-releases/tallinn-summit-marks-significant-progress-in-three-seas-initiative/

[17] https://www.usaid.gov/europe-and-eurasia/news-information/speeches/us-europe-energy-bridge-next-generation-usaids-energy-sector-assistance