Insight

September 2, 2020

Highlights of CBO’s Updated Budget Outlook for 2020-2030

Executive Summary

- According to new projections from the Congressional Budget Office (CBO), the debt will reach the highest levels in U.S. history in 2023.

- The combined economic, legislative, and technical effects of the COVID-19 pandemic are projected to add $4.4 trillion to baseline deficits, but net of substantially discounted debt service costs, the net change in projected deficits since March is “only” $2.1 trillion over 2020-2030.

- The deficit is projected to be lower, in both nominal terms and as a share of gross domestic product, in 2025 than CBO estimated in its last projection.

Introduction

The Congressional Budget Office (CBO) released an update to its periodic budget outlook, which provides Congress with a 10-year budget projection. This update is the first comprehensive assessment of the nation’s fiscal outlook that fully incorporates the economic and budgetary consequences of the COVID-19 pandemic. The analysis shows that the economic and budgetary consequences of the pandemic combine to push the United States into its highest levels of indebtedness in its history.

Typically, these estimates are paired with an economic forecast and released twice yearly. The extraordinary effects of the COVID-19 pandemic on the economy have necessitated that the agency update its economic estimates sooner as Congress considers policy responses to the health and economic challenge posed by the pandemic. In June, CBO released a 10-year economic outlook that underpins the agency’s budgetary projections. Both reports reflect a nation that has been struck with a severe economic shock that will takes years and trillions in additional borrowing from which to recover.

What’s Changed?

The September 2020 CBO outlook is substantially different from CBO’s projections released in March due to the cost of the federal response to COVID-19 and the related economic effects of the virus and relief efforts. These dynamics are at once reinforcing, in that the recession and federal relief efforts have contributed to higher spending, lower tax receipts, and therefore higher deficits. Indeed, over the period 2020-2030, legislation enacted since March will add a combined $2.8 trillion to baseline deficits. Simultaneously, the COVID-19 pandemic pushed the United States and other global economies into recession. Typically, during a recession, tax receipts decline and spending on income and other federal support programs increases – and this effect is observable in CBO’s estimates. Interest rates also typically fall during recessions, and that effect is also borne out in CBO’s estimates. Because the United States is so substantially indebted, the effects of interest rates on federal debt service costs can significantly affect the budget outlook. Just this effect is estimated to reduce deficits over the 2020-2030 period by over $2.4 trillion. Excluding debt service effects, CBO’s budget estimates show that legislative, technical, and economic considerations have combined to add $4.4 trillion to U.S. baseline deficits. But including the substantially reduced interest costs, baseline deficits are projected to have increased by “only” $2.1 trillion over this period. Indeed from 2024-2030, deficits are projected to be lower than CBO previously estimated.

By the Numbers[1]

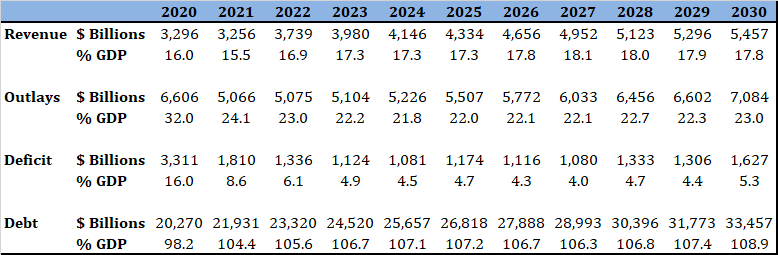

Taxes: By the end of the 10-year budget window, tax revenues will amount to 17.8 percent of gross domestic product (GDP), after recovering from a projected low of 15.5 percent in 2021. Tax revenues will average 17.3 percent of GDP over the next 10 years, which is equal to the 17.3 percent historical average. It is important to note that significant elements of the Tax Cuts and Jobs Act sunset in 2025, helping to drive up revenue as a share of the economy in the budget window’s last four years.

Spending: CBO estimates that, by the end of the budget window, overall spending will total 23.0 percent of GDP, slightly down from CBO’s last projection of 23.4 percent. Entitlement, or mandatory, spending will continue to grow as a share of the federal budget, comprising 66 percent of federal expenditures in 2029, up from 61 percent in 2019 and 29 percent in 1969.

Deficits: The federal budget deficit is estimated to be $3.3 trillion in 2020, or 16 percent of GDP. The highest nominal deficit ever previously recorded was $1.4 trillion in 2009. As a share of GDP, the 2020 deficit will surpass the deficit of 1942, the first time federal deficits have ever exceeded any of those observed during World War II. The deficit will average 6.1 percent of GDP over the 2020-2030 period.

Interest Payments: Interest payments on the debt will reach $664 billion in 2030. While this figure reflects a 77 percent increase in debt service costs over those of fiscal year 2019, it does reflect a substantial decline in projected debt service costs due to lower projected interest rates.

Debt Held by the Public: Borrowing from the public is projected to increase as a share of the economy under current law, reaching 108.9 percent of GDP in 2030. The debt is expected to surpass 100 percent of the economy in 2021, when it will reach 104.4 percent of GDP. By 2023, the debt is expected to reach the highest level as a share of GDP in U.S. history – surpassing the 106.1 percent record from 1946 following the end of World War II.

[1] Note that this analysis includes FY2020, whereas CBO totals cover the period 2021-2030.