Insight

January 28, 2020

Highlights of the January 2020 CBO Budget and Economic Outlook

Today, the Congressional Budget Office (CBO) released its Budget and Economic Outlook: 2020-2030, which provides Congress with a 10-year budget projection to evaluate the costs of potential legislation. Underpinning the budgetary estimate is CBO’s economic forecast for the next decade, which incorporates the assumed economic effects of federal laws currently in force.

What’s Changed?

CBO’s January 2020 outlook is broadly similar to its August estimates, with two major differences. First, Congress enacted a substantial spending and tax bill at the end of last year, increasing the deficit compared to CBO’s prior estimates by $505 billion. CBO also reduced its interest rate forecasts, reducing projected debt service costs by $530 billion over the next decade. Other economic and technical changes also variously affected CBO’s outlook.

By the Numbers

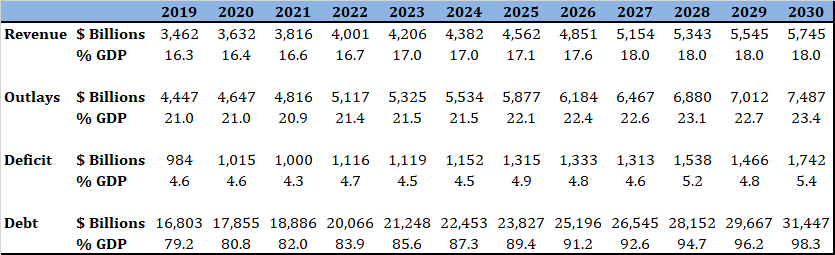

Taxes: By the end of the 10-year budget window, tax revenues will amount to 18.0 percent of gross domestic product (GDP). Tax revenues will average 17.4 percent of GDP over the next 10 years, which is equal to the 10-year average projected in CBO’s August update, and is slightly above the 17.3 percent historical average. It is important to note that significant elements of the Tax Cuts and Jobs Act sunset in 2025, helping to drive up revenue as a share of the economy in the budget window’s last four years.

Spending: CBO estimates that, by the end of the budget window, overall spending will total 23.4 percent of GDP, amounting to $60.7 trillion over the period 2021-2030. Entitlement, or mandatory, spending will continue to grow as a share of the federal budget, comprising 65 percent of federal expenditures in 2029, up from 61 percent in 2019 and 29 percent in 1969.

Deficits: Projected budgets deficits will grow substantially over the budget window, reaching over $1 trillion in 2020, similar to what CBO projected in August. The deficit will average 4.8 percent of GDP over the 2021-2030 period, exceeding average economic growth over the same period by a full percentage point. Accordingly, debt accumulation will continue to grow as a share of the U.S. economy over the next 10 years.

Interest Payments: Interest payments on the debt will reach $819 billion in 2030. While this figure is more than twice the $376 billion in debt-service costs during FY2019, it does reflect substantial declines in projected debt service costs due to lower projected interest rates.

Debt Held by the Public: Borrowing from the public is projected to increase as a share of the economy under current law, reaching 98.3 percent of GDP in 2030. Only in 1945 and 1946 was the debt held by the public higher.

Economic Projections

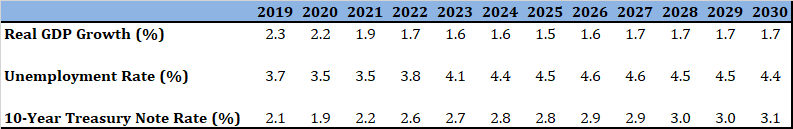

CBO’s economic outlook is broadly similar to its August 2019 Update. CBO projects real GDP growth to average 1.7 percent over the budget window, slightly slower than in its August estimate. CBO projects a persistent, low-interest rate environment reducing its estimates of interest rates compared to its previous forecast. CBO’s 10-year economic forecast therefore reflects the agency’s somewhat consistent view that the U.S. economy will continue to enjoy moderating real GDP growth in the near-term, followed by persistent real growth of below 2 percent per year. This outlook is generally consistent with those of the Blue Chip forecast and those published by members of the Federal Reserve.