Insight

April 13, 2016

Low Oil Prices Won’t Deter Russian Aggression, American Leadership Will

SUMMARY

- Russia’s aggressive behavior has put it at odds with the United States and the West.

- Low oil prices are unlikely to force a significant reversal of Russia’s sustained increase in military spending or restrain the country’s aggressive behavior.

- The United States should take proactive measures to deter future disruptive actions from Russia by reassuring European allies, committing to Ukrainian stability, and restoring U.S. leadership in the world.

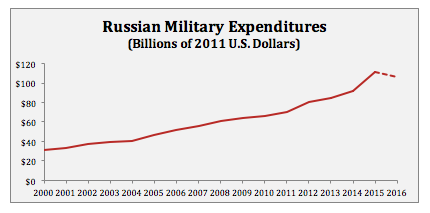

Chart 1

2014 figures based on SIPRI reports; 2015 figures based on IHS Jane’s 2015 Budget Report; 2016 figures reflect anticipated 5% cut.

INTRODUCTION

Russia’s recent aggression has put it at odds with the United States and the international community. On a quest to return to the global stage, Russia has violated state sovereignty, undermined regional security, subverted European unity, and reinforced an authoritarian regime in Syria—all while repressing civil liberties at home. This behavior has garnered only mediocre responses from the United States and the West. With oil prices at historic lows and the partial withdrawal of Russian troops from Syria, it is tempting to believe that the decline in the Russian economy will restrain the country’s disruptive behavior. The United States, however, should not rely on the depressed oil market as a substitute for action to deter Russia.

ECONOMIC ANALYSIS

Nearly half of Russia’s budget revenues come from oil and gas taxes, suggesting that Russian economic health is directly related to the strength of the oil market. Recent AAF research shows that the Russian economy is in poor shape, but low oil prices have not severely affected the country’s ability to finance government expenditures.

The main reason behind this is that oil is traded in U.S. dollars, which has worked to Russia’s advantage. As an oil exporting country, Russia has benefited from the relative strength of the dollar, cushioning the fall of the ruble in the midst of low oil prices. While oil prices in U.S. dollars fell 70 percent over the past three years, the price in Russian rubles only fell by 20 to 30 percent. Additionally, Russia’s foreign currency reserves have appreciated with the strength of the dollar. This fortifies Moscow’s ability to fund expenditures, since the country is able to finance even more of its budget, which is set in rubles, by drawing from their reserves and converting the currency.

RUSSIA IN CONTEXT

To be sure, the Russian economy has suffered due to historically low oil prices. In response to the 3.7 percent contraction in the economy, Russia adjusted some of the country’s budget, even sacrificing some defense spending. Late last year, Russia announced that it would cut its 2016 defense budget by 5 percent. While a surprising move, given the country’s ongoing military modernization project, the 5 percent cut must be read in context. First, this decrease in spending is less than the anticipated 10 percent across the board cuts for the rest of the budget. Second, Russia’s defense budget has increased significantly in the past 15 years, as seen in Chart 1, and military modernization remains a policy priority for the Russian state and its economy.

Similarly, it would be easy to misread Russia’s partial withdrawal from Syria. Many have speculated that a weak economy at home may have motivated Russian President Vladimir Putin’s decision to pull back troops. Reports of ongoing military shipments to Syria indicate that Putin is not completely disengaging from the conflict. While any withdrawal will save Russia some money, it is too simplistic to assert that economic pressures alone, or even primarily, motivated Russia’s decision.

Moscow is in a greater position of power now than it was before Putin led his country into Syria and reemerged as a power broker. The initial withdrawal from Syria demonstrates that Putin is close to achieving his stated goal to stabilize Assad’s regime. At the same time, Putin is also achieving his goals in Ukraine by annexing Crimea, weakening the national government, and perpetuating the conflict in the country’s east. For all of the international criticism, Putin’s foreign aggression has only boosted his popularity at home and emboldened his commitment to remain in a position of power.

Expecting the global oil market to force a reduction in defense expenditures would be an unreliable and irresponsible way to deter Russian aggression. The Russian economy relies on oil prices for long-term stability, but in the short-term, foreign currency reserves and a strong U.S. dollar are saving its economy from a real crisis. The United States must take significant steps to counter Russian aggression, reassure European allies, and restore U.S. leadership in the world.

RECOMMENDATIONS

First, the United States should invest more in defense spending in Europe. The administration’s proposed 2017 defense budget requests $3.4 billion for the European Reassurance Initiative (ERI) — a four-fold increase. This funding would increase the number of U.S. troops in Europe, allow for more bilateral and multilateral military exercises, and provide for capacity building measures, mostly focusing on Central and Eastern European states. This is a necessary but insufficient step toward countering Russia’s subversive presence in the region.

Second, the United States and NATO should fulfill its commitment to increase the number of troops in Europe’s east, closer to Russia’s border. While U.S. European Command coordinates with NATO to ensure military readiness and disaster response, the current number of rotational troops does not signal the West’s commitment to the security of the continent. A more substantial force could prompt a strong response, but it is unlikely that Russia would risk an open conflict with NATO troops. Increasing the troop presence on Russia’s doorstep would deter further Russian expansionism and reassure allies like the Baltic states, where tensions along borders highlight potential flashpoints with Moscow.

Third, the United States should commit to security in Ukraine by providing the country with the means to defend itself. Congress approved sending defensive weapons and lethal assistance with broad bipartisan support in 2015, but the administration has refused to send anything beyond economic and non-lethal assistance. Sending arms to the Ukrainian military would not only help restore peace and security to the country, it would also send a strong signal to Russia that American leaders are committed to international standards of state sovereignty and territorial integrity—and deter further Russian aggression in Eastern Europe.

Fourth, the United States should stand strongly against human rights violations in Russia. Increasing rhetorical support for Russia’s democratic dissidents would demonstrate that the United States supports their cause of freedom. United States should stand with those fighting for their civil liberties and condemn government-sponsored violations of political freedoms. Civil liberties have steadily declined in the past few years in Russia and the world seems to have overlooked the state’s restrictive policies.

Fifth, U.S. leaders should expand the current list of individuals responsible for the degradation of human rights in Russia. Following the model of the Magnitsky Act, sanctions could have the capacity to freeze assets and prohibit travel to the United States. Targeting the core concerns of the Russia oligarchs has drawn their attention in the past, prompting strong responses from the Kremlin.

CONCLUSION

Assertive power has consequences but draws a clear boundary of what the United States is willing to accept. Rather than relying solely on low oil prices to atrophy Russian aggression, the United States must employ a strong, holistic response that couples diplomatic pressure and military deterrence. The United States should take up its leadership mantle, reassure our European allies, and work to deter a revanchist Russia. This will take resolute action against an aggressive state and cannot be left to the fate of oil prices.