Insight

February 20, 2026

U.S.-India Energy Trade Deal: Is It Achievable?

Executive Summary

- The United States and India have reached a trade agreement in which India is expected to purchase $500 billion worth of goods including energy, technology, and other products from the United States over the next five years.

- In 2025, U.S. goods exports to India were nearly $39 billion, with energy exports accounting for about a third of the total. Based on historical trends, these exports are projected to total $261 billion over the next five years, leaving a $239 billion gap relative to the trade deal’s target; even if India doubled its U.S.-imports growth rate, a $152 billion gap would remain.

- This insight summarizes the U.S.-India trade deal, analyzes the energy market dynamics between the two nations, and explains why India is unlikely to meet the trade deal’s target – whether through total imports from the United States, or the specific goods outlined in the agreement.

Introduction

The United States and India have reached a trade agreement in which India is intended to purchase $500 billion worth of goods including energy, technology, and other products from the United States over the next five years. This deal also eliminates the 25-percent U.S. punitive tariffs on India that had been put in place to discourage the country’s purchase of Russian oil.

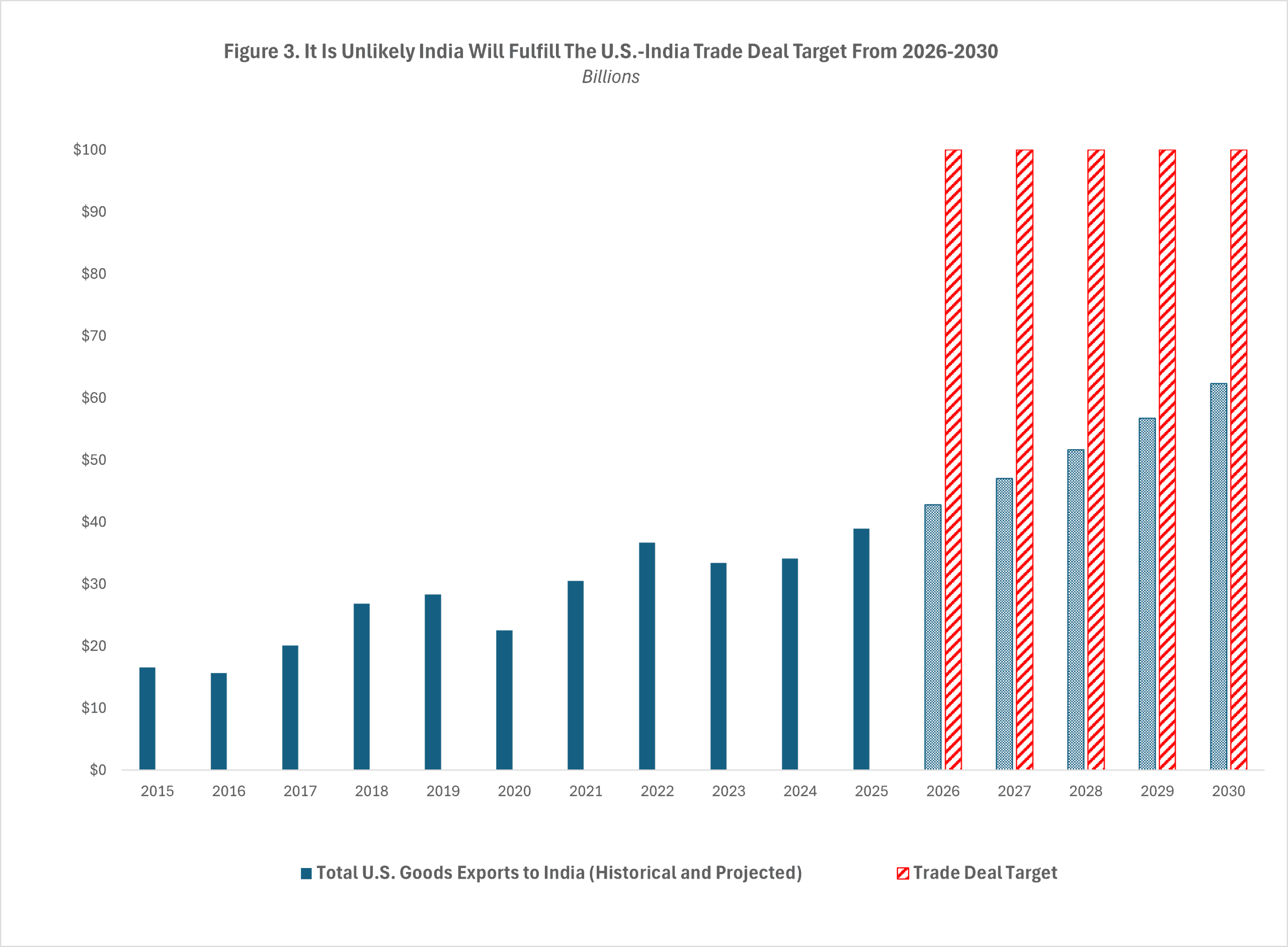

Total U.S. goods exports to India were just shy of $39 billion in 2025, and are projected to reach about $261 billion over the next five years. But this would leave a massive U.S. import shortage of $239 billion for India to fulfill the trade deal. Even if India were to double the growth rate of its goods imports from the United States, there would still be a $152-billion gap.

This insight summarizes the U.S.-India trade deal, analyzes the energy market dynamics between the two nations, and explains why India is unlikely to meet the deal’s ambitious target – whether through total imports from the United States, or the specific goods outlined in the agreement.

The U.S.-India Trade Agreement

On February 9, the White House released a fact sheet on the recently announced what it billed as a “historic trade deal” with India that “will open up India’s market of over 1.4 billion people to American products.” According to the document, India “intends to buy more American products and purchase over $500 billion of U.S. energy, information and communication technology, coal, and other products” over the next five years.

The fact sheet is light on details and does not specify which energy products would be purchased or a purchase amount by product category. Whether this includes natural gas, oil, or other energy-related products remains to be seen.

The U.S.-India joint statement released on February 6 provided a slightly more detailed description of the “framework for an interim agreement” the two countries have reached. Its key provisions are: 1) India intends to purchase “$500 billion of U.S. energy products, aircraft and aircraft parts, precious metals, technology products, and coking coal over the next 5 years”; and 2) the United States intends to eliminate the 25-percent punitive tariffs on India which had been put in place to discourage the country’s purchases of Russian oil. Within the agreement, India has committed to stop purchasing Russian oil by swapping these imports with those of the United States and potentially Venezuela.

U.S.-India Trade

Total bilateral trade

The trade relationship between the United States and India has experienced steady growth over the past decade, with total bilateral trade increasing by roughly 135 percent. In 2025, estimated U.S. goods exports to India are estimated to have totaled just under $39 billion, while U.S. imports from India were close to $105 billion, both of which were a notable uptick from 2024. The primary U.S. export categories to India have been precious metals, mineral fuels, aircraft, mechanical appliances, machinery, and medical instruments. Since 2018, the number-one U.S. export category has been mineral fuels and other energy related products. The top U.S. import categories from India include electrical equipment, pharmaceuticals, precious metals, and organic chemicals. and organic chemicals.

Energy Trade

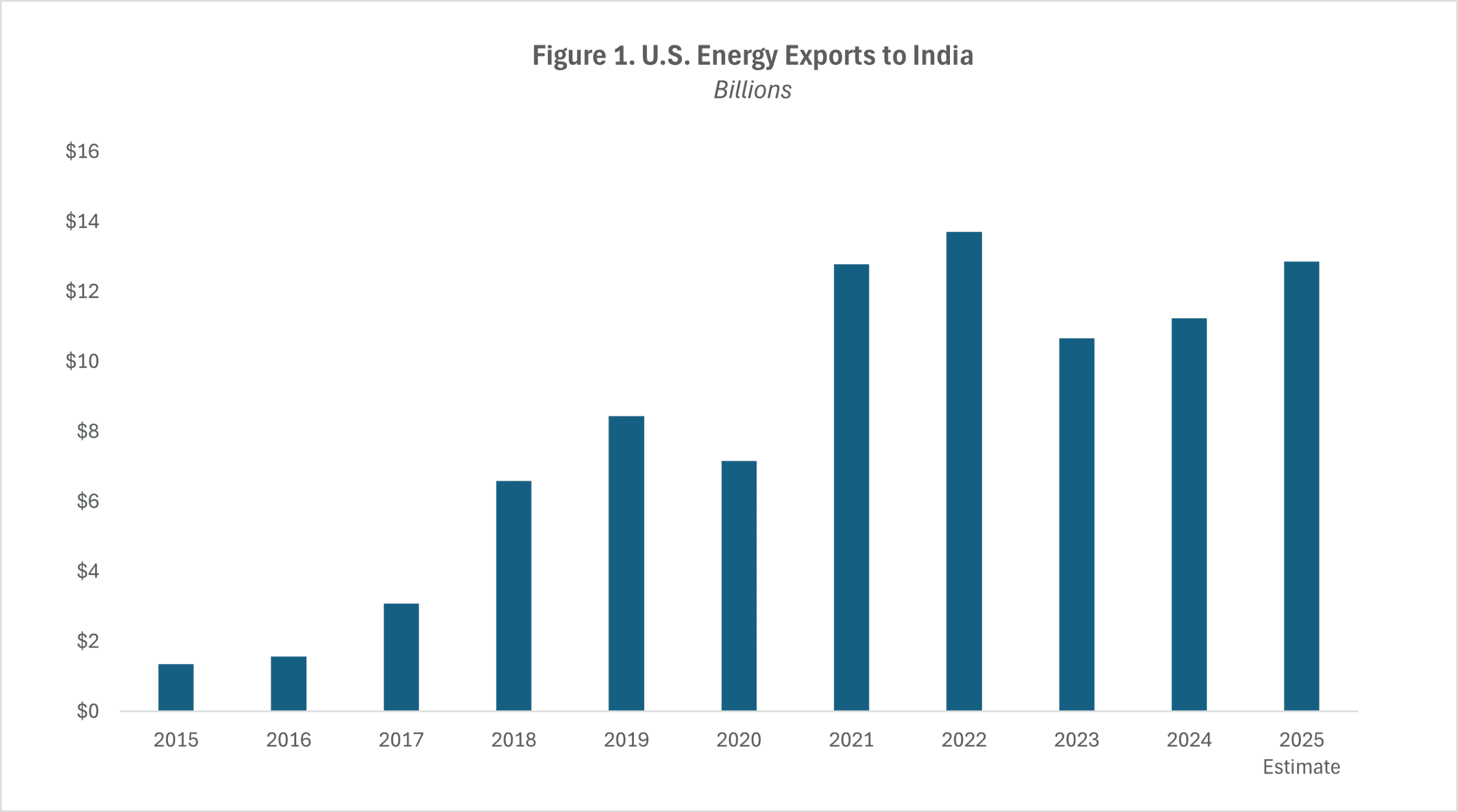

In 2024, the United States exported $11.4 billion worth of energy products to India, representing 33 percent of total U.S. exports to India. This amount only accounted for about 3 percent of total U.S. energy exports, however. Based on data from January to November, energy exports to India in 2025 are expected to have been $12.8 billion.

The largest categories of U.S. energy exports included crude petroleum, coking coal, and natural gas. As displayed in Figure 1, U.S. energy exports to India have remained relatively flat since 2022 despite a large growth spurt between 2015–2021.

Source: United States International Trade Commission

In 2023, India imported nearly 40 percent of its crude oil from Russia at approximately 1.8 million barrels per day. This was a drastic increase compared to 2021 before Russia’s invasion of Ukraine when India imported just 2.5 percent of its oil or 100,000 barrels per day from Russia (see Figure 2).

Source: Financial Times

The primary reason for this increase was that Russian oil was sanctioned by both the United States and European Union, meaning Russia heavily discounted the price of its oil to those that would make the purchase. For instance, discounts were between $20 to $25 per barrel at the onset of the war in Ukraine and are currently at around $12. As of February 2026, Russia has widened the discount offered to China to about $9, likely to incentivize Chinese buyers to replace lower sales to India.

By comparison, just 4 percent of India’s crude oil came from the United States. Furthermore, 14 percent of its liquified natural gas (LNG) imports and 8 percent of its coal imports came from the United States. India primarily imports LNG from Qatar (50 percent) and coal from Indonesia (42 percent) while Russia has not been a significant supplier of these specific energy products.

Trade Deal Practicality

The Trump Administration’s objective to export $500 billion to India within five years is a tall order and likely an impractical target to achieve based on historical export growth rates. Over the past decade, both the average and median annual growth in U.S. exports to India has been right around 10 percent. This means that over the next five years, total U.S. exports to India are expected to total $261 billion, representing a $239 billion gap (see Figure 3 and Figure 4). Even if U.S. exports to India grow by double the historical rate over the next five years, there would still be a $152 billion gap. Notably, these figures represent the sum of all U.S. exports to India rather than the discrete product categories identified in the trade deal, which suggests the U.S.-India trade agreement is more of a symbolic and political agreement than a realistic and binding trade pact.

Source: U.S. International Trade Commission

Source: U.S. International Trade Commission; authors’ analysis.

India’s Energy Consumption

In 2023, India ranked the third globally in terms of its total energy consumption, behind China and the United States. In 2024, India surpassed the United States to become the second-largest energy consumer in the world.

India has substantial demand for fossil fuel, which accounted for almost 95 percent of its energy consumption in 2023. In that year coal accounted for 59 percent of its energy consumption, petroleum and other liquids, 29 percent, and natural gas, 6 percent. The country consumed only a small amount of clean energy, with renewables at 4 percent and nuclear energy at 2 percent. In the same year, it was the world’s third-highest consumer of petroleum and other liquids, and the fourth-biggest importer of LNG.

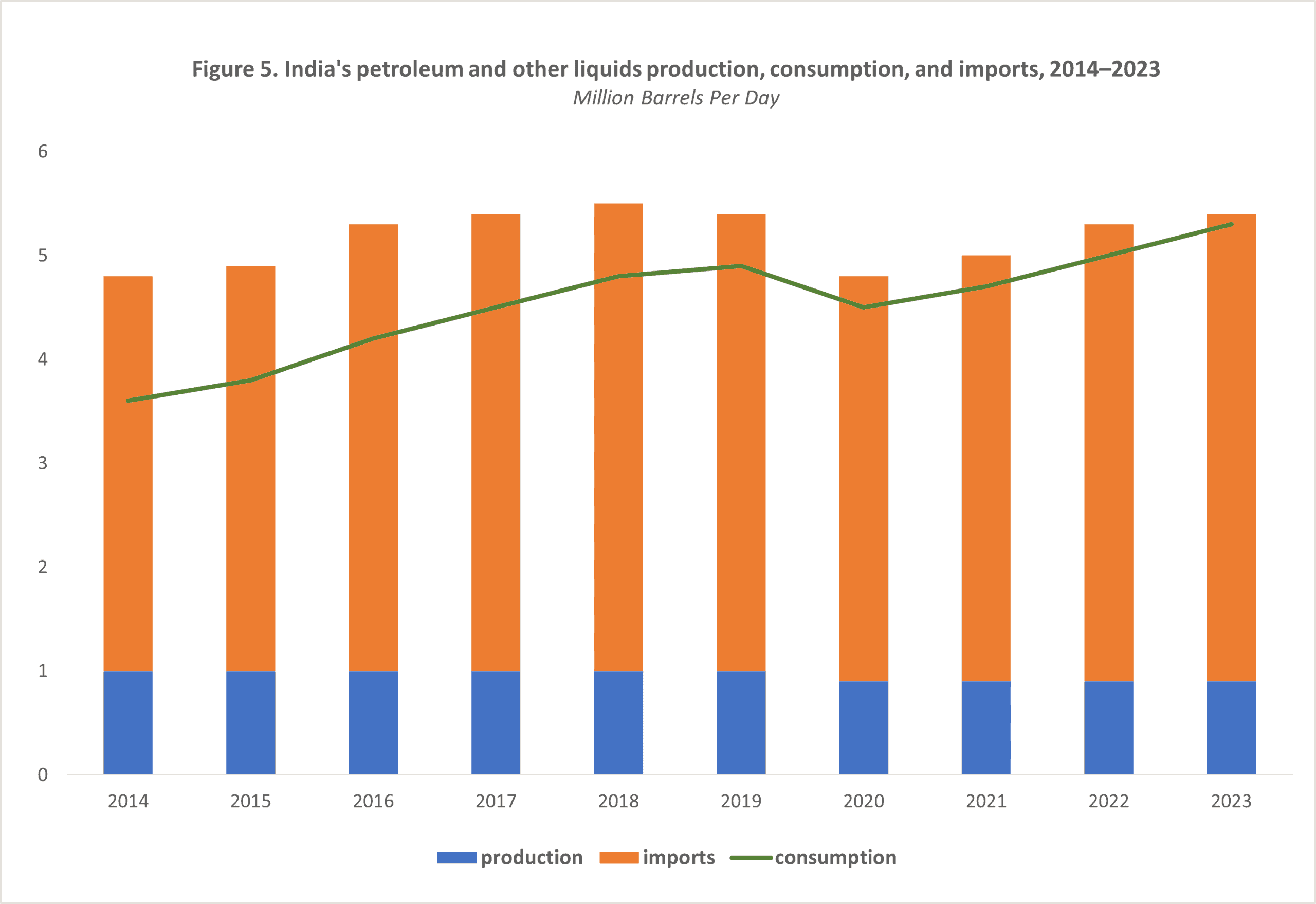

As shown in Figure 5, India has been relying on imports for most of its energy consumption. Its petroleum and other liquids production were flat from 2014–2023, while energy imports and total energy consumption trended steadily upward from 2020–2023.

Source: U.S. Energy Information Administration

Despite its large coal deposits and status as one of the world’s top coal energy producers, India imports coal to meet its soaring electricity demand. It is estimated that coal will continue to be the major energy source for power generation in India through 2030.

About one quarter of India’s coal consumption is for industrial purposes such as manufacturing steel. The coal used for generating power—thermal coal— is different from metallurgical or coking coal, which is used to make steel. Coking coal typically contains more carbon than thermal coal.

Although India has vast coal reserves, it has a significant shortage of coking coal. More than 90 percent of India’s consumption of coking coal comes from imports. As the second-largest producer of crude steel, India plans to double its steel production between now and 2030. India’s coking coal imports are estimated to reach 160 million tons by 2030. Top countries exporting coking coal to India include Australia, the United States, and Russia.

India’s large demand for coking coal and a lack of domestic production capabilities give the United States an opportunity to continue to grow its exports of coking coal to the country. This may explain why coking coal is specifically mentioned in the joint statement as one product that India intends to purchase from the United States. The U.S. coal energy industry currently has strong support from the administration through a series of executive orders and a production tax credit included in the 2025 One Big Beautiful Bill Act.

Conclusion

Given the U.S.-India energy market dynamics and trade relationship, it is unlikely that India will be able to achieve the intended imports target within the next five years. The trade deal’s $500 billion number for the selected traded products seems to be symbolic rather than practical.