Insight

August 25, 2025

Union Pacific-Norfolk Southern Merger Unlikely to Derail Competition

Executive Summary

- On July 29, rail operator Union Pacific announced the $85 billion acquisition of Norfolk Southern, which would create the first transcontinental railroad in the United States operated by a single firm.

- The combination – to be named The Union Pacific Transcontinental Railroad – would link Union Pacific’s western operations with Norfolk Southern’s eastern rails, connecting more than 50,000 route miles across 43 states, and link approximately 100 ports.

- The Surface Transportation Board, the regulator responsible for assessing the merger’s effect on competition, will need to weigh efficiency gains with the possibility of blocking connecting tracks for rivals; the review will be conducted using the agency’s new merger guidelines, which substantially increased the burden on merging firms.

Introduction

On July 29, rail operator Union Pacific announced an $85 billion acquisition of Norfolk Southern. The combination – to be named The Union Pacific Transcontinental Railroad – would link Union Pacific’s western operations with Norfolk Southern’s eastern rails.

According to the announcement, the acquisition would connect more than 50,000 route miles across 43 states and link approximately 100 ports.

The Surface Transportation Board (STB) will assess the merger’s effect on competition and whether it is in the public interest. The STB will need to weigh the efficiencies gained via eliminating interchange traffic with the possibility of blocking connecting tracks for rivals. The review will be the first merger evaluated under the agency’s new merger guidelines, which substantially increased the burden on merging firms.

Merger Proposal

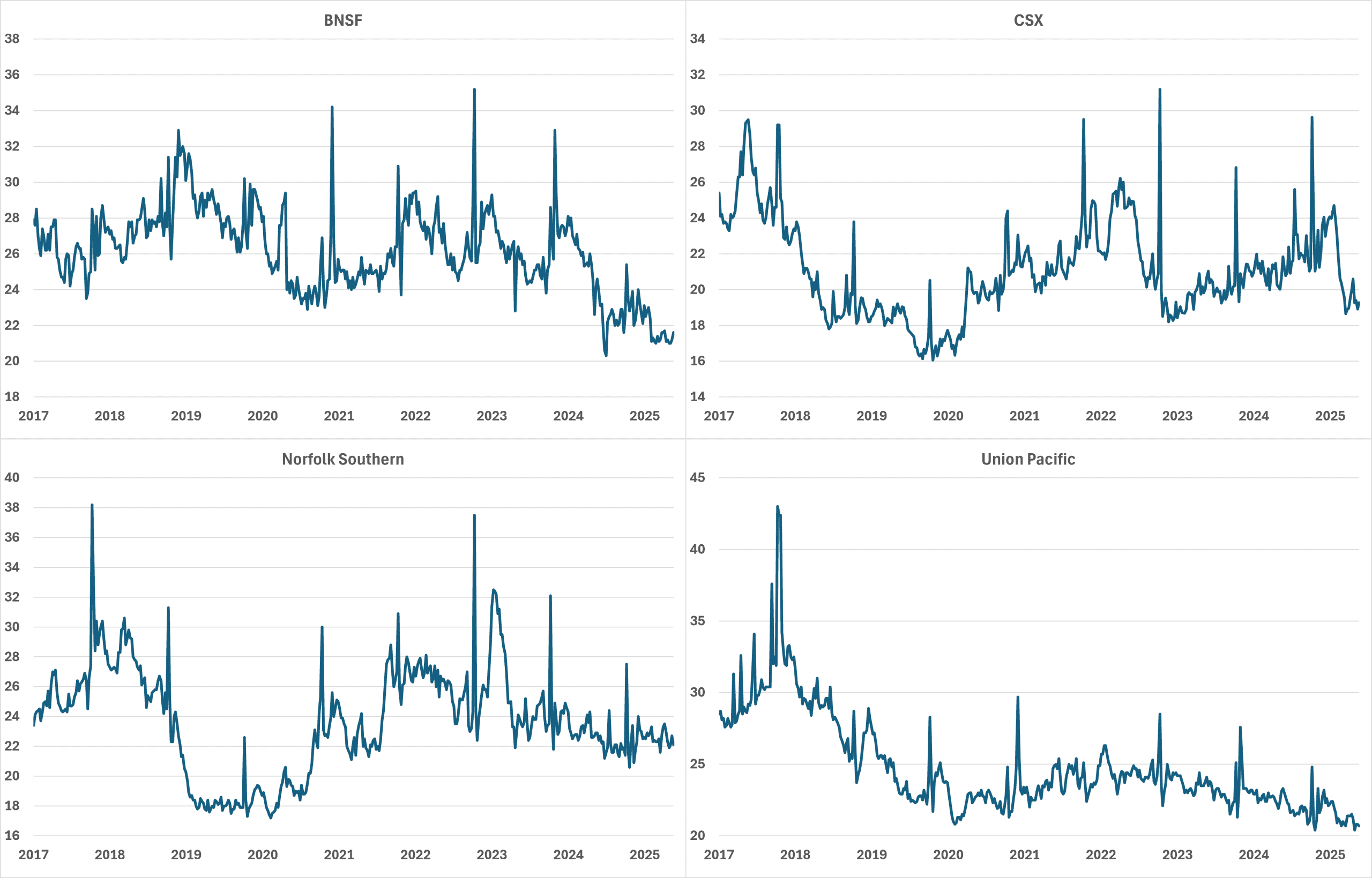

Data from the Bureau of Transportation (Figure 1) show that Union Pacific’s rail network spans from the West Coast to the western borders of Indiana, Kentucky, Tennessee, and Mississippi. Norfolk Southern, meanwhile, connects the eastern limits of Union Pacific’s network with the eastern seaboard. The data show little overlap in rail networks.

Figure 1

*Source: The Wall Street Journal

Union Pacific and Norfolk Southern argue that the merged firm would gain logistical efficiencies that allow shippers to “seamlessly” haul freight from coast to coast.

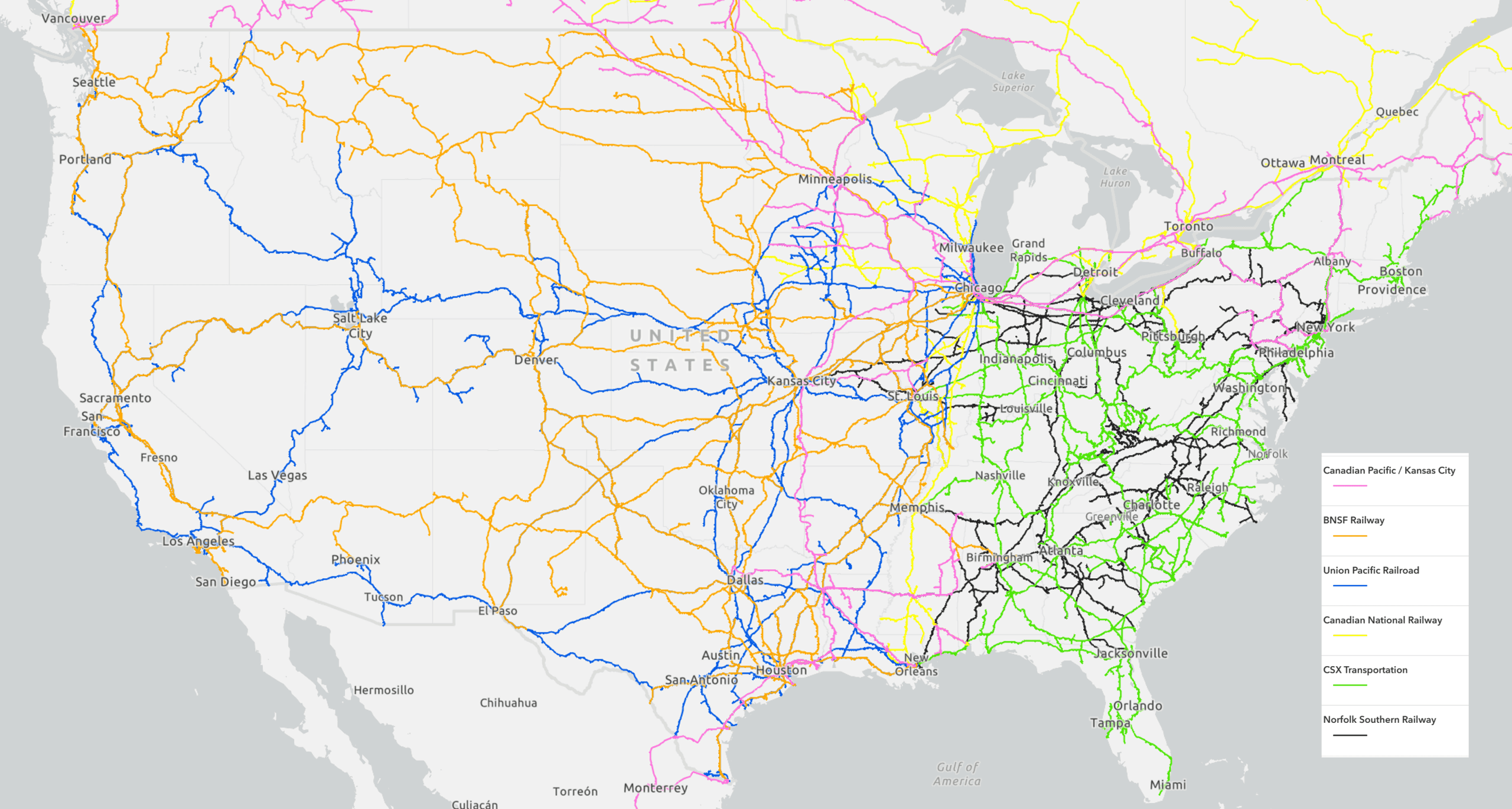

Rail operations are plagued by interchange delays, which occur when various rail networks converge to pass railcars from one line to another, and traffic exceeds handling capacity. Interchange delays are closely related to terminal dwell time, a metric measuring the average time a railcar spends at a terminal before departure. Figure 2 shows the weekly average terminal dwell time by rail operator.

Figure 2

Average Terminal Dwell Time, in Hours (Excl. Cars on Run Through Trains)

*Source: Surface Transportation Board: Rail Service Data

Increased dwell time could lead to increased costs, missed delivery windows, and disrupted inventory management. Union Pacific and Norfolk Southern currently exchange about 1 million shipments per year and are each other’s largest interchange partners. Combining the Union Pacific and Norfolk Southern rail networks could alleviate interchange bottlenecks and reduce dwell times as less freight would need to be switched from one carrier to another.

The merger could also offer increased competition to coast-to-coast trucking. The expansive network of highways affords trucking freight an advantage in “door-to-door” service. Rail, however, is more limited in where it can be delivered. Reducing the need to change rail lines, which could decrease delays, could make longer hauls by rail a more attractive option for shippers.

Furthermore, shipping is often intermodal, meaning it uses various modes of transport including rail, air, waterways, and trucks for delivery. A transcontinental network of rail could enable a longer trip on rail before changing the mode of final delivery. RSI Logistics found that the cost of shipping per net ton via truck is $214.96 compared to just $70.27 if shipped directly by rail, meaning that extending the length of the rail route would likely lower shipping costs.

Recent Rail Mergers

Canadian Pacific Railway and Kansas City Southern

In 2023, the STB approved the merger between Canadian Pacific Railway (CP) and Kansas City Southern (KCS), which connected Canada and Mexico through the United States.

The STB approved the merger, in part, because the transaction was “‘end-to-end,’ meaning there are little to no track redundancies or overlapping routes.” The STB noted that the merger would “eliminate the need for the two now-separate CP and KCS systems to interchange traffic moving from one system to the other.” This is the same claim made by Union Pacific and Norfolk Southern.

New Merger Rules

In 2001, the STB adopted new rules for governing major rail mergers. This new set of rules put an increased burden on the merging parties to show that the merger enhances competition rather than simply preserving it. The review of the merger between Union Pacific and Norfolk Southern will be the first under these new guidelines.

Although the merger between CP and KCS happened more than two decades after these rules were adopted, they were able to obtain a waiver and be judged under the old regulations because they were the two smallest railroads and their networks would be extended end to end. There is unlikely to be such a waiver in the Union Pacific and Norfolk Southern merger review because of the relative size of their operations.

Possibility of Foreclosure

The railroad operations of Union Pacific and Norfolk Southern, as shown above in Figure 1, have little geographic overlap. Union Pacific operates in the western half of the United States, while Norfolk Southern is an eastern network. As shown in Figure 3 below, the major rail networks are similarly divided. This division demands seamless logistical coordination and agreements among rail operators to move freight across the country.

Figure 3

*Source: Surface Transportation Board

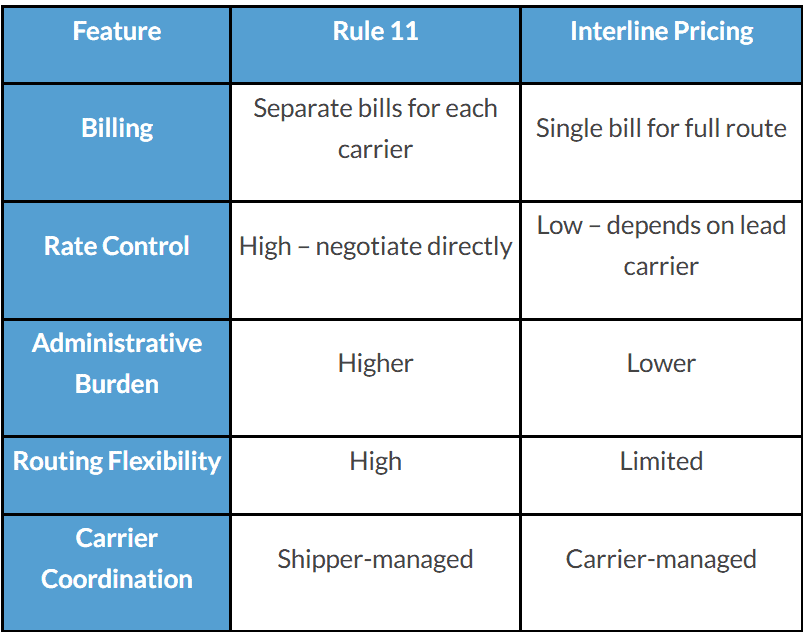

InTek Intermodal Logistics explained the logistics behind moving freight and the two primary billing methods used by shippers and carriers. Rule 11 is a billing regulation used in rail freight transportation that allows shippers to contract separately with each rail carrier involved in a multi-carrier move. An interline agreement, meanwhile, is an agreement between two or more railroads that allows them to jointly transport freight over a route that crosses multiple networks and a revenue split based on the portion each route handles. InTek provided a comparison table between the two modes of billing, shown in Figure 4.

Figure 4

*Source: InTek Intermodal Logistics

A transcontinental railroad would likely change existing industry billing dynamics. Customers may no longer need to negotiate with multiple carriers for cross-country shipments. Interline agreements, meanwhile, could face disruption after Union Pacific and Norfolk Southern combine rail operations, as the need for interchange stops would be reduced. These scenarios will likely raise foreclosure concerns at the STB, so it is possible that the post-merger firm could block rivals from using its tracks. The ability to foreclose could leave shippers with fewer shipping options and higher prices.

Foreclosure – typically a concern of vertical mergers – refers to practices that prevent rivals from accessing markets. Foreclosure in a vertical merger, which combines firms at different stages of the supply chain, typically involves an input to production. Illumina’s forced divestment of Grail at the order of the Federal Trade Commission (FTC) in 2023 exemplifies the foreclosure theory. Grail makes non-invasive, early detection liquid biopsy tests that can screen for multiple types of cancer. To conduct the test, Grail uses a next-generation sequencing platform manufactured by Illumina. The FTC found that Illumina could foreclose Grail’s competitors by raising costs or withholding access to the technologies on which other multi-cancer early detection tests developers rely.

A firm seeking to ship from the East Coast to the West Coast currently requires an eastern carrier such as Norfolk Southern or CSX Transportation and a western railroad such as Union Pacific or BNSF. The opportunity to foreclose on rivals could present itself when the post-merger firm blocks rivals from connecting tracks. In other words, a cross-country shipper could lose the ability to use multiple rail services and negotiate costs by being forced to use the single Union Pacific/Norfolk transcontinental network. This could allow the firm to raise shipping costs.

Yet the networks of East Coast shippers Norfolk Southern and CSX only marginally overlap; it is the same for Union Pacific and BNSF on the western half of the United States. Because rail is not as versatile as trucking in terms of where things can be shipped, it is likely still to be advantageous for the post-merger firm to continue interchange agreements with competitors to ensure freight is shipped by rail rather than other methods of transport.

Conclusion

Union Pacific’s proposed acquisition of Norfolk Southern would create the first transcontinental railroad in the United States operated by a single firm. The combination would likely provide efficiencies that could lower costs to shippers and reduce delays. Yet the possibility that the merged firm could foreclose on other competitors from accessing their combined network is likely to be considered when the STB reviews the merger under stricter standards.