Press Release

January 10, 2020

Wealth Tax Would Disproportionately Harm Workers

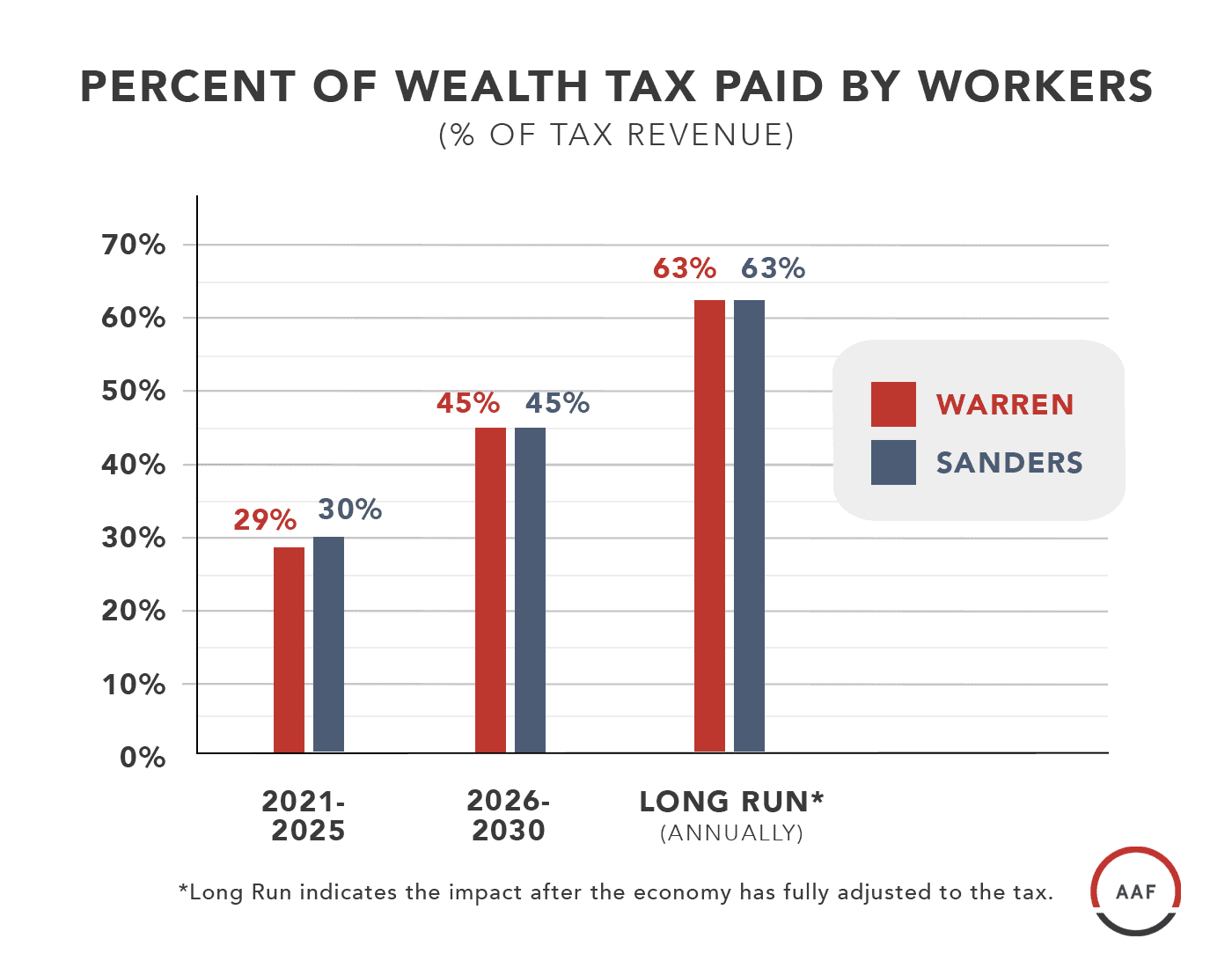

Senators and presidential candidates Elizabeth Warren and Bernie Sanders have proposed taxes on household wealth, seeking to impose the burden of government expansion on a small number of individuals. New research from the American Action Forum, employing a third-party model similar to those used by federal government agencies, examines the economic impact of their proposals. It finds that such a tax would have a uniquely negative impact on workers’ real wages – ultimately imposing an effective tax of 63 cents on workers for every dollar the government raises in revenue from the wealthy.

See related piece in today’s Washington Post, “Liberals’ wealth tax would ripple through U.S. economy, GOP economist says.”

The key findings:

- The Warren wealth tax would cost workers $1.2 trillion (in 2018 dollars) in lost earnings over the first 10 years, and ultimately, for every dollar of revenue raised, workers would lose more than 60 cents of earnings;

- The Sanders wealth tax would result in similar impacts, costing workers $1.6 trillion (in 2018 dollars) in lost earnings over the first 10 years, and imposing over 60 percent of the burden of the proposal on workers (see Executive Summary Table); and

- The magnitudes of the results are large despite a conservative approach to the analysis.

Results of modeling by Robert Carroll, James Mackie, and Brandon Pizzola of EY’s Quantitative Economics and Statistics (QUEST) Group

Results of modeling by Robert Carroll, James Mackie, and Brandon Pizzola of EY’s Quantitative Economics and Statistics (QUEST) Group