Research

August 11, 2025

Health & Economy Medicare Medigap Transition Estimates

The Center for Health and Economy (H&E) is dedicated to assessing the impact of proposed reforms to the entire health insurance market. In this report, we simulate a Market Choice reform that considers removing Medigap as a choice for the Medicare market. The following details the H&E report of this Market Choice approach with a focus on Medicare insurance choices, federal budgetary impact, and the premium landscape of health insurance for Americans over the age of 65. The estimates are compared to the Medicare program as it exists today under current law.

KEY FINDINGS:

- The Medicare market includes an estimated 62 million U.S. residents in 2025, half of whom must make an active choice among combinations of Medicare Advantage, Part D (pharmacy benefit), and private Medigap plans; among the active choosers, 14.2 million selected Medicare Advantage combined with a pharmacy benefit.

- The total size of the Medicare market is estimated to increase throughout the budget window, growing to 78 million in 2034. Eliminating Medigap as a Medicare choice will not affect these population estimates since the enrolled population will remain the same.

- Eliminating Medigap will lead to a significant shift of the Medigap populations (both with Part D and without). Medicare fee for service (FFS) and Part D will have addition 1.3 million in 2026 and 1.2 million in 2034. FFS without Part D will see an increase of 1.8 million by 2026 and 1.7 million by 20234. Medicare Advantage with Part D will see the largest increase with 7.4 million in 2026 and 6.5 million by 2024.

- Eliminating Medigap will result in significant saving of $286 billion over 10 years if implemented from 2025 to 2034. The 2034 annual estimated savings to the federal budget is $30 billion.

- The per capita cost of the of the Medicare program will be reduced by eliminating Medigap by about $1,000 per person, primarily through a reduction in expenses on Medicare FFS.

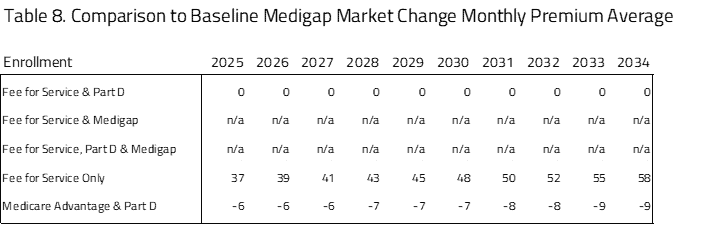

- The premiums paid by seniors will be significantly higher for the FFS-only population by eliminating Medigap with additional premiums ranging from $37 to $58 over the 10-year period. Medicare Advantage combine with Part D premiums will go down by eliminating Medigap with premium reductions ranging from $6 to $9 per month from 2025 to 2034.

MEDICARE MEDIGAP MARKET TRANSITION POLICY

Market-based solutions have been central to Medicare reform proposals for well over a decade. Broadly, market reform policies involve providing beneficiaries with a fixed amount of money, often in the form of a voucher or subsidy, to help them purchase private health insurance. This is in contrast to the current Medicare structure, which is a government-run program, albeit with the option of purchasing Medicare Advantage plans, which are managed by private health insurance firms with Medicare program oversight.

The Medicare supplemental insurance policy – otherwise known as Medigap – originates with the start of Medicare in 1966. They were designed to provide additional coverage outside of Part A and Part B traditional Medicare FFS programs. Typically, they would cover a part of the cost-sharing of FFS Medicare and later included a drug benefit prior to the introduction of Medicare Part D. In 1992, the federal government enacted legislation to standardize Medigap policies and make them easier to understand. The 2003 Medicare Modernization Act (MMA) introduced Part D drug benefits for seniors and re-established Medicare managed care Part C plans as Medicare Advantage plans.

The central tenet of Medicare market reform is that by introducing competition among private insurers, premiums may more accurately reflect costs of care. For this Medicare microsimulation, we simulate a Medicare market where Medigap policies have been eliminated from the Medicare senior choice set. Recent empirical research suggests that Medigap can create a more hazard problem in the Medicare market and increase overall health care costs.[1]

The effects of this policy are twofold. First, Medicare expenses fall, partially due to greater premiums paid by enrollees. Second, the relative price of different potential insurance options changes, which affects how consumers will sort among those available options. The following report explores these effects in detail.

For illustration, the MARCOLA simulation presented assumes an instantaneous switch between current law and the proposed policy reform starting in 2025 and remaining in effect through 2034. Of course, we recognize such a substantive reform will take years to implement. Even if it were to pass in 2026, it could not be implemented until 2027 at the earliest based on prior health reform initiatives, including the 2003 MMA and the 2010 Affordable Care Act, each of which had at least two implementation periods.

INSURANCE COVERAGE

H&E estimates there are 67 million U.S. residents with Medicare insurance coverage in 2025. Table 1 provides a 10-year estimate of Medicare Market Choice enrollment. Within the Medicare population, H&E’s microsimulation separates two major populations. The first population is directly affected by consumer choices for Medicare Advantage, Part D, or supplemental Medicare policies Medigap). The second population consists of consumer groups with eligibility-specific incentives that may affect their choices in ways that H&E’s microsimulation does not currently capture. It includes the Medicaid eligible population (e.gdual eligible), the Medicare disabled and end-stage renal disease (ESRD) populations, and Medicare recipients that receive employer-sponsored retirement benefits. The first population constitutes half of the Medicare market, with 34.8 million beneficiaries in 2025. The second population is not modeled in microsimulation estimates. Instead, we use national account data from the Centers for Medicare and Medicaid Services (CMS) and the Census to project these beneficiaries’ Medicare enrollment. This second group also includes individuals under the age of 65 who are disabled or using the ESRD benefit. The overall size of the second population is approximately 32.2 million in 2025.

Within the active-choice first group of Medicare beneficiaries, there are five product groups, representing combinations of FFS, Medigap, Part D pharmacy benefit, and Medicare Advantage. The most popular product group is Medicare Advantage and Part D with 24.5 million beneficiaries. This group will increase to 28.5 million by 2034. The FFS and Part D product group will grow by 0.8 million from 2025 to 2034. Also, the FFS-only group grows from 5.9 million beneficiaries in 2025 to 7.1 million in 2034. The FFS and Medigap, FFS only, Part D and Medigap product groups are 0 since they eliminated for this projected simulation.

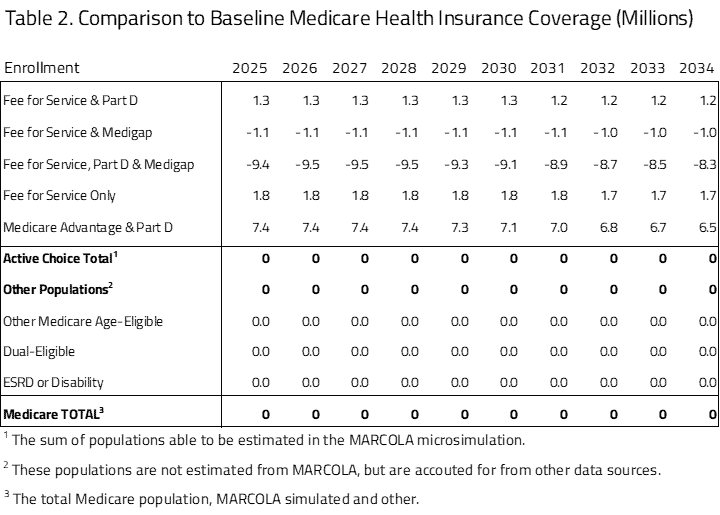

Table 2 provides the impact on enrollment between the Medicare Medigap Transition Policy proposal and status quo Medicare program. The status quo comparison is based on the H&E MARCOLA baseline estimate published in November 2023 and updated in October 2024. Eliminating Medigap will lead to a significant shift of the Medigap populations (both with Part D and without). Medicare FFS and Part D will have addition 1.3 million in 2026 and 1.2 million in 2034. FFS without Part D will see an increase of 1.8 million by 2026 and 1.7 million by 20234. Medicare Advantage with Part D will see the largest increase with 7.4 million in 2026 and 6.5 million by 2024. Because Medicare coverage is mandatory, we assume that the net effect on total insurance coverage is zero.

BUDGET

H&E estimates the impact on the federal budget of the major health insurance coverage provisions of current law with regard to the Medicare population. Budget impact estimates do not include estimates for Medicare expenditures not directly related to care, such as Graduate Medical Education or other program costs related to Center for Medicare and Medicaid Innovation demonstration expenditures.

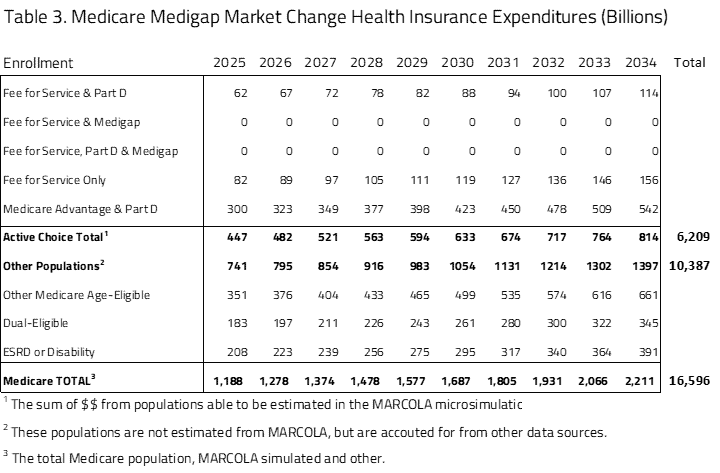

Ten-year Medicare projected expenditures are presented in Table 3. Over the decade spanning between 2025 and 2034, H&E estimates that elderly coverage provisions under Medicare Medigap Transition policy will cost $16.6 trillion. Medicare costs associated with the first population of Medicare active choice consumers have an expenditure of $447 billion in 2025 that will grow to $814 billion in 2034. The largest product within this group is the Medicare Advantage population with expenditures growing from $300 billion in 2025 to $542 billion by 2035. The non-active choice, second group has a total expenditure of $741 billion in 2025 that will grow to $1.4 trillion by 2034.

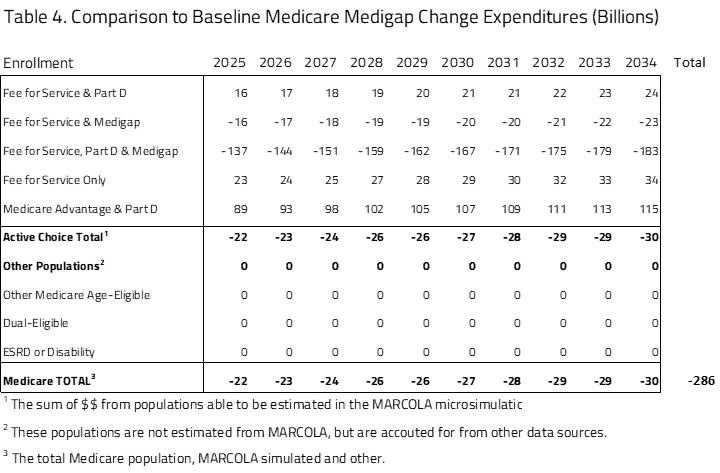

As seen in Table 4, the Market Choice policy will result in significant saving of nearly $286 billion over 10 years if implemented from 2025 to 2034. The 2034 annual estimated savings to the federal budget is $30 billion.

PER-CAPITA EXPEDITURES

Using the projected Medicare beneficiary population size and expenditure, H&E estimates the per-capita cost of each Medicare program category for the Market Choice policy. As seen in Table 5, within the active-choice Medicare consumer choice group there is little variation among the subgroups. The one significant difference is in the Medicare Advantage and Part D subgroup, where the average per-beneficiary cost is $12,000 in 2025, compared to the other groups’ $14,000 average cost. This difference is maintained throughout the budget window with costs for Medicare Advantage and Part D averaging $19,000 by 2034 and the other subgroup, including all the FFS choices, having higher average per-beneficiary costs of $22,000 in 2034.

The second group of Medicare beneficiaries, projected but not active choice, has significantly higher per-capita costs. The largest per-capita cost within this subgroup is the dual-eligible population, followed by the ESRD and disabled population, with 2025 per-capita costs of $32,000 and $30,000, respectively. The other Medicare age-eligible group is most similar to the group with Medicare choices, with lower subgroup costs of $18,000 in 2025. Notably, we do not apply the reductions in subsidies and premium increases in Medicare FFS to these other groups.

Table 6 presents what the per-capita differences would be compared to current law policy. The per-capita cost of the Medicare program will be reduced under Market Choice with an overall average cost of approximately $1,000.

MEDICARE PREMIUM ESTIMATES

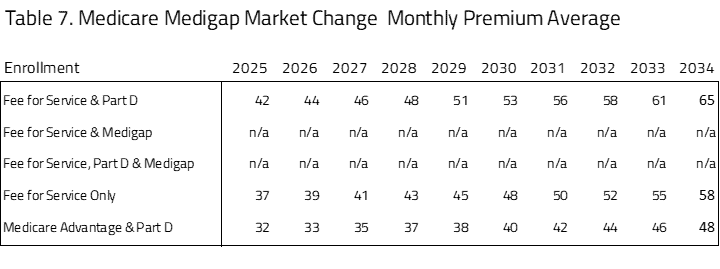

In Table 7, H&E presents the Medicare premiums for the active choice consumers for the Medigap Transition policy. The five subgroups we have profiled represent those where the consumers will choose which plans they will participate in. This table does not include programs organized by an employer. The table also does not include populations that are disabled, enrolled in Medicaid, or participating in the ESRD program. The data sources for this information are a mix of public and private.

The premiums for FFS and Part B compared to Medicare Advantage and Part D are roughly comparable throughout the 10-year window. The least expensive of the Medicare plans with Part D coverage is the Medicare Advantage plus Part D plan. The most expensive of the options for consumers is FFS plus Part D.

As seen in Table 8, there are significant premium differences between Medigap Transition policy compared to current law. The premiums paid by seniors will be significantly higher for the FFS population, with additional premiums ranging from $37 to $58 over the 10-year period. This accounts for the higher cost of pricing Medicare FFS as a choice based on its current cost. Medicare Advantage has the lowest premium ranging from $6 to $9 per month from 2025 to 2034.

SENSITIVITY TESTING FOR ALTERNATES

A key assumption of the modeling presented above is that Medicare Advantage firms will raise premiums in order to recoup the reduction in per-person subsidies. This is especially important given that, under current law, Medicare Advantage plans are given large rebates to provide extra benefits and services to consumers. One potential outcome under Market Choice is that Medicare Advantage firms will stop offering these extra benefits, and therefore will not raise their prices by quite as much. In one set of results, we assume that Medicare Advantage firms do not raise their prices to recoup the rebates and consumer demand for Medicare Advantage firms remains unaffected. This is an extreme assumption but provides some evidence about the range of outcomes.

In this scenario, the estimated premium for Medicare Advantage and Part D in 2025 decreases from the $236 estimated above to $92. Accordingly, Medicare Advantage enrollment increases to 21 million in 2025, much greater than the 17.9 million estimated above. We believe that the impact of such a policy will lie between these two estimates but will likely be closer to the results presented above.

UNCERTAINTY IN PROJECTIONS

H&E uses a peer-reviewed micro-simulation model of the health insurance market to analyze various aspects of the health care system. As with all economic forecasting, H&E estimates are associated with substantial uncertainty. While the estimates provide a good indication of the nation’s health care outlook, there is a wide range of possible scenarios that can result from policy changes, and current assumptions are unlikely to remain accurate over the course of the next 10 years.

THE MARCOLA MICROSIMULATION

This simulation builds on the ARCOLA simulation work done by H&E for the under-65 market and has been published externally since 2013. The primary objective of MARCOLA (Medicare ARCOLA) is to estimate future proposed changes to the Medicare program through a set of policy briefs to inform Congress and the executive branch.

This project entailed building micro-simulation models to address how many seniors will be affected with respect to their health plan choices and out-of-pocket expenses, as well as the cost to the federal government. The project involves estimating a comprehensive demand model for the Medicare population that accounts for all possible choices: Medicare only, Medicare with Part D drug coverage, private MA plans with and without drug coverage, and private supplementary insurance (“Medigap”) with and without Part D.

A novel attribute of the simulation is the MA plan bid from CMS and premium data from at least one large Medigap insurer. In addition, we utilize the most recent years of the Medicare Current Beneficiary Survey for estimation of the models and the Medicare National Claims History File data to establish baseline trends for health care cost projections.

We use a set of limited dependent variable estimation models to build a prediction engine, taking into consideration out-of-pocket plan premiums, other plan attributes, and beneficiary socio-economic attributes. This will permit the opportunity to vary premium and income effects to gauge effects on beneficiaries in the simulation model.

Additional information on the MARCOLA model and assumptions made can be requested from H&E.

[1] Keane, M., Stavrunova, O. Adverse selection, moral hazard and the demand for Medigap insurance,

Journal of Econometrics, Volume 190, Issue 1, 2016, Pages 62-78, ISSN 0304-4076, https://doi.org/10.1016/j.jeconom.2015.08.002.