Research

July 20, 2017

The Job Implications of Raising the Minimum Wage in Nevada

Summary Points

- The recently vetoed bill to raise Nevada’s minimum wage to $11 or $12 per hour (depending on health insurance coverage) would have cost the state 52,000 to 59,000 jobs by 2025.

- The newly proposed constitutional amendment to raise Nevada’s minimum wage to $14 per hour would cost the state 85,000 to 113,000 jobs by 2028.

- With a particularly weak economic recovery from the Great Recession and a labor market dependent on the leisure and hospitality industry, Nevada is not in a good position to absorb this shock.

Introduction

Over the past few years, pushes for minimum wage increases have swept the nation. In 2017 alone, 22 states and Washington, D.C. are raising the minimum wage.[1] Currently, lawmakers in Nevada are working to have their state be the next to raise the minimum wage. A bill recently vetoed by Governor Brian Sandoval would have raised the state’s minimum wage from $7.25 or $8.25 per hour (depending on whether the employer provides health insurance) to $11 or $12 per hour by 2022. Now state lawmakers are planning to bypass the governor by issuing a referendum on a constitutional amendment that would raise the minimum wage to $14 per hour by 2025. While these may be well-intended efforts to improve the livelihoods of low-wage workers, American Action Forum (AAF) research has shown that proposals to raise the minimum wage put low-skilled workers at risk of losing their jobs and fail to deliver substantial raises to low-income households.[2] Nevada is no different, as the vetoed bill would have cost the state 51,800 to 58,900 jobs and the new $14 minimum wage initiative would cost the state between 84,800 and 113,200 jobs.

Background

In Nevada, employers can pay a lower minimum wage if they offer health insurance to their workers. The current minimum wage in Nevada is $7.25 per hour for employees with health insurance and $8.25 per hour for those without the benefit.[3] In May, the Nevada legislature passed a bill that aimed to raise the state’s minimum wage to $11 or $12 per hour (contingent on health insurance coverage) by 2022;[4] the bill was vetoed by Governor Sandoval. Anticipating Governor Sandoval’s veto, the Nevada legislature took a step to bypass the governor by passing a constitutional amendment to raise the state’s minimum wage to $14 per hour by 2025.[5] For the constitutional amendment to become law, it must be approved during two consecutive legislative sessions and receive voter approval in a referendum. Consequently, the $14 minimum wage would not begin to phase-in until 2021.[6] In the following, we analyze the labor market implications of both minimum wage proposals.

Labor Market Consequences

While proposals to raise the minimum wage are well intended, it is important to consider the negative labor market consequences. Meer & West (2015) conclude that raising the minimum wage reduces job creation.[7] Specifically, they find that a 10 percent increase in the real minimum wage is associated with a 0.3 to 0.5 percentage-point decrease in the net job growth rate. As a result, three years later employment becomes 0.7 percent lower than it would have been absent the minimum wage increase.

This may not seem very problematic, but the vetoed Nevada bill would have mandated a 45.5 percent increase in the minimum wage for workers without health insurance and a 51.7 percent increase for workers with health insurance. So, if the minimum wage were to be $11 and $12 by 2022, by 2025 employment would be 3.2 percent to 3.6 percent lower than under current law.[8] Using the Nevada Department of Employment, Training and Rehabilitation (DETR) employment projections as a baseline,[9] this comes out to a loss of 51,700 to 58,900 jobs.[10]

Table 1: Projected Job Losses Under Each Minimum Wage Proposal

| Proposal | Lower Bound | Upper Bound |

| $11/$12 by 2022 | 51,800 | 58,900 |

| $14 by 2025 | 84,800 | 113,200 |

Additionally, the proposed constitutional amendment to raise the state’s minimum wage to $14 per hour by 2025 would result in a 69.7 percent to 93.1 percent mandated wage increase (depending on provided health insurance). This means that by 2028 employment would be 4.9 percent to 6.5 percent lower than under current law.[11] This translates to a loss of 84,800 to 113,200 jobs.[12]

To put these figure in perspective, the DETR projects that between 2014 and 2024 Nevada will create 313,300 jobs. The minimum wage increase that Governor Sandoval vetoed would have eliminated 16.5 percent to 18.8 percent of those jobs. The new $14 minimum wage initiative would offset 27.1 percent to 36.1 percent of the projected job growth.

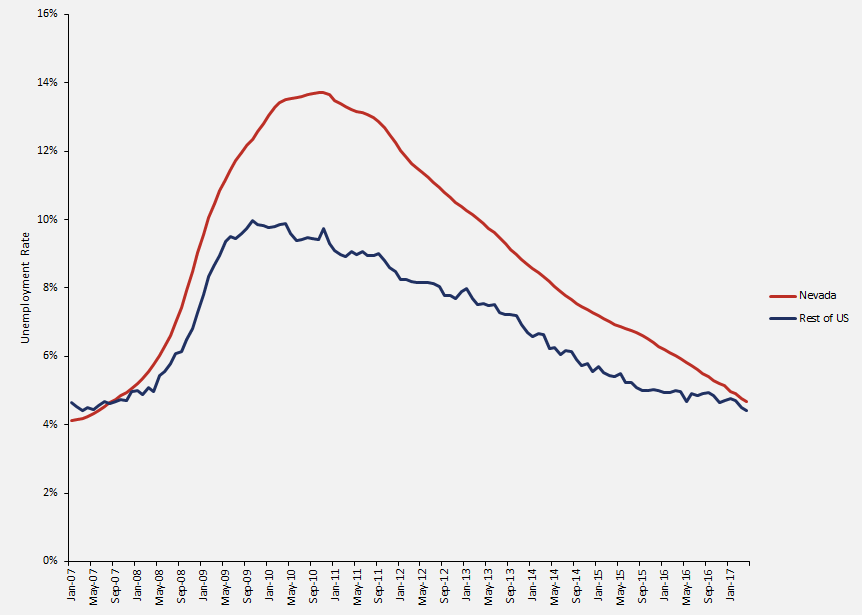

Moreover, Nevada’s labor market is not in a good position to be able to absorb such a large shock, particularly one that directly affects low-wage industries. Chart 1 shows that Nevada was hit particularly hard by the Great Recession as its unemployment rate rose and remained well above the rest of the country for almost a decade.

Chart 1: Unemployment Rate in Nevada and the Rest of the United States (2007-2017)[13]

In September and October 2010 Nevada’s unemployment rate peaked at 13.7 percent, a full year after the rest of the country hit its high of 10 percent in October 2009. Nevada’s unemployment rate remained above the rest of the nation throughout most of the recovery. Specifically, it took until the beginning of 2017 for the state’s unemployment rate to catch up with the rest of the country.

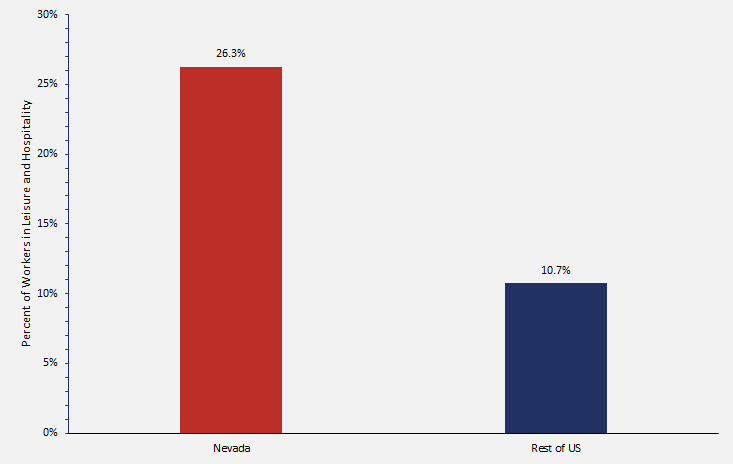

Even more problematic is that Nevada’s labor market relies substantially on the leisure and hospitality sector, which most frequently employs low-wage workers and would be hit hardest by a minimum wage increase. As illustrated in Chart 2, leisure and hospitality businesses employ Nevada’s workers much more frequently than they do in the rest of the country.

Chart 2: Leisure and Hospitality Workers as a Percent of Total Employment[14]

As of May 2017, the leisure and hospitality sector employed 26.3 percent of Nevada’s workers. In the rest of the country, the sector only employed 10.7 percent of the workforce. Both minimum wage proposals in Nevada would wipe out recent job growth in the sector. Since the end of the Great Recession in June 2009, the leisure and hospitality sector created 42,000 jobs in the state. So, the 51,800 to 58,900 jobs lost from the more modest minimum wage proposal that Governor Sandoval vetoed would have been larger than all jobs that leisure and hospitality businesses created during the recovery.

Conclusion

Although raising the minimum wage is a popular proposal, it is important to understand that it does have a cost. Specifically, evidence consistently shows that low-wage, low-skill workers are the very workers who tend to bear this cost by being unable to maintain their current job or attain a new one.[15] In Nevada, the proposal to raise the state’s minimum wage to $11 or $12 per hour (depending on health insurance coverage) would have cost the state 51,800 to 58,900 jobs. The $14 minimum wage proposal currently under consideration would cost the state between 84,800 and 113,200 jobs. Given that Nevada’s economy and labor market depend on a thriving leisure and hospitality industry, the state is in no position to absorb these job losses.

[1] Ben Gitis & Curtis Arndt, “The Job and Wage Implications of State Minimum Wage Increases in 2017 and Beyond,” American Action Forum, February 2, 2017, https://www.americanactionforum.org/research/job-wage-implications-state-minimum-wage-increases-2017-beyond/

[2] Douglas Holtz-Eakin & Ben Gitis, “Counterproductive: The Employment and Income Effects of Raising the Minimum Wage to $12 and to $15 per hour,” American Action Forum, July 27, 2015, https://www.americanactionforum.org/research/counterproductive-the-employment-and-income-effects-of-raising-americas-min/

[3] “State Minimum Wages: 2017 Minimum Wages by State,” National Conference of State Legislatures, January 5, 2017, http://www.ncsl.org/research/labor-and-employment/state-minimum-wage-chart.aspx

[4] SB106, Introduced February 7, 2017, https://www.leg.state.nv.us/App/NELIS/REL/79th2017/Bill/4835/Overview

[5] “Proposing to amend the Nevada Constitution to provide for certain increases in the minimum wage,” SJR6, Introduced February 27, 2017, https://www.leg.state.nv.us/App/NELIS/REL/79th2017/Bill/5088/Overview

[6] Victor Joecks, “What I got right, wrong about the 2017 legislative session,” Las Vegas Review-Journal, June 11, 2017, https://www.reviewjournal.com/news/news-columns/victor-joecks/what-i-got-right-wrong-about-2017-legislative-session/.

[7] Jonathan Meer & Jeremy West, “Effects of the Minimum Wage on Employment Dynamics,” Journal of Human Resources, August 2015, http://people.tamu.edu/~jmeer/Meer_West _MinimumWage_JHR-final.pdf.

[8] Since we do not know how often low-wage workers receive health insurance from their employers in Nevada, we estimate a range of job losses. At one end, we assume that the state’s minimum wage increases from $7.25 to $11 per hour for every worker and at the other we assume that it increases from $8.25 to $12 per hour for every worker.

[9] “Projections,” Nevada Labor Market Information, Nevada Department of Employment, Training and Rehabilitation, http://nevadaworkforce.com/Projections.

[10] DETR projects the change in employment between 2014 and 2024. To estimate Nevada’s projected employment level in 2025 (three years after the $11/$12 minimum wage would be implemented) we calculate the compounded annual total employment growth rate implied by the 2014-2024 projection. We then assume the 10-year growth rate remains the same and project total state employment to 2025.

[11] Again, since we do not know how often low-wage workers receive health insurance from their employers in Nevada, we estimate a range of job losses. At one end, we assume that the state’s minimum wage increases from $7.25 to $14 per hour for every worker and at the other we assume that it increases from $8.25 to $14 per hour for every worker.

[12] Again, DETR projects the change in employment growth between 2014 and 2024. To estimate Nevada’s projected employment level in 2028 (three years after the $14 minimum wage would be implemented) we calculate the compounded annual total employment growth rate implied by the 2014-2024 projection. We then assume the 10-year growth rate remains the same and project total state employment to 2028.

[13] Authors’ analysis of the Bureau of Labor Statistics’ data from the Current Population Survey and Local Area Unemployment Statistics, https://www.bls.gov/data/.

[14] Authors’ analysis of the Bureau of Labor Statistics’ data from Current Employment Statistics, https://www.bls.gov/data/.

[15] Ben Gitis, “First Look: Employment Trends in States Raising the Minimum Wage in 2017,” American Action Forum, March 2017, https://www.americanactionforum.org/research/first-look-employment-trends-states-raising-minimum-wage-2017/.