Research

July 1, 2025

Movie Tariffs: A Ticket To Destroying U.S. Film Studio Dominance

Executive Summary

- President Trump has proposed imposing a 100-percent tariff to protect the domestic film industry from foreign competitors and bring movie production back to the United States, marking the first potential service-based tariff in U.S. history.

- In fact, the top-10 largest film studios are U.S. companies that have accounted for over 85 percent of the domestic box office since 1995, with the U.S. maintaining a trade surplus in film and services broadly.

- While it is unclear whether Trump’s movie tariff would hit all movies produced abroad or solely foreign film studios, it is clear that such a tariff would limit U.S. consumers’ movie choices and increase the cost to see them; moreover, such a tariff would severely restrict the long-standing cultural impact of American movies overseas due to likely foreign retaliation and higher operating costs for U.S. studios.

Introduction

President Trump has proposed imposing a 100-percent tariff to protect the domestic film industry from foreign competitors and bring movie production back to the United States –marking the first potential service-based tariff in U.S. history. In fact, the top-10 largest film studios are U.S. companies that have accounted for over 85 percent of the domestic box office since 1995, with the United States maintaining a trade surplus in film and services broadly.

Details on how Trump’s movie tariff would operate remain sparse, as it is currently unclear what part of the film industry would be hit with the tariff, how that tariff would be calculated, and whether streaming services would be impacted. While it is unclear whether Trump’s movie tariff would hit all movies produced abroad or solely foreign film studios, it is clear that such a tariff would limit U.S. consumers’ movie choices and increase the cost to see them; moreover, such a tariff would severely restrict the long-standing cultural impact of American movies overseas due to likely foreign retaliation and higher operating costs for U.S. studios.

The U.S. Film Industry

Hollywood, California – the historic center of the U.S. film industry – has been a pioneer and global leader in movie production since the early 1900s. Hollywood is a term that is not only synonymous with every aspect of domestic moviemaking but an iconic symbol, and exporter, of American culture around the world. Unlike any other country’s film industry, U.S. movies are the most accessible, well-known, and best performing due to the numerous language options and worldwide reach provided by U.S.-based studios.

The U.S. film industry produces a service for consumers rather than a tangible product. While the United States has an overall trade deficit in goods, it excels in services, with a trade surplus of just over $275 billion as of 2023. The film industry had more than $22 billion in exports in 2023, with a trade surplus between $14.9 billion and $15.3 billion.

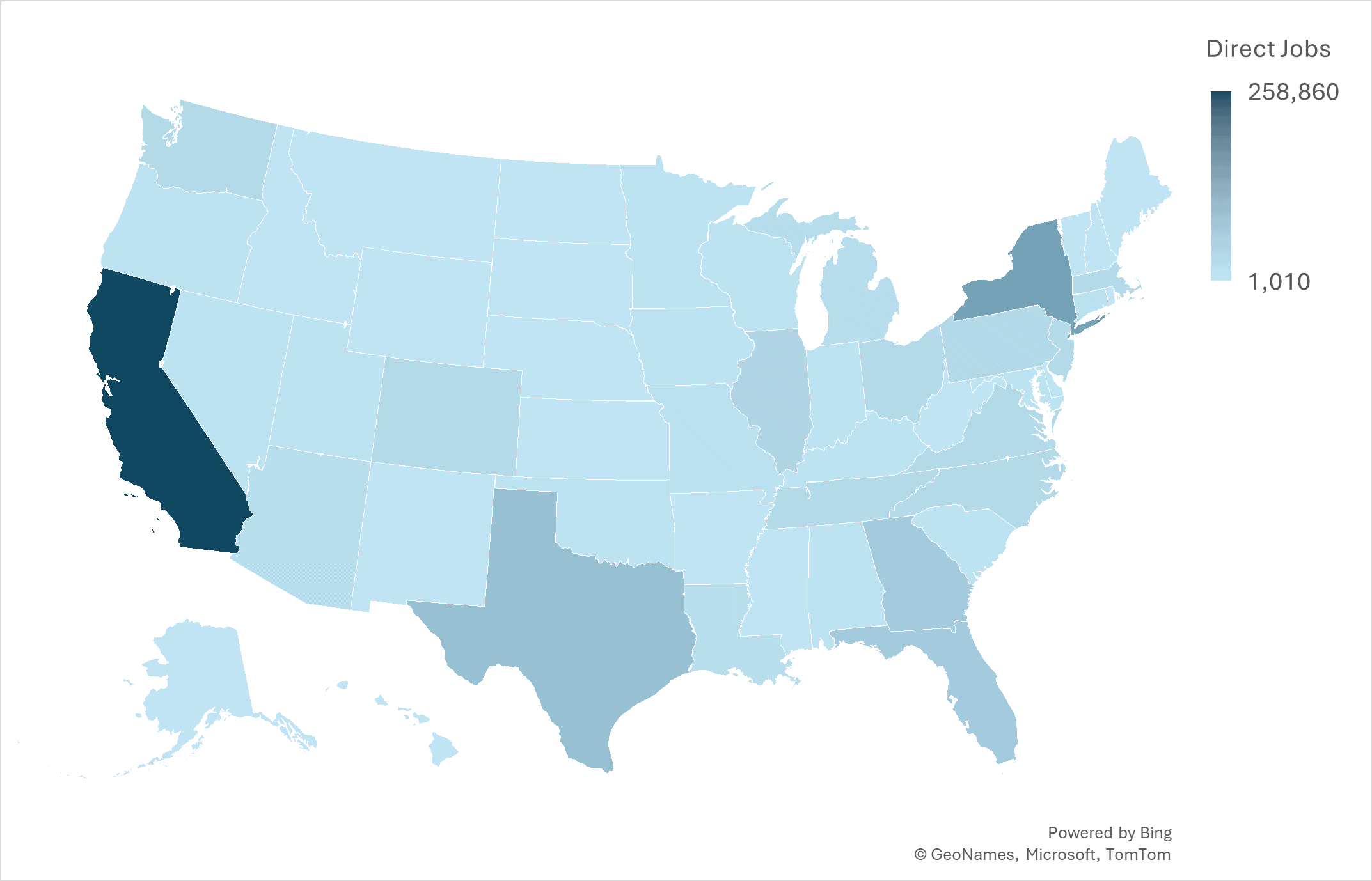

The domestic film and television industries directly employ around 850,000 people across the United States, indirectly supporting an estimated 2.3–2.7 million additional jobs. While California, the home of Hollywood, accounts for just over one in four of these jobs, the industry supports 1 percent or more of the total employment in 25 states and accounts for more than $100 billion in wages annually. Figure 1 displays the 2022 employment metrics for film, television, and broadcasting. This includes total direct employment within the industry and the jobs it indirectly supported downstream. The indirect employment estimates utilize the Regional Input-Output Model from the Bureau of Economic Analysis.

Figure 1: Top 10 States by Direct and Indirect Employment from Film, Television, and Broadcasting

|

State |

Direct Jobs | State |

Direct Employment as Percent of Total State Employment |

|

| California |

258,860 |

California |

1.46% |

|

| New York |

110,480 |

New York |

1.16% |

|

| Texas |

62,050 |

D.C. |

1.03% |

|

| Florida |

46,380 |

Georgia |

0.87% |

|

| Georgia |

41,590 |

Hawaii |

0.67% |

|

| Illinois |

26,910 |

Connecticut |

0.64% |

|

| Pennsylvania |

23,920 |

Louisiana |

0.63% |

|

| New Jersey |

21,660 |

Colorado |

0.63% |

|

| Washington |

21,100 |

Washington |

0.60% |

|

| Ohio |

18,530 |

Utah |

0.59% |

|

|

State |

Indirect Jobs | State |

Indirect Employment as Percent of Total State Employment |

|

| California |

816,580 |

California |

4.62% |

|

| New York |

348,840 |

New York |

3.66% |

|

| Texas |

182,060 |

Georgia |

2.87% |

|

| Florida |

165,890 |

D.C. |

2.25% |

|

| Georgia |

137,830 |

Connecticut |

2.00% |

|

| Illinois |

78,350 |

Colorado |

1.92% |

|

| Pennsylvania |

71,480 |

Florida |

1.76% |

|

| New Jersey |

69,680 |

Washington |

1.76% |

|

| Washington |

62,050 |

New Jersey |

1.64% |

|

| Colorado |

55,070 |

Tennessee |

1.53% |

Source: Motion Picture Association; Bureau of Labor Statistics

Figure 2: Heat Map of Total Employment Within the Film Industry (2022)

Source: Motion Picture Association; Bureau of Labor Statistics

Figure 3: Heat Map of Film Industry Employment as a Percent of Total State Employment

Source: Motion Picture Association; Bureau of Labor Statistics

While the above charts provide a brief overview of the scope and size of the overall U.S. film industry, they also show where the fallout of a movie tariff would be concentrated. While the particular approach President Trump’s movie tariff would take is unclear, implementing the tariff will have an impact on states with a heavy reliance on film, television, and broadcasting, both direct and indirect. Even if domestic studios were excluded from the movie tariff and only movies from foreign-based studios were targeted, other countries would likely retaliate. This retaliation could take the form of unofficial boycotts, tariffs, or outright limits placed on movie releases, all of which would hurt the U.S. film industry. This damage would lead to layoffs within the film industry that impact employment in nearly every U.S. state. Less spending by studios and lower direct employment would have indirect consequences on overall economic activity as well, potentially to the tune of billions of dollars annually.

How Would a Movie Tariff Work?

There are quite a few ways a movie tariff could play out, with varying levels of complexity and damage to U.S. film studios. Setting the mechanics and oversight aside, there are two different forms a tariff could take that require clarification from the administration. The first is a tariff placed directly on foreign-film studios that release movies in the U.S. market. U.S. studios would likely face backlash in foreign markets but, for the most part, would be unaffected by the tariff itself. The second form is a tariff placed on any film studio that produces or films abroad and releases movies in the United States. U.S. studios would be heavily impacted by this approach. Most studios film and produce outside the United States, even if the result of which is only a small component of the finished movie.

In the single Truth Social post that sparked the movie tariff conversation, President Trump argued points that may be used to support either tariff scenario. Trump considers a movie tariff necessary for national security, stating that other countries draw away talent and make a concerted effort to propagandize in the United States. Under this theory, perhaps the administration would structure its tariff to solely target foreign studios. In the same post, Trump also claimed that all movies produced “in foreign lands” may be subject to a tariff, which supports the idea that all studios would be hit.

Tariffs on Foreign Film Studios

The president’s invocation of national security, the beginning of the remedy for which is a Section 232 investigation, suggests that the administration may only target foreign film studios with a tariff to prevent the dissemination of propaganda in the U.S. market and block those studios from obtaining market share. Yet the data suggest this is not a concern. Of the top-10 largest film studios since 1995, all are considered U.S. studios. Widening the view to the top 50, only one can be considered entirely foreign, and it eventually merged with Universal Pictures, a U.S. firm. Moreover, the film industry is relatively consolidated. The top-10 movie studios accounted for slightly more than 85 percent of the domestic box office between 1995 and 2025, meaning Americans overwhelmingly watch American-made movies from American movie studios on American screens. Widening the scope to the top 200 studios, the picture casts even more doubt on Trump’s movie tariff, as 99.6 percent of the domestic box office went to U.S. film studios (see Figure 4).

Figure 4: U.S. vs Foreign Film Studio Domestic Box Office Between 1995 and 2025

Source: The Numbers

As Figure 4 clearly illustrates, a tariff that targets foreign film studios that release movies in the United States would have virtually no impact on the market. It would at most be a preventative measure that limits the growth of foreign studio market share or further induces foreign filmmakers to partner with U.S.-based studios. While tariff revenue, and therefore added costs, from this approach would be minimal, it would likely invite retaliatory measures from abroad that ultimately shrink the global market for U.S. film studios. China, for instance, has threatened to severely curb its imports of American films in the past which leaves this option wide open in the case of a U.S. movie tariff.

Tariffs on Foreign-produced Movies

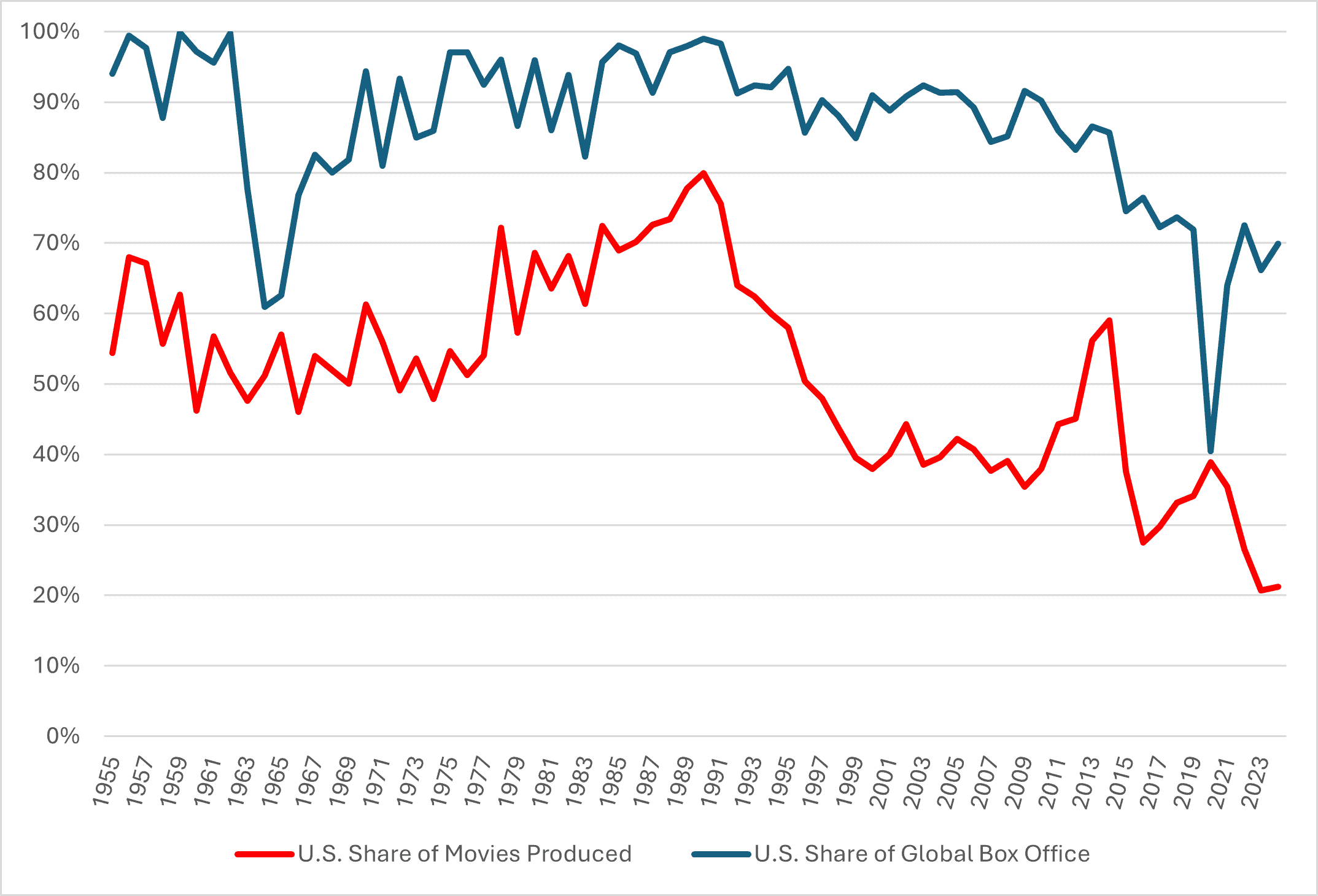

Another possible scenario with far greater consequences would be a tariff placed on any movie produced outside the United States and released in the U.S. market. This would almost entirely impact U.S. film studios, as virtually every major film has a diversified production process that does not rely only on U.S. locations, crews, or editors. In many instances, movies are written, filmed, edited, and distributed by multiple film studios or firms that can be either partially U.S.-based or entirely foreign. Figure 5 displays a noticeable decline in the share of movies produced solely in the United States, falling from a peak of 80 percent in 1990 to about 21 percent in 2024. While these data support the president’s concern about the U.S. film industry losing ground to global competitors, it fails to account for U.S. dominance at the global box office, commanding a 70-percent share. So, while film production has diversified, U.S. film studios maintain a dominant position worldwide, and while more movies are being produced in other countries, in many cases, they do not receive a worldwide release, critical acclaim, or widespread distribution, which limits their potential box office. It is possible that the box office figures are distorted in recent years with the advent of streaming services, but there is no evidence that this would necessarily sway the data toward favoring or disfavoring U.S. films versus foreign box office.

This more expansive version of the president’s protectionist proposal could also invite substantially more foreign retaliation than the scenario under which only foreign film studios are targeted. In this scenario, U.S. studios would have a much stronger incentive to shift entirely toward domestic movie production. This would mean U.S. studios move away from foreign countries, severely impacting their local economies, and sparking either retaliatory tariffs or other restrictions to stop U.S. studios from jumping ship. It might also encourage U.S. studios to further segment the movies available in the U.S. market vs other regional markets. For example, the current Netflix offerings in India are different than those in the United States due to different tastes and content restrictions. In the event segmentation grew, there would be an even more distinct “India Netflix” vs “U.S. Netflix” content divide based on production location. Netflix would not be able to offer as much to each market, meaning U.S. consumers would ultimately have fewer entertainment options.

Figure 5: U.S. Share of Movie Production and Global Box Office

Source: The Numbers

How Would a Movie Tariff Be Calculated?

The Trump Administration likely has much to figure out in the design of this proposal. The biggest implementation challenge would be calculating the tariff, specifically for streaming services, regardless of whether the tariff is on all foreign-produced movies or just foreign film studio movies. The 100-percent tariff could be calculated using either:

- Box office sales (movie revenue)

- Production budget (movie cost)

- Entire budget

- Non-U.S. production

For the purposes of the following scenarios, this paper assumes the chosen tariff is on all foreign-produced movies.

Tariff on Movie Revenue

A straightforward way this tariff could be calculated is as a 100-percent tax on the total box office for a movie. If a foreign-produced movie is released in theaters and makes $100 million through ticket sales, then either the distributors or film studio would owe an import duty of $100 million. Given the exorbitant cost of the tariff, no studio would opt to produce a film with any foreign content. Many soon-to-be released films would have virtually no chance of turning a profit, with ongoing productions having to factor in this added cost and adjust accordingly. The burden could be lowered if the 100-percent tariff is levied on the movie’s profit but, again, this would completely eliminate the profitability of the movie in theaters and force distributors/studios to raise the ticket price of entirely American-made movies or charge significantly more for product licensing and at-home movie sales.

Tariff on Movie Cost

Alternatively, the tariff could be based on the total production budget of a movie. This would be comparatively more practical as it would allow distributors and studios a chance of maintaining a profit. This scenario would likely inflate the price of movie tickets as businesses would pass along at least a portion of the tariff costs to U.S. consumers. (A 100-percent tariff on movie revenue, as with the first scenario, means that raising ticket prices would have no impact on profitability). This tariff could either be on the entirety of the production budget or it could attempt to target the share of the budget spent on production outside the United States.

Conclusion

There has yet to be a clearly defined path forward for President Trump’s proposed movie tariff, the first of its kind to impact a U.S. service. It is also unclear whether such a tariff would narrowly impact foreign-film studios or, more broadly, any film studio that produces a movie outside the United States. If the tariff takes the latter approach, U.S. studios will be severely impacted and lose the competitiveness that has made them globally dominant. This move would also likely invite retaliation that further restricts U.S. cultural exports. Ultimately, a movie tariff would raise costs for U.S. consumers as well as limit available entertainment options within the U.S. market.