Research

June 25, 2025

Plastics and the Economy

Executive Summary

- While there is much discussion of domestic and international efforts to curb plastics waste, many proposals involve a top-down approach that restricts plastics production while placing little focus on market-driven recycling technologies or the potential economic impact.

- Because of plastics’ strength, versatility, formability, and cost-effectiveness, they are used worldwide for everything from packaging to motor vehicle parts, construction, and even medical equipment.

- This research analyzes both U.S. and global plastics production and applications, as well as the industry’s formidable U.S. employment, gross output, trade, and use in the supply chain.

Introduction

The quandary of dealing with plastics waste continues to frustrate domestic policymakers, international organizations, and underdeveloped countries. Plastics’ lack of biodegradability paired with ever-increasing global demand for plastics products impacts landfills, environmental health, groundwater, soil, and beyond. Poorer economies tend to bear the brunt of the plastics waste predicament, since they are least able to have strong waste infrastructure and are the final destination for plastics exports from developed nations. While improving re-use and recyclability potential makes sense from both an economic and environmental perspective, lofty domestic and international efforts to curb plastics production and waste often give little focus on the potential for economic disruption or the downstream effects throughout the supply chain.

Plastics, widely used in both commercial and industrial settings, play an essential role in the daily work and personal lives of tens of millions of Americans. The strength, versatility, formability, and cost-effectiveness of plastics make them an ideal option for packaging, motor vehicle parts, construction, and even medical equipment.

The plastics industry produced $358 billion in gross output in 2023, employed more than 660,000 workers, paid over $46 billion in wages, and had 13,500 establishments sprawled across 49 states, the District of Columbia, and Puerto Rico.

Nearly 460 million metric tons of plastics were used globally, with China and the United States being the largest consumers, using a combined 178 million metric tons.

This research walks through U.S. and global plastics production and use, including the scope of the industry, its total trade value, and its prominence in practically every aspect of the worldwide economy to answer the question: Just how important are plastics?

Plastics’ Economic Reach by the Numbers

Domestic

The plastics industry is a vital component of the economic engine driving the economy of the United States.

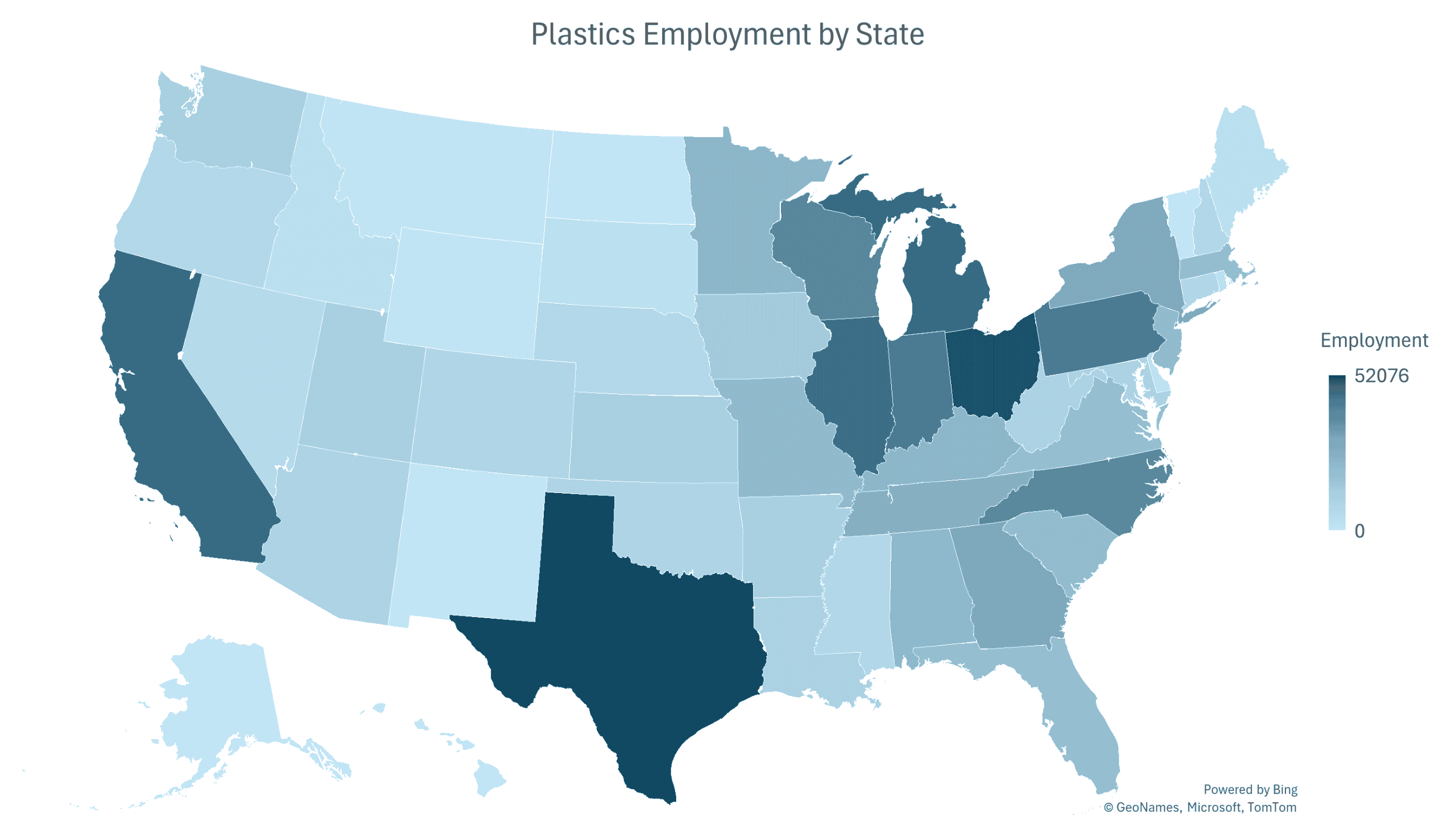

The plastics industry employed more than 660,000 workers in 2023 and paid over $46 billion in wages, according to the Bureau of Labor Statistics. Industry employment spanned 45 states and Puerto Rico with employment in Texas, Ohio, California, Michigan, and Illinois home to roughly one-third of the industry’s employees.

*Source: Bureau of Labor Statistics Quarterly Census of Employment and Wages; note: some state data withheld due to agency disclosure policy; author’s calculations

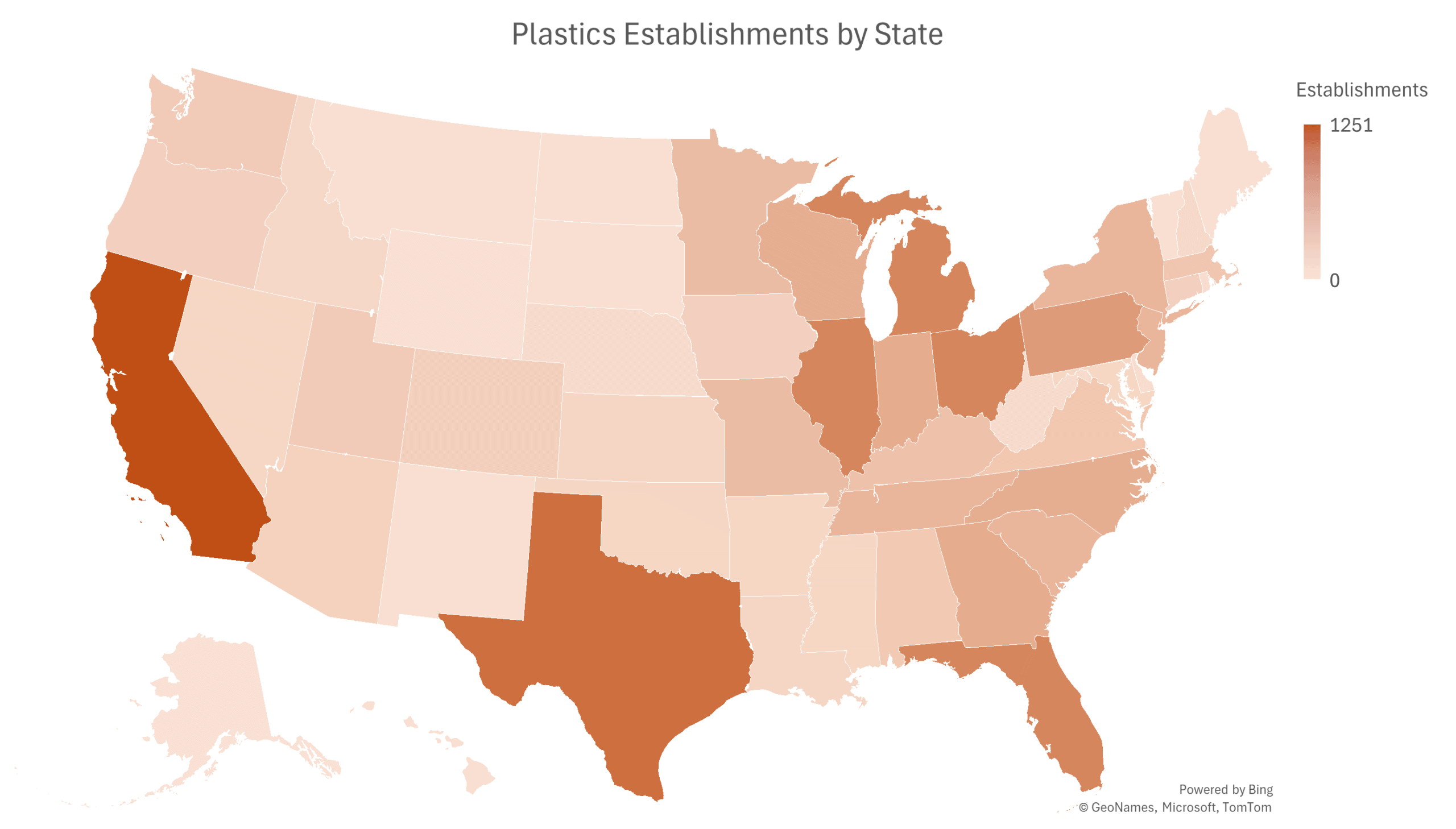

The physical presence of more than 13,500 plastics industry establishments sprawled across 49 states, the District of Columbia, and Puerto Rico. California was home to 1,251 establishments while Texas had nearly 1,000.

*Source: Bureau of Labor Statistics Quarterly Census of Employment and Wages; note: some state data withheld due to agency disclosure policy; author’s calculations

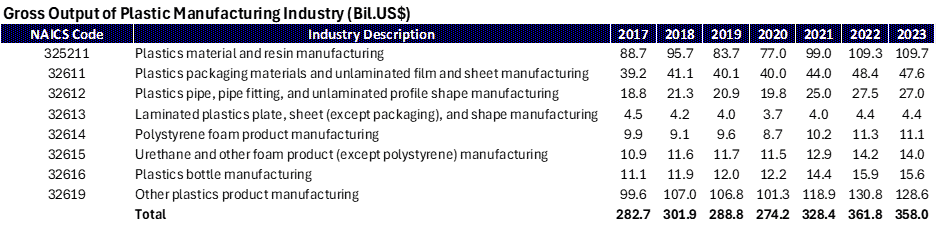

Plastic manufacturers produced $358 billion of gross output in 2023, according to the Bureau of Economic Analysis. Gross output increased by 26.6 percent between 2017 and 2023.

*Source: U.S. Bureau of Economic Analysis, “U.Gross Output by Industry – Detail Level“

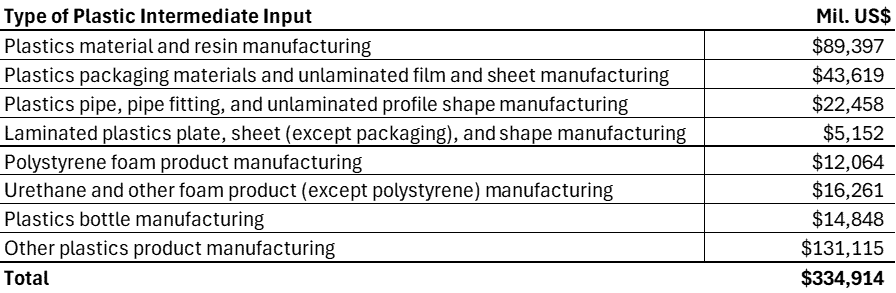

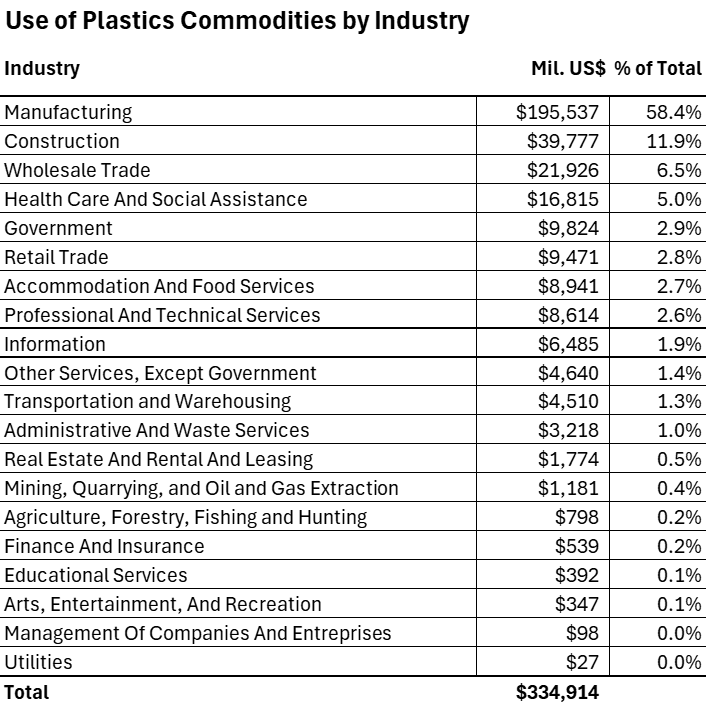

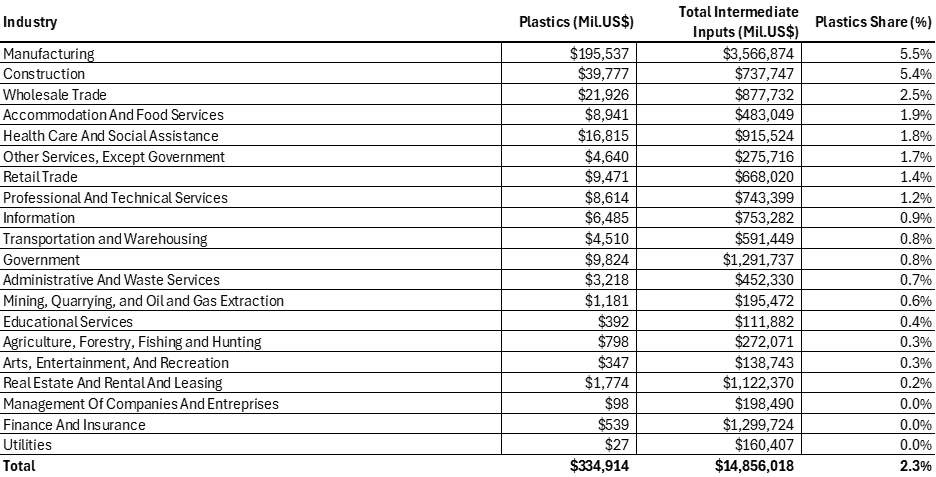

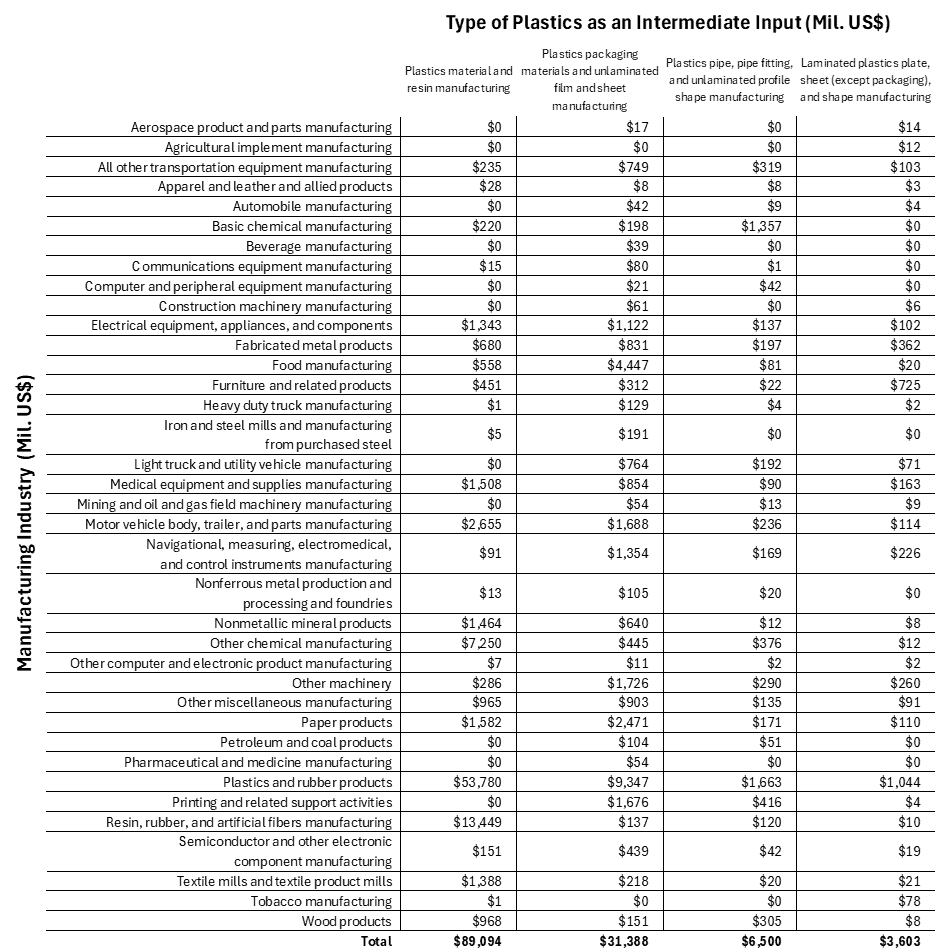

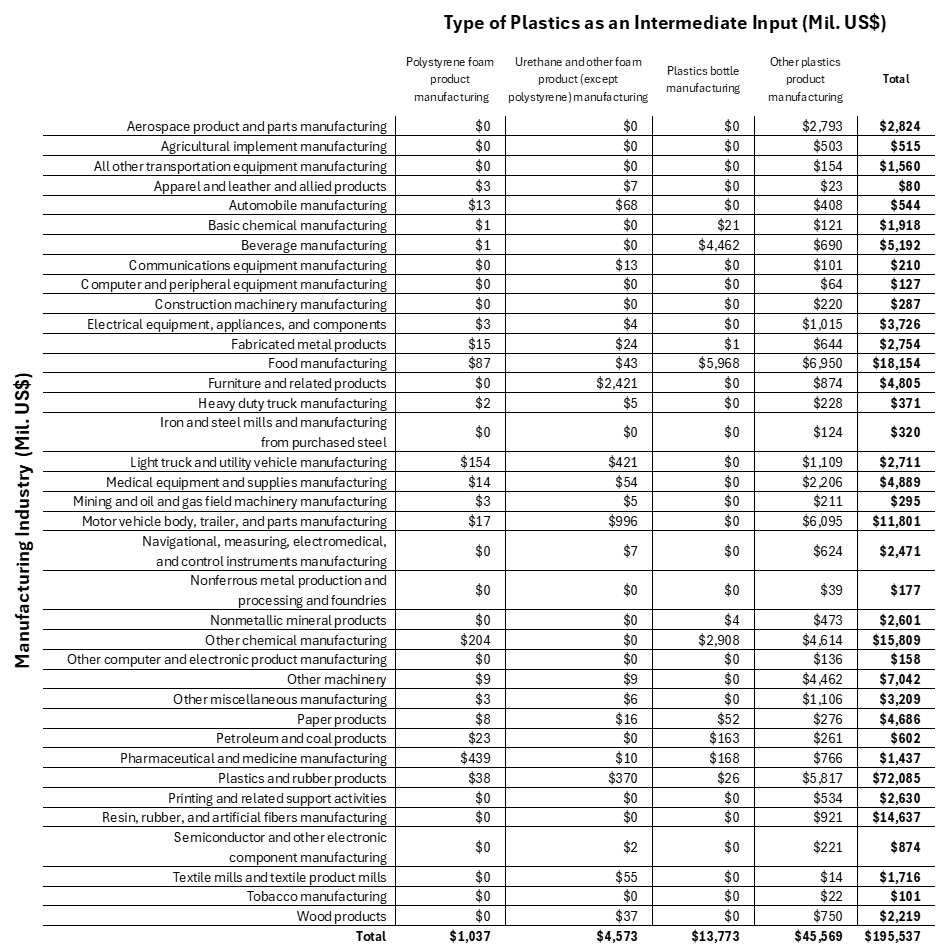

AAF analysis using the Bureau of Economic Analysis’ 2017 Input-Output tables found that $334.9 billion of plastics were used as an intermediate input in production. A breakdown by type of plastics as an intermediate input – goods used in the production process – can be found in the table below.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

The manufacturing sector was the largest consumer of plastics as an intermediate input, using $195 billion, or 58 percent. A breakdown of total plastics use by major industry can be found below.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

Economy-wide, plastics represented 2.3 percent of total intermediate inputs. A breakdown can be found in the following table.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

Manufacturing Sector Use

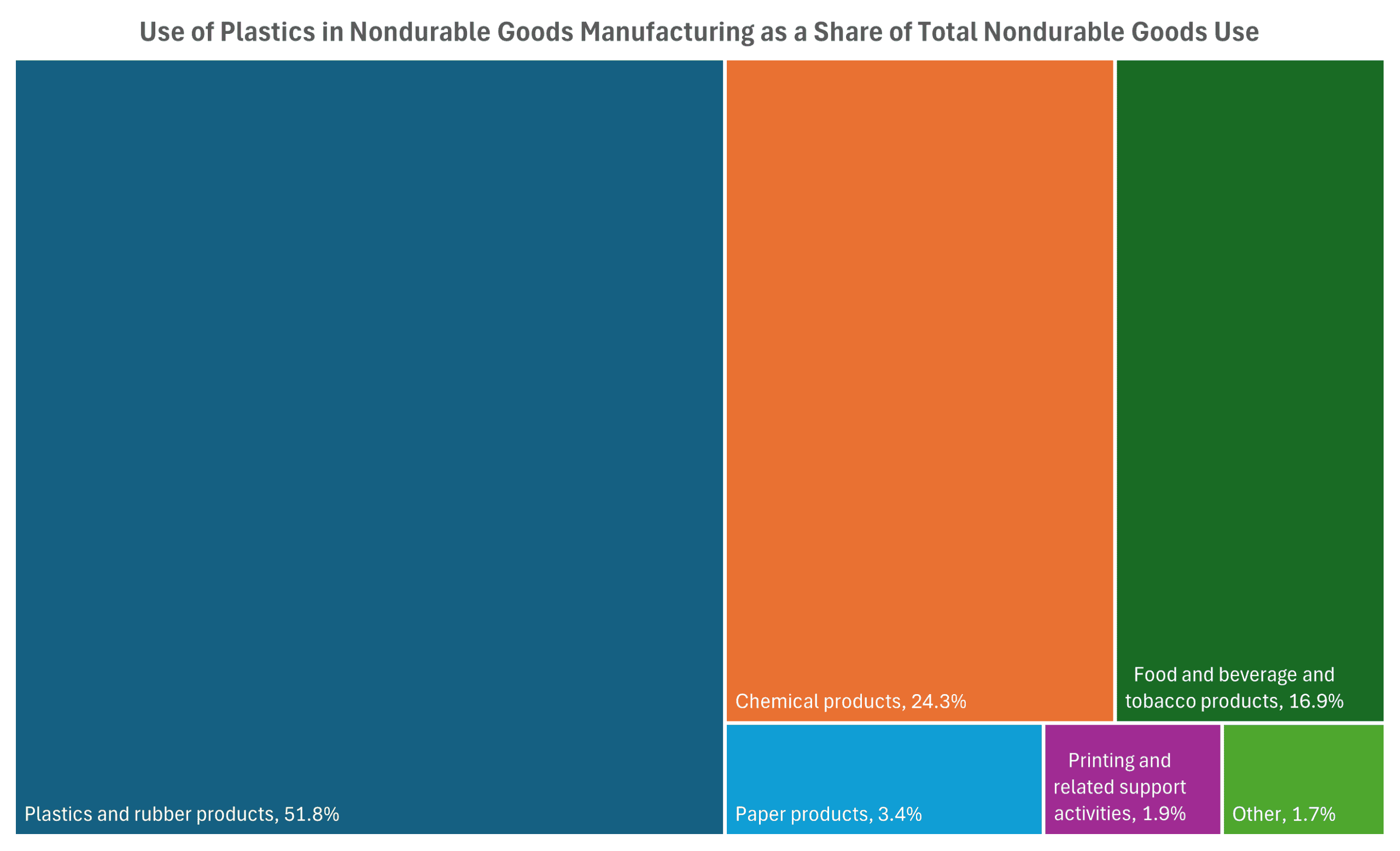

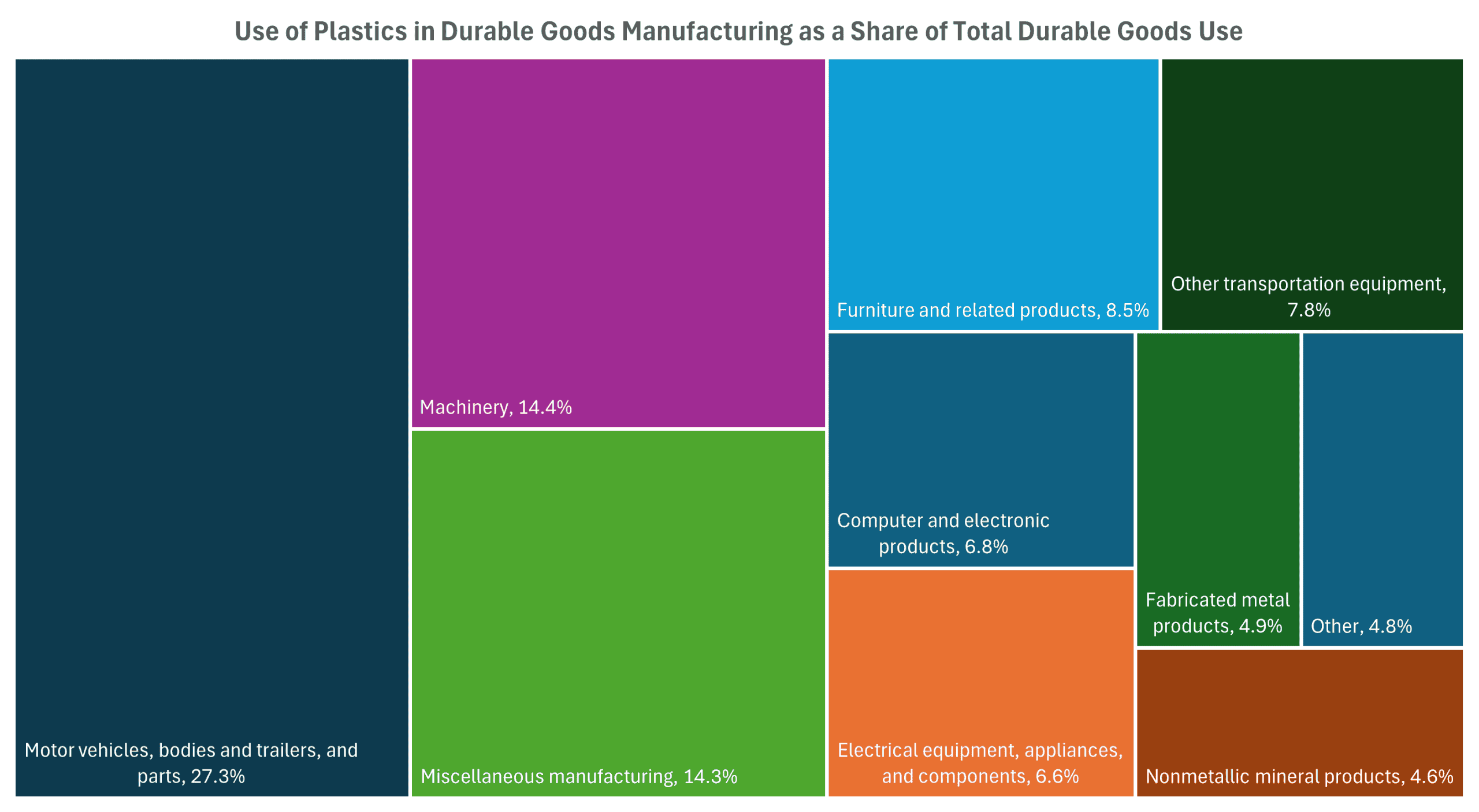

A detailed look at the manufacturing sector showed that nondurable goods manufacturing consumed 41.5 percent of plastics while durable goods manufacturing consumed nearly 17 percent.

Plastics and rubber products manufacturing and chemical products manufacturing used 51.8 percent and 24.3 percent of the plastics used in nondurable goods manufacturing, respectively.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

Motor vehicles, bodies and trailers, and parts manufacturing used 27.3 percent of plastics used in durable goods manufacturing, while machinery manufacturing used 14.4 percent.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

A more detailed breakdown shows the type of plastics used as an intermediate input across 37 manufacturing industry groups.

cont.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

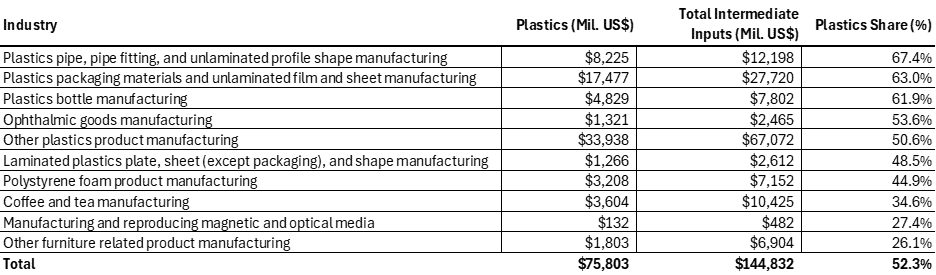

An AAF analysis of 232 detailed manufacturing industries showed that plastics as a share of total intermediate inputs was greater than or equal to 10 percent in 40 sub-industries and 25 percent in 12 sub-industries. Plastics pipe, pipe fitting, and unlaminated profile shape manufacturing was the industry most reliant on plastics, accounting for 67 percent of total intermediate inputs. The top 10 most intense users can be found below.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

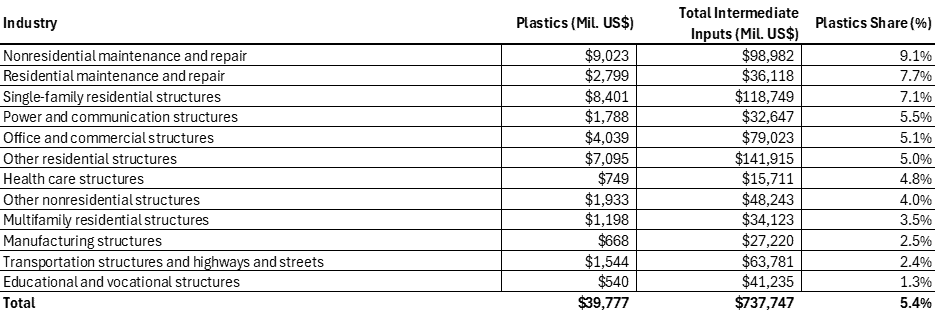

Construction Industry

Behind the manufacturing industry, the construction sector was the second-largest user of plastics products as an intermediate input in production, consuming $39.8 billion. AAF analysis found that the nonresidential and residential maintenance and repair sub-sectors were the heaviest users of plastics, representing 9.1 percent and 7.7 percent of total intermediate inputs, respectively.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

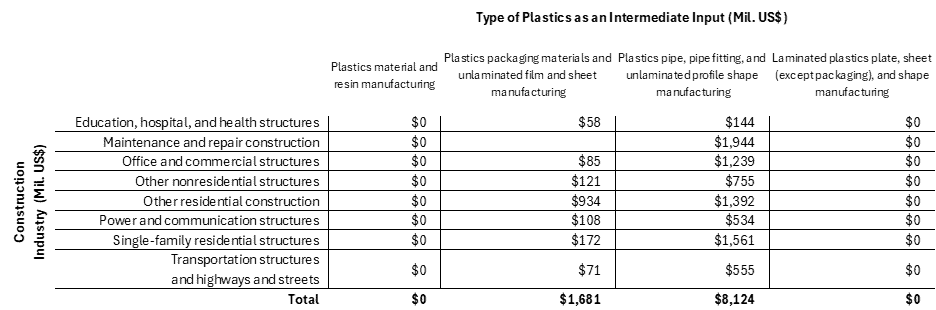

A further breakdown shows the type of plastics used as an intermediate input across various construction industry groups.

cont.

*Source: Bureau of Economic Analysis Input-Output The Use of Commodities by Industry – Detail 2017; author’s calculations

International

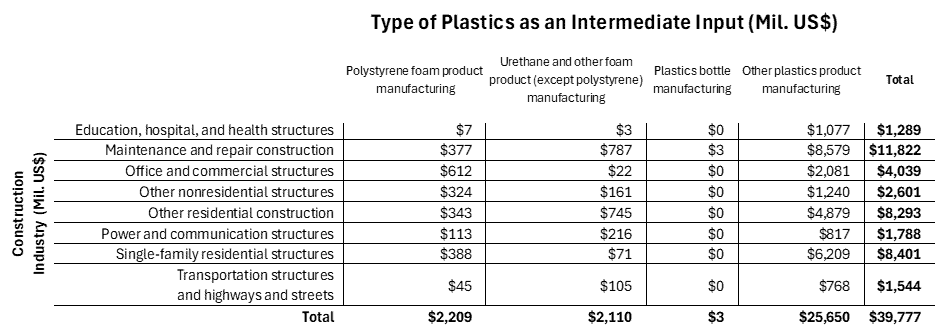

The plastics industry is a net exporter of goods, meaning the industry exports more than it imports. In 2024, the United States exported $68.5 billion of plastics goods and imported $65.0 billion.

*Source: U.S. Trade and Tariff Data USITC

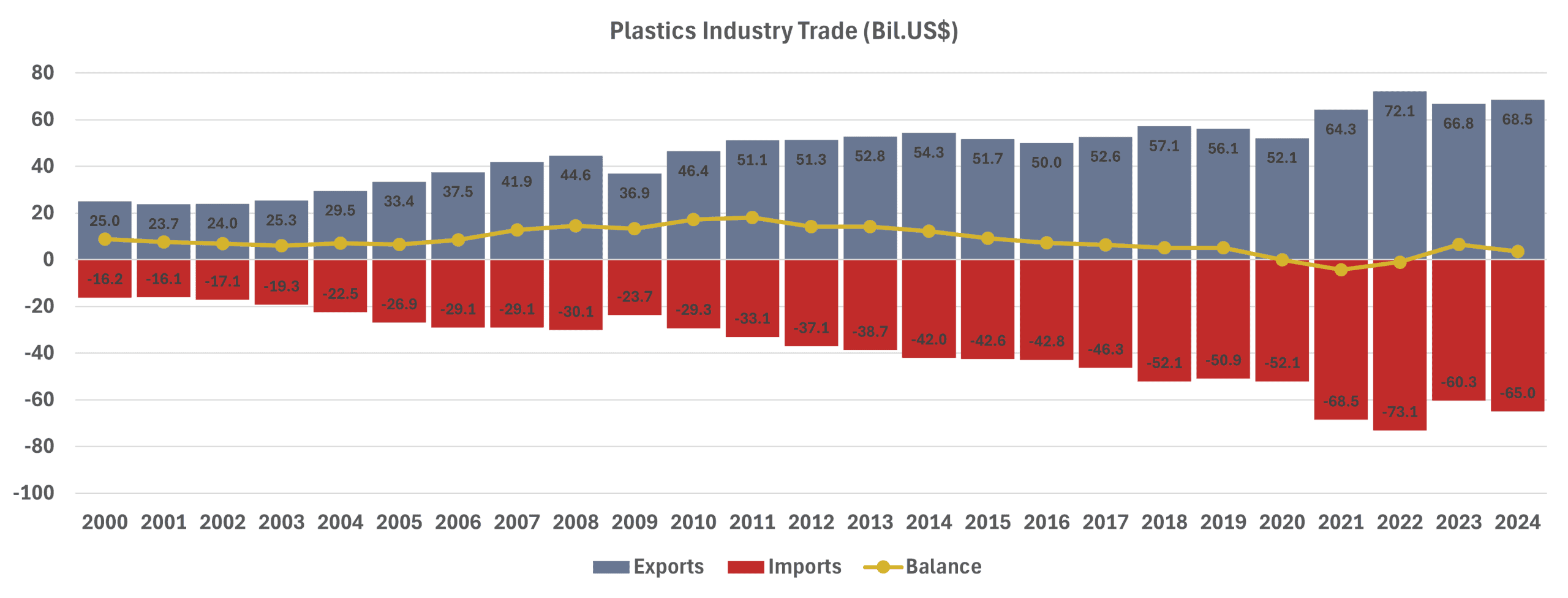

Mexico and Canada were among the largest export destinations with exports of $18.9 billion and $14.0 billion, respectively. These two countries accounted for nearly half of all plastics industry exports.

*Source: U.S. Trade and Tariff Data USITC

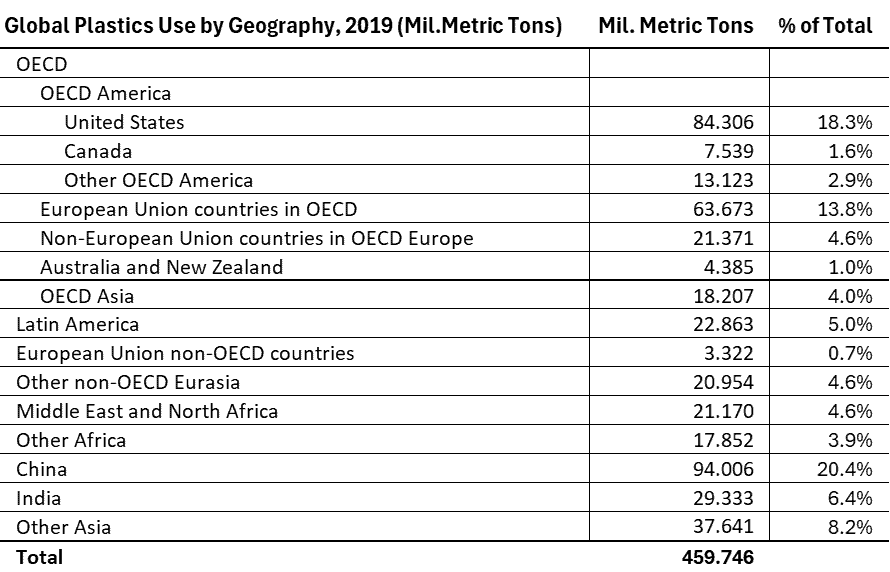

China dominated the global use of plastics according to the most recent data from the OECD, consuming more than 94 million metric tons, or 20.3 percent. The United States was the world’s second-largest user of plastics, consuming 84 million metric tons, or 18.3 percent.

*Source: OECD Plastics Use in 2019

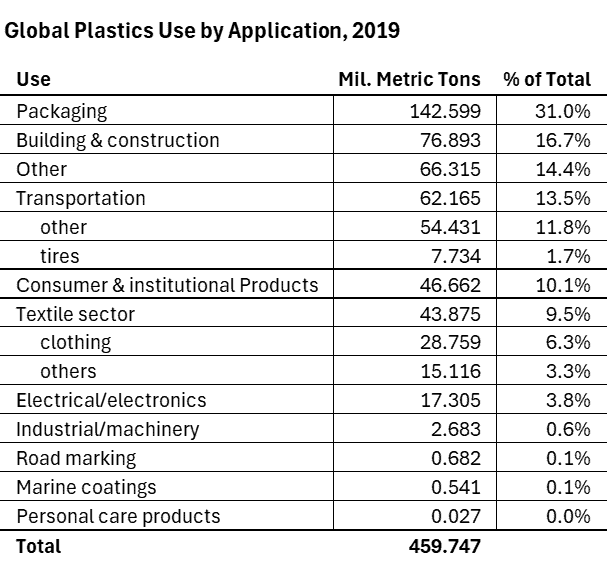

Globally, plastics are predominantly used for packaging. Data from the OECD showed that 142.6 million metric tons of plastics were used for packaging, representing more than 30 percent of total plastics use.

*Source: OECD Plastics Use in 2019

Plastics Waste

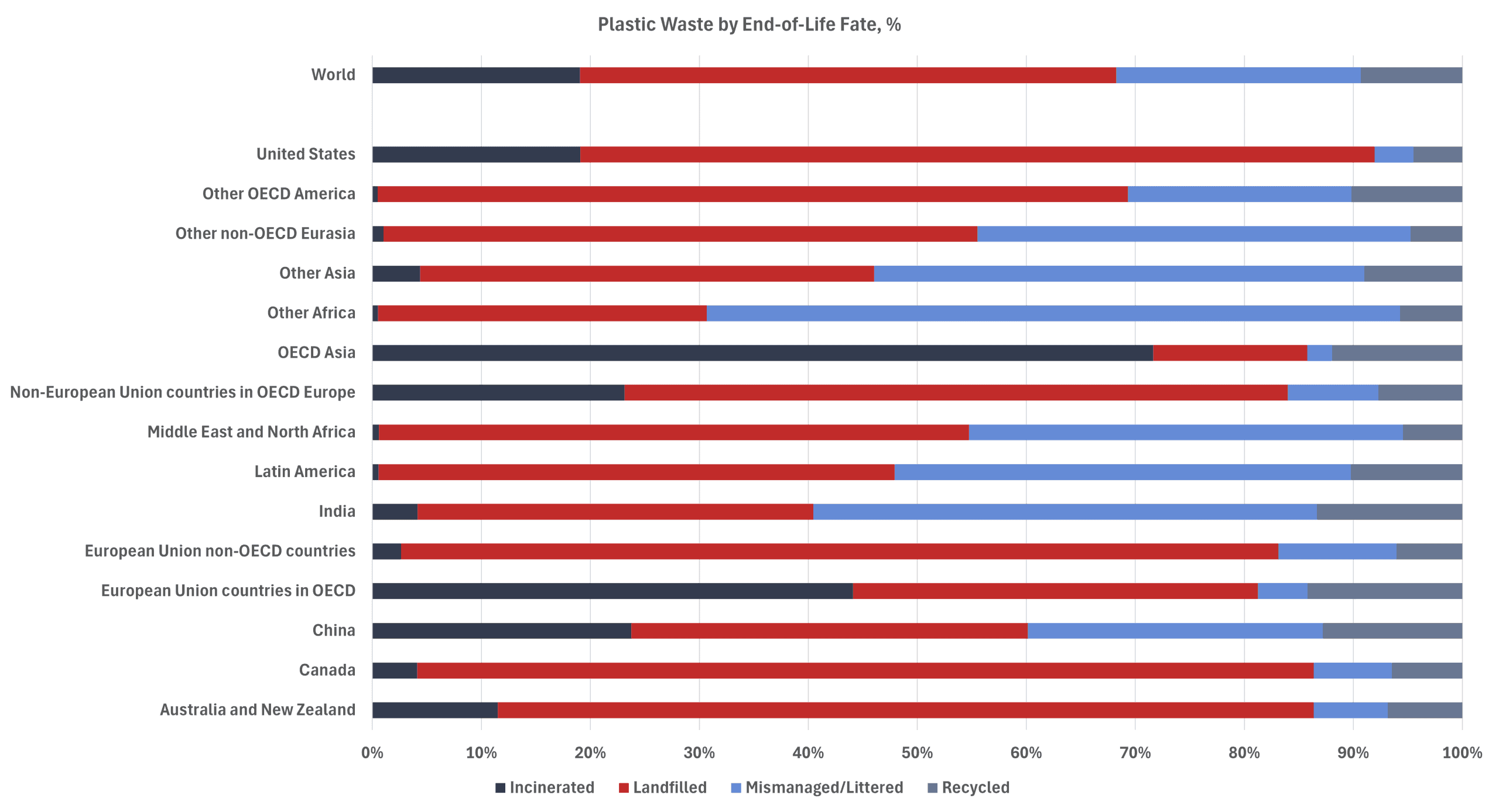

The Organisation for Economic Co-operation and Development (OECD) estimated that 9 percent of the 353 million metric tons of plastics waste was recycled in 2019. Meanwhile, 49 percent of plastics waste ended up in landfills, 22 percent was either mismanaged – plastics waste that is not properly disposed of and can end up in uncontrolled dump sites – or littered, and the remaining 19 percent was incinerated. In the United States, only 4 percent of plastics waste was recycled while 73 percent ended up in landfills.

*Source: OECD Plastic Waste – Estimations from 1990 to 2019; author’s calculations

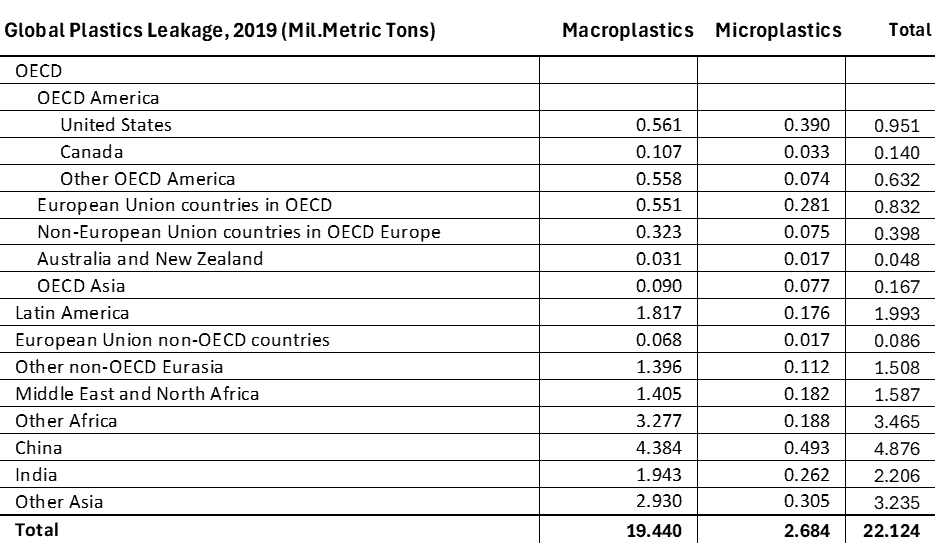

Plastics leakage – the amount of plastics waste that inadvertently enters the environment – is another area of concern. The OECD estimated that 22 million metric tons of plastics leaked into the environment in 2019.

*Source: OECD Plastic Leakage 2019

Domestic policymakers and international organizations have proposed several solutions to curb the harmful environmental and human health risks posed by plastics pollution.

Efforts to Curb Plastics Waste

Domestic and International Response

Domestic production of plastics products and plastics material and resin has increased nearly 36 percent and 19 percent since 1990, respectively. The increased production and use of plastics, specifically single-use plastics, has prompted several state and local governments to implement regulations to curb the resulting plastics waste. States and municipalities across the country have imposed taxes on single-use plastic bags while 10 states, including California, Connecticut, and New York, have banned them outright.

Internationally, the United Nations Environment Assembly is negotiating a legally binding treaty focused on ending plastics pollution. The latest proposal from the UN includes measures to reduce primary plastics production and regulate chemicals used in plastics. In response to the potential UN agreement, industry groups have warned that proposals limiting plastics production could harm innovation and “result in the production and use of less environmentally friendly alternatives.” Instead, these industry groups have advocated for an approach focused on preventing plastics waste, and private-sector recycling programs.

A reduction in plastics products would significantly curb the $358 billion U.S. plastics industry and ripple through the supply chain.

Market-Driven Advanced Recycling

Although industry groups and individual plastics manufacturers have largely pushed back against efforts to curb plastics production, they have promoted advanced recycling measures to offset the potential environmental and health impacts of increased waste.

Advanced recycling technology breaks down plastics to their molecular level which can then become raw materials used in future plastics or other production. Moreover, these processes allow for a wider variety of products to be recycled.

Analysis by McKinsey noted that while advanced recycling is currently at limited scale and requires the development of new technologies and waste collection, companies are working to make these plans possible.

Plastics producers have both a financial and reputational incentive to continue investing in advanced recycling technologies. The ability to recycle plastics into usable materials can reduce costs and, perhaps, make their brands more appealing to consumers. This market-driven approach would expand commercial opportunities for both recycling and production whereas the UN proposal would reduce production.

Conclusion

Dealing with plastics waste continues to frustrate domestic policymakers and international organizations. Industry-led advancements in recycling technologies promise to create commercial opportunities and avoid top-down efforts to reduce plastics waste through production curbs that fail to consider the potential economic impact.

Any domestic or international policy changes that impact the production of plastics would cause significant manufacturing and supply chain disruption to the $358 billion U.S. plastics industry that employs more than 660,000 workers with establishments that spanned 49 states, the District of Columbia, and Puerto Rico.