Research

December 14, 2017

Reforming Puerto Rico’s Electric Company Would Save Money

Summary

- Much of Puerto Rico is still without electricity because its publicly owned electric authority, PREPA, was in a failing state even before the island was devastated by the 2017 hurricane season.

- PREPA’s highly politicized organizational structure has removed the elements of private sector choice and competition, while putting the burdens of failure on the public. The result is a mismanaged utility that is $9 billion in debt.

- AAF research finds that if PREPA is reformed to respond to price signals in markets, the utility could save over $200 million per year and repay a $3.15 billion capital investment in only 10 years.

Introduction

Hurricane Maria may have knocked out power to Puerto Rico, but the island’s electric grid was failing its residents long before the lights went out. The Puerto Rico Electric Power Authority (PREPA) has only restored power to 52 percent of the island as of writing, and is not expected to fully restore power until February. To expedite this process, Congress will likely consider appropriating funds for PREPA as part of another disaster relief legislative package.

If Congress simply provides additional funding, the deep and long-standing challenges that have allowed PREPA to sink $9 billion into debt will likely persist. The utility suffers from a range of problems created both by the federal government and by the island itself. Among them is Puerto Rico’s continued reliance on costly imported oil.

A long-term solution for PREPA needs to focus on restructuring the organization and its energy portfolio. Too many decisions are influenced by politics, preventing the utility from making much-needed but politically unpopular reforms. The utility’s processes need to incorporate some form of market-based competition, and the island’s energy mix should move toward market-favored – that is, cheaper – and cleaner renewable sources and natural gas. This research estimates that moving PREPA in this direction could result in savings of over $200 million annually – certainly worthwhile for a utility that sinks $267 million deeper into debt each year.

PREPA’s Mismanagement

Even before Hurricane Maria, PREPA suffered from a host of chronic problems. PREPA’s frequent turnover in board management, continued reliance on costly imported fuel, aging power plants, and a poorly maintained transmission network resulted in costly and unreliable electricity access. Instead of investing in resiliency and maintenance upgrades, PREPA operated in a state of triage for decades.

Politics likely drive many of PREPA’s failings. All of PREPA’s decisions must be approved by a governing board, which is comprised of individuals appointed by Puerto Rico’s governor. Consequently, PREPA has little power to implement new policies that may be good for the utility and its consumers, but are politically unpopular.

Since the management of the utility is handled by political appointees, decisions are based on the preferences of the governor rather than market conditions. PREPA is owned by the public, so its inability to capitalize on opportunities is borne by the whole population. Thus, the organizational structure of PREPA fails to incentivize fiscal responsibility.

The evidence of politics influencing PREPA’s activities include subsidization of for-profit businesses totaling $283 million per year (meaning PREPA must either fall further in debt or charge ratepayers more to keep offering free electricity to select businesses); awarding a $300 million contract to an unknown two-person company now being investigated by the FBI; misuse of hurricane relief funds after Hurricane Georges in 1998; and failure of its director to appear at a congressional hearing to explain PREPA’s decisions. Fixing PREPA starts with a recognition that it has not been a responsible steward, and must be improved before Congress contemplates throwing good money after bad.

Drivers of High Costs

PREPA is in a debt spiral, as it continues to borrow to pay off its deficits, resulting in increased interest payments. Its balance sheet reflects its poor finances, as the table below shows.

| PREPA Budget (2014, Actual) | |

| Revenue | (millions USD) |

| Operating Revenue | $ 4,635.00 |

| Other Income | $ 45.00 |

| Total Revenue | $ 4,679.00 |

| Expenses | |

| Fuel | $ 2,345.00 |

| Purchased Power | $ 808.00 |

| Contribution in Lieu of Taxes | $ 283.00 |

| Interest Charges | $ 463.00 |

| Other Expenses | $ 1,092.00 |

| Total Expenses | $ 4,991.00 |

| Contributed Capital | $ 45.00 |

| Net Position | $ (267.00) |

Source: Puerto Rico Electric Power Authority, FY2015 Budget[1]

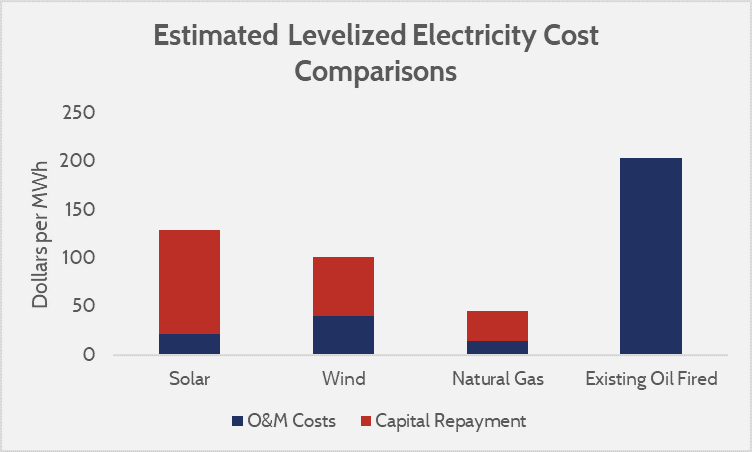

This debt is driven in large part by the high cost of energy on the island. To produce one megawatt hour (MWh) of electricity in Puerto Rico, assuming 2013 data and all expenses, it costs approximately $204/MWh, or about four times the typical cost of energy produced by a new facility. That assumption is broad, and assumes a 2013 oil price and high administrative overhead. Even if administrative costs are omitted and lower oil prices are assumed, the expenses relative to output would still mean a cost of at least $125/MWh today – far higher than typical electricity costs.

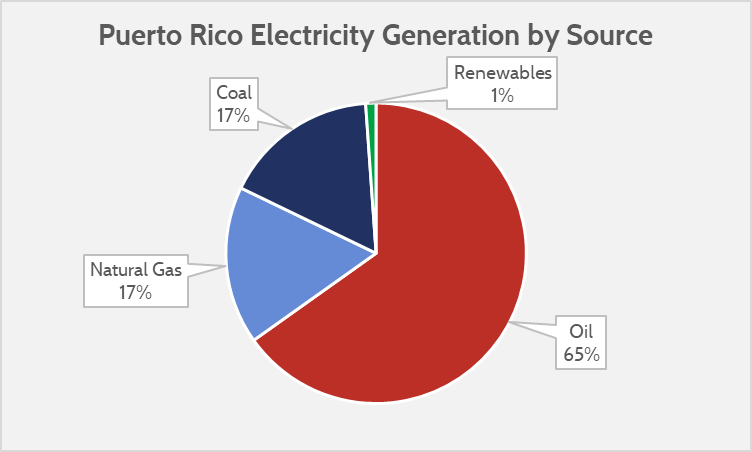

This high expense is due to the high maintenance and fuel costs of PREPA’s generation sources. Reliance on oil is typical of islands, as it tends to be cheaper to import than coal and more accessible than other fossil fuels. What is puzzling is that PREPA has made no attempt to diversify its generation portfolio to newer and cheaper sources. Despite a mandate to achieve 12 percent of its generation from renewable energy, PREPA only gets 2 percent of its electricity from renewables. Instead it relies on old oil-fired power plants that have an average age of over 43 years. Typically, islands facing high fuel import costs tend to be early adopters of renewable power. To complicate energy import considerations further, the Jones Act requires U.S. vessels to ship all Puerto Rico-bound products coming from within the United States. This contributes to the cost of fuel imported from the mainland.

Reforming PREPA to Save Money

The fundamental questions for PREPA are 1) What changes must be made to make the utility infrastructure and production less costly? and 2) How much capital is required to make those changes? To answer these questions, AAF devised a counterfactual scenario for Puerto Rico’s electricity grid. In this scenario, PREPA adheres to the governmental mandate to achieve 12 percent renewable energy. While renewable portfolio standards (RPS) typically impose a distortion on markets, in the case of PREPA, the changeover would likely result in savings, since one would expect some market preference for renewables given the import costs of fossil fuels. AAF also assumes that, given the age of PREPA’s generation facilities, at least one of PREPA’s largest and oldest power plants is replaced with a natural gas power plant.

In line with AAF’s goal for this counterfactual, meeting the 12 percent RPS target as well as replacing one of PREPA’s oldest plants is accomplished by installing 550 MW of solar power capacity, and 420 MW of wind power capacity (both numbers are half the National Renewable Energy Laboratory’s estimated potential). The electricity from these two plants would be enough to replace the Palo Seco oil-fired power plant (built in 1959). It is also assumed that Puerto Rico’s biggest oil plant, the Costa Sur oil-fired power plant (built in 1960) is replaced with a natural gas plant.

| Capacity Needed (MW) | Capital Costs (Dollars per KW) | Total Capital Required (millions) | |

| Photovoltaic Solar | 550 | $2,534 | $1,394 |

| Wind | 420 | $1,877 | $788 |

| Replace Costa Sur with Natural Gas | 990 | $978 | $968 |

| Total | 1960 | $3,150 |

Source: AAF estimates based on EIA Data

The initial cost for the replacement infrastructure would be $3.15 billion—certainly a substantial amount. But the investment would result in substantial annual savings. The chart below details the expected annual costs to run the new power plants. It is assumed that the costs to operate and maintain the new plants are consistent with national averages, and that the capital costs of the plants will be recouped in the electricity rate and repaid over only 10 years.

| Capacity Added (MW) | Expected Annual Generation (thousand MWh) | Annual Operation and Maintenance Costs (millions) | Annual Capital Repayment (millions) | Annual Savings Relative to Current System | |

| Photovoltaic Solar | 550 | 1,301 | $28 | $139 | $(15.99) |

| Wind | 420 | 1,288 | $51 | $79 | $21.78 |

| Replace Costa Sur with Natural Gas | 990 | 3,120 | $45 | $97 | $209.98 |

| Total | 1960 | N/A | $125 | $315 | $215.77 |

Source: AAF estimates based on EIA Data

At an expected savings of $215.8 million per year, PREPA could almost eliminate its deficit, or pass the savings on to Puerto Rican residents. Including all the capital costs for new facilities, and assuming they are paid off over 10 years, the overall lifetime costs divided by the lifetime output of the plant – known as a levelized cost – would be $77 per MWh for the new facilities (though unchanged for existing facilities). This would be enough to cut the average Puerto Rican customer’s electric bill by nearly $150 per year – not an insignificant amount in a territory with a median income of under $20,000. Ending the “contribution in lieu of taxes” program would raise another $283 million annually, and the combined changes would allow PREPA to finally generate a profit.

Source: AAF estimates based on EIA Data

In a competitive market, one expects that a utility which is maximizing profits or savings would recognize opportunities to transition to cheaper fuels — but that has not happened. The above example is similar to an NRG Energy and ITC Holdings proposal for Puerto Rico from 2015, indicating that is within the realm of realistic scenarios that PREPA could consider. The upshot is that PREPA has not responded to market signals, and as a consequence is spending more to produce electricity than would typically be expected of a competitive utility.

The Need to Introduce Competition

Puerto Rico’s governmental policies on electricity management, since the inception of PREPA, have been fundamentally anti-competitive. The island attempted to remedy some of PREPA’s problems by establishing a regulator in 2014 – the Puerto Rico Electric Commission (PREC) – but the burdens of that regulation enforcement fall on a publicly owned company, meaning the liability to absorb the fines or other costs falls on the public that financially support PREPA. As there is no accountability to privately owned capital, there is no incentive to correct the behavior that the regulator is supposed to rectify.

Reforming PREPA, or more accurately, electricity generation in Puerto Rico, is not as simple as merely privatizing PREPA. An effort that is aimed purely at privatizing PREPA may not yield the hoped-for benefits, because it is not privatization alone that cuts costs – it is privatization in the context of competition. A privatized PREPA would certainly be better at finding ways to reduce costs and improve efficiency, but would have no incentive to pass those savings on to consumers. In the contiguous United States, those savings are passed on because utilities are either regulated to do so (California), or operate in competitive markets (Texas). Thus, successfully reforming PREPA would require more than a fire sale of the utility to “privatize” it. Merely selling the utility to a private party would create a privately-owned monopoly; a desirable reform is one that goes beyond an ownership change and embraces structural reforms that allow competition to play a role in electricity delivery.

PREPA could adopt reforms to make its electricity markets and regulatory structure similar to that of the contiguous United States, and particularly to that of Texas, which heavily leverages the advantages of competition. There is little guarantee, however, that such radical changes would be politically palatable for an island that has only known a state-run electric provider.

An alternative to privatizing PREPA and reforming its electricity markets could be to adopt a similar approach to the federal government’s creation of government-owned corporations when funding the construction of hydroelectric power plants. These corporations, known as Power Marketing Administrations (PMA), rely on a mix of public ownership and privatization of various elements of the electric grid. A model that could work for Puerto Rico is to establish a new government corporation, modeled after the Tennessee Valley Authority (TVA). The TVA model allows the government-corporation to own all generation and transmission assets, but privatizes hiring decisions and separates human resources management from the government. The attraction of the TVA model, or that of PMAs, is that they have managed to achieve comparable cost-performance to regulated private utilities.

Conclusion

In October, the Senate approved a $36.5 billion in relief funds for areas affected by this year’s damaging hurricane season. Soon, Congress will produce another disaster relief package for continued reconstruction – and Puerto Rico will be a major focus of those relief funds. Unfortunately, PREPA has not shown itself to be a fiscally responsible or accountable recipient of government support. Federal taxpayers risk throwing good money after bad, and unwittingly entrench a mismanaged and inefficient utility. If PREPA is merely bailed out, it will begin the cycle anew until the next disaster.

When Congress offers assistance for PREPA, it should consider tying those funds to reform in order to incentivize good governance practices, competitive procurement processes, and better resource management. While these changes may not completely fix the utility’s ailments, competition-centered reform would be a step in the right direction, which could help to attract future investment in the island.

AAF estimates that, if PREPA were to adopt policies that allow for a more market-driven generation portfolio, it could result in $215.8 million annual savings for an upfront capital cost of $3.15 billion. If Puerto Rico wants a better performing electric utility, especially in the wake of Hurricane Maria, it must adopt reforms that will allow it to leverage the benefits of competition.

[1] The figures from the budget used are the prior year’s recorded figures (actual), rather than the next fiscal year’s estimated figures. This is due to a concern that PREPA’s estimates for future years may not be accurate.