Research

June 8, 2016

Restricting Natural Gas Exports Harms the Economy

- U.S. natural gas exports must go through a lengthy and convoluted regulatory process which has led to export application approvals being delayed by up to four years.

- U.S. natural gas production is rapidly increasing which creates opportunities to supply a rising global natural gas demand.

- From 2016-2040, U.S. natural gas exports could bring in $1.63 trillion in trade value, increase worker earnings by $110 billion, and raise $118 billion in federal revenues.

The Energy Information Administration (EIA) predicts that by 2040 global energy demand will increase by 48 percent, much of which will be serviced by rising natural gas consumption. The EIA also expects the U.S. to be the largest producer of natural gas by that time, and a net exporter of 5.62 trillion cubic feet per year (Tcf/y). However, U.S. regulations surrounding natural gas exports does not reflect this new reality, and the U.S. remains mired in policy that prohibits natural gas exports unless exempted. Lifting restrictions would allow the U.S. to reduce its trade deficit, increase demand for higher paying jobs, and raise government revenue.

The State of Natural Gas

Thanks to improvements in natural gas extraction from shale deposits, shale gas has now become the primary source of U.S. natural gas production, accounting for about two-thirds of production. America is now expected to be a net exporter of natural gas in 2016, rather than a net importer.

Despite this new status, U.S. policy does not allow exportation of natural gas without approval from the Federal Energy Regulatory Commission (FERC) and the Department of Energy (DoE). The approval stems from a law set in 1938 which requires these contracts to be deemed “in the public interest.” The challenges of an ambiguous requirement being evaluated by regulators is leading to an approval process taking up to 4 years instead of 8 weeks.

Defenders of the regulation point out that no natural gas contract has been rejected yet. Such an argument does not consider the possibility that potential exporters did not apply because they did not believe they would be approved, or may not have known if their contract would be “in the public interest.” Only Congress has the power to change the approval process.

Other critics of natural gas exports fear increases to domestic prices, which would rise by 0-3 percent due to reduced supply. The EIA assessed this though, and determined that increased natural gas exports would increase GDP by 0.05-0.17 percent. The biggest advantage of low energy prices is spurred economic growth, but it makes little sense to keep energy prices low if that ends up constraining growth. America’s policies on natural gas exports are convoluted, and designed for expectations that are no longer true.

There is enormous potential for economic gain through natural gas exports, but this requires policy changes and streamlining the regulatory process. Currently, other natural gas producers—notably Australia—are attempting to secure market share with new projects. The U.S. has only just started building natural gas export facilities to meet increased demand, and only secured about 1 Tcf/y in long term contracts. The longer the U.S. delays improving its export approval process, the more market share it will cede to emerging producers.

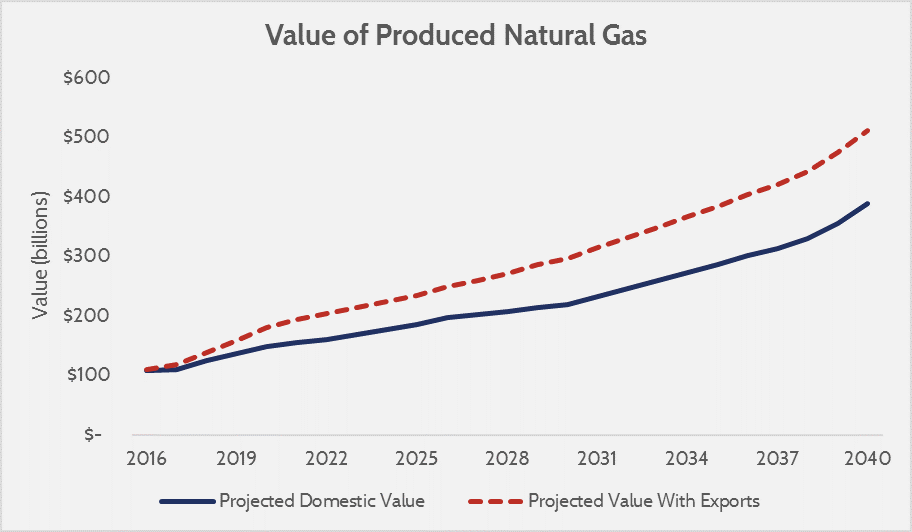

Potential Trade Value of Natural Gas Exports

The American Action Forum (AAF) estimates that the cumulative nominal value of natural gas exports between 2016 and 2040 will be $1.63 trillion USD. The graph below shows the estimated production value of domestically consumed natural gas versus the total value if exports are permitted.

Source: EIA International Energy Outlook 2016, and American Action Forum estimates.

Source: EIA International Energy Outlook 2016, and American Action Forum estimates.

AAF determined this value by applying EIA projections of natural gas production and consumption to projections of natural gas prices, as well as LNG price estimates we derived from applying a coefficient to oil prices (LNG prices are commonly indexed to oil).

AAF research estimates the annual trade value of natural gas exports will reach $31.8 billion annually by 2020, which would reduce our trade deficit by 7.3 percent. By 2026 the annual trade value would be $51.8 billion, and by 2040 it would be $123 billion.

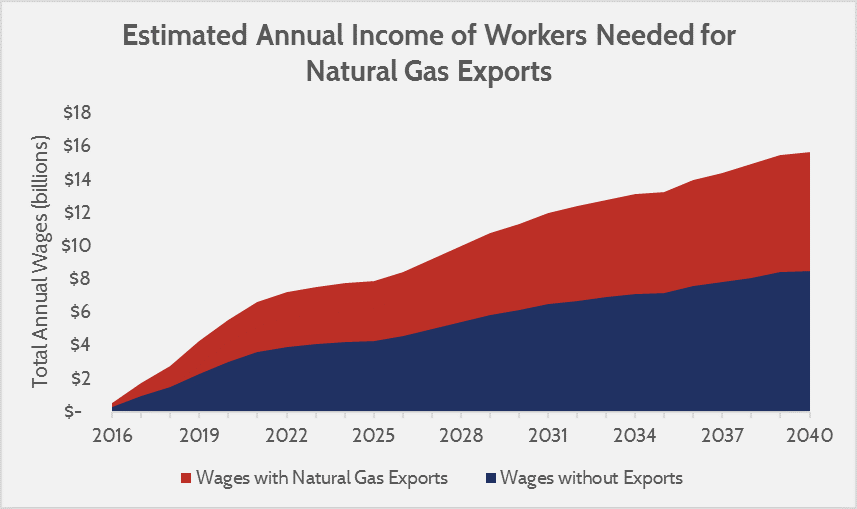

Worker Earnings

Increased productivity in the natural gas industry is reflected in wages, which is the incentive for workers to transition from other sectors of the economy. The Bureau of Labor Statistics shows that the mean annual wage of workers in oil and gas extraction is $89,060—$40,740 higher than the national average of $48,320. Exporting natural gas will require increased production, which requires more workers. These workers will then earn more as they switch from lower paying jobs (we assume they would not transition if they would earn less).

Using research from IHS Global Insight, we estimate that natural gas exports will require an average of 20,500 workers for 1 Tcf/y of production.[1] Achieving the EIA’s projected natural gas exports of 5.62 Tcf/y will require 108,472 workers. Compared to the national average, these workers would be earning over $7 billion more per year than they would otherwise.

Source: American Action Forum estimates and Bureau of Labor Statistics data.

Source: American Action Forum estimates and Bureau of Labor Statistics data.

Cumulative annual earnings of workers related to natural gas exports would increase by $6.8 billion over the national average by 2020, $28 billion by 2026, and $110 billion by 2040.

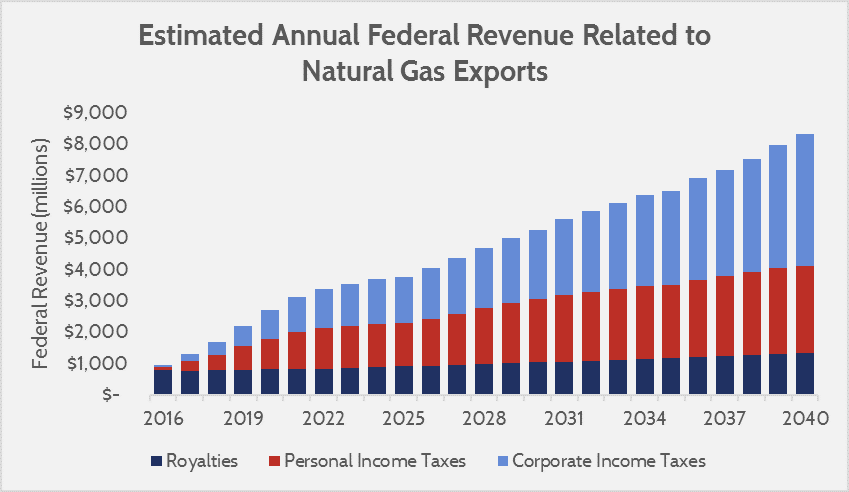

Federal Revenues

Natural gas exports will generate revenue for the federal government from land lease royalties, increased personal income taxes from higher worker earnings, and corporate income taxes on energy companies. The American Action Forum applied IHS Global Insight data estimating energy sector government revenues and applied them to our projected employment and revenues from natural gas exports (corporate taxes from supported industries are not included). The graph below shows the breakdown of these revenues.

Source: American Action Forum estimates based on IHS reports.

Source: American Action Forum estimates based on IHS reports.

By 2020 annual federal government revenues from natural gas exports could reach $2.7 billion, $4 billion by 2026, and $8.3 billion by 2040. Cumulatively from 2016-2040 this would amount to $118 billion in federal revenue.

These estimates do not consider state level taxes and revenue, which would be substantial for natural gas producing states.

Conclusion

By 2040, natural gas exports could generate $1.6 trillion in trade revenue, increase worker earnings by $110 billion, and raise $118 billion for the federal government. The economic benefits of natural gas exports far outweigh the justifications for existing policy, which requires potential exporters to go through an outdated, lengthy, and convoluted approval process where approval is contingent upon an undefined “public interest.” In the United States’ post-energy revolution, where natural gas production is skyrocketing, these rules make little sense, and policymakers should address them as soon as possible to avoid a losing out to competitive emerging producers.

[1] The Economic and Employment Contributions of Shale Gas in the United States (http://anga.us/media/content/F7D1750E-9C1E-E786-674372E5D5E98A40/files/shale-gas-economic-impact-dec-2011.pdf); The Contributions of the Natural Gas Industry to the U.S. National and State Economies (http://anga.us/media/content/F7BE35D7-E47C-5BB9-DA1CBB373BFBDB3C/files/ihs%20global%20insight%20anga%20u.s.%20economic%20impact%20study.pdf)