Research

July 8, 2025

The Cost of a Tomato Tariff

Executive Summary

- On July 14, the Trump Administration is set to impose a 21-percent antidumping tariff on imports of fresh tomatoes from Mexico, terminating the Tomato Suspension Agreement (TSA) last renewed in 2019.

- Undergirding this decision is the Trump Administration’s conclusion that Mexican tomatoes undermine domestic producers with “unfairly” low prices – although Mexican tomato imports are already subject to a price floor under the TSA that artificially raises their prices for U.S. consumers.

- The forthcoming tariff on fresh Mexican tomatoes will raise U.S. prices by roughly 8 cents per pound, resulting in a 7-percent increase in prices for the overall U.S. fresh tomato supply.

Introduction

On July 14, the Trump Administration is set to impose a 21-percent antidumping tariff on imports of fresh tomatoes from Mexico, terminating the Tomato Suspension Agreement (TSA). The TSA, last renewed in 2019 during the first Trump Administration, put U.S. antidumping duties on hold in exchange for regulating the price of imported fresh tomatoes from Mexico.

Undergirding this decision is the Trump Administration’s conclusion that Mexican tomatoes undermine domestic producers with “unfairly” low prices – although tomato imports are already subject to a price floor under the TSA that artificially raises the price of tomatoes Americans purchase from Mexico. The most likely rationale behind this move is that the Trump Administration would like to replace the import price controls to receive more tariff revenue. The forthcoming tariff on fresh Mexican tomatoes will raise U.S. prices by roughly 8 cents per pound, resulting in a 7-percent increase in prices for the overall U.S. fresh tomato supply.

Mexican Fresh Tomatoes

Since 1996, the United States and Mexico have agreed to limit the use of tariffs on fresh tomatoes in a deal formally known as the Agreement Suspending the Antidumping Duty Investigation on Fresh Tomatoes from Mexico, more commonly as the Tomato Suspension Agreement (TSA). The United States intended to introduce antidumping duties on fresh tomato products from Mexico after determining that exporters were selling at less than fair value within the U.S. market. The United States agreed to abandon this tariff investigation in exchange for Mexican producers agreeing to sell at reference prices set by the agreement. There have been multiple versions of the TSA between 1996–2025, with the last TSA renewal in 2019 accounting for all fresh tomatoes coming from Mexico. The reference prices of the 2019 TSA range from 31–83 cents per pound depending on the exact tomato product. In practice, this acts as a set of import price controls, specifically a price floor, for Mexican tomatoes at the point of entry into the United States.

In 2023, the Florida Tomato Exchange, a group of U.S. tomato producers, requested that the U.S. Department of Commerce terminate the TSA, with an expedited review of the suspended antidumping investigation published in late 2023. It found that dumping was likely to recur, sparking a full five-year sunset review which is currently underway; however, all administrative reviews are set to be rescinded at the same time new antidumping duties take effect.

On April 14, 2025, the Commerce Department notified all Mexican fresh tomato exporters as well as the U.S. International Trade Commission that the TSA will be terminated in 90 days. A 21-percent tariff will be imposed on all fresh tomatoes from Mexico beginning on July 14, 2025. This antidumping tariff rate was set based on weighted-average dumping margins, determined to be between 3.9–30.5 percent. The justification behind such a tariff relies on attributing the large increase in tomato imports from Mexico and the decline in U.S. producer market share to “unfair” pricing of Mexican tomatoes.

Looking at the Supply of Tomatoes

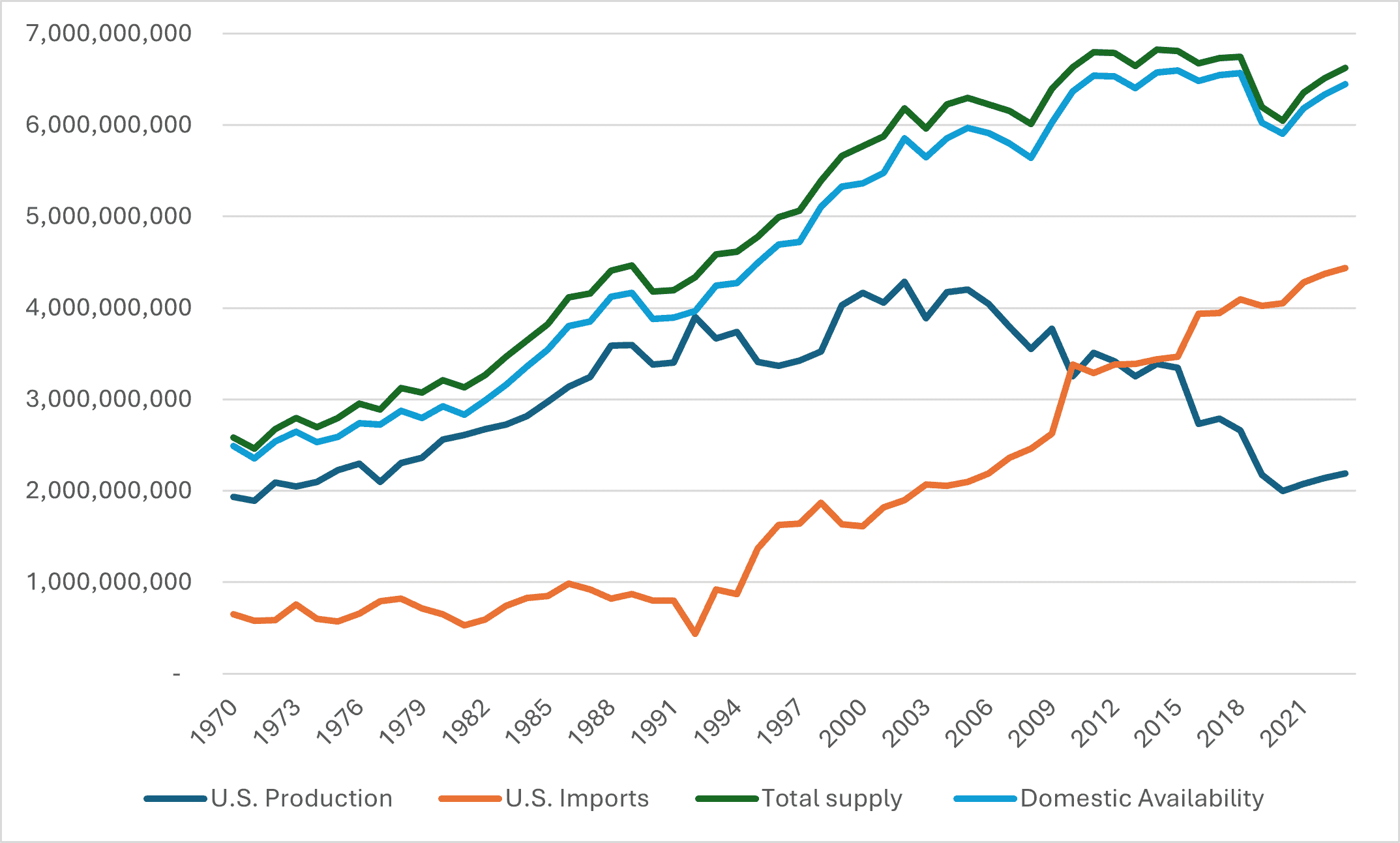

In 2023, there were nearly 6.5 billion pounds of fresh tomatoes available within the U.S. market, with domestic production accounting for 33 percent of the total supply. As Figure 1 shows, the total supply of fresh tomatoes has steadily increased since 1970 at a median annual growth rate of 2 percent. Over the same period, there has been a 348-percent increase in the average price per pound of fresh tomatoes, which translates to a 26-percent price decline using constant 2012 dollars. Between 2010–2015, imports overtook domestic production as the primary source of fresh tomatoes in the United States, although the decline in U.S. tomato growing began a decade prior. Figure 1 also displays the domestic availability of tomatoes – discounting domestically grown tomatoes that are exported – to give a better look at overall availability for U.S. consumers.

Figure 1: United States Supply of Fresh Tomatoes Over Time (Pounds)

Source: U.S. Department of Agriculture; Dataweb

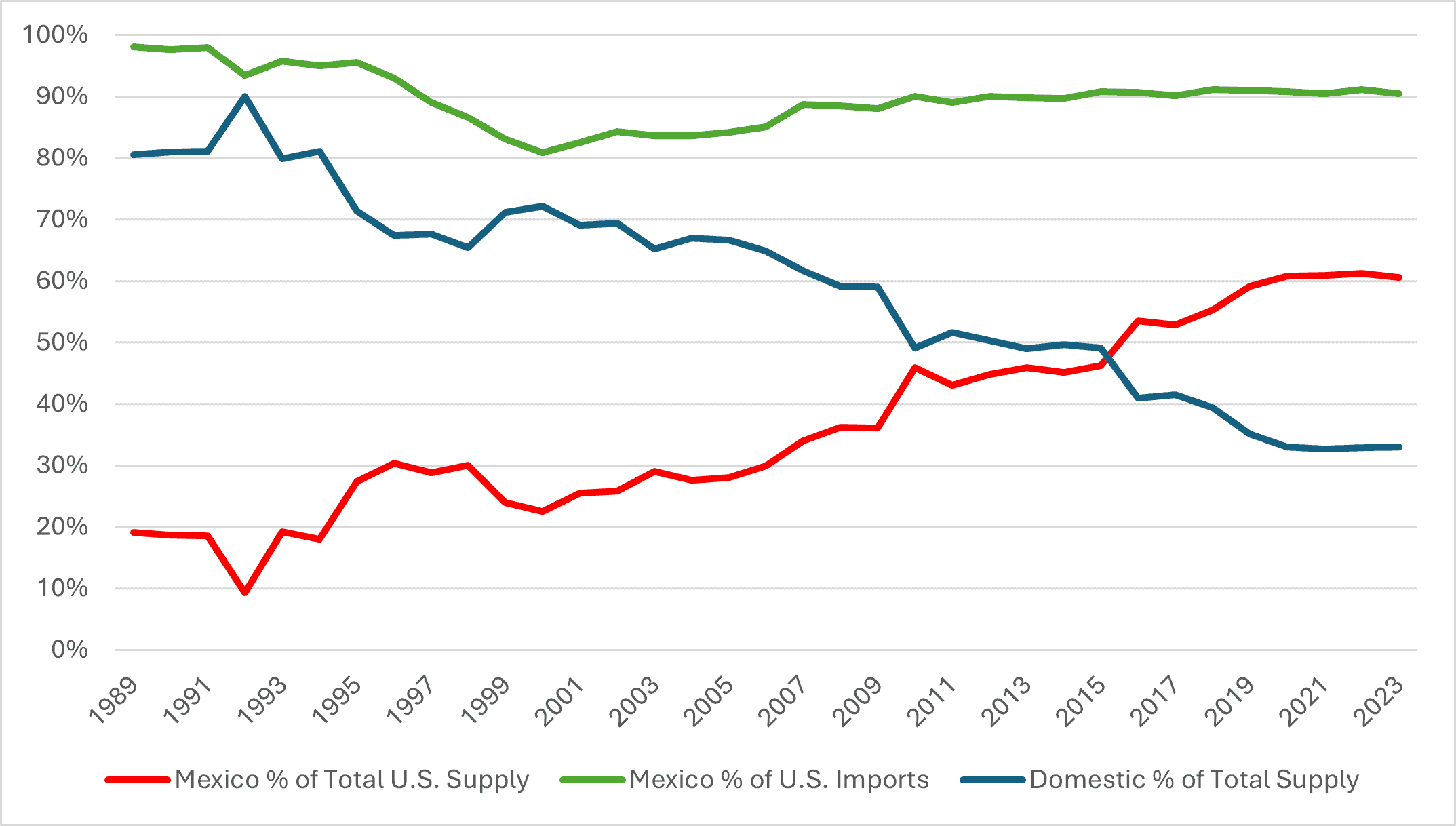

While the United States sources tomatoes from 13 countries, 90 percent of fresh tomato imports come from Mexico. As of 2023, Mexico accounted for 61 percent of the total U.S. supply of fresh tomatoes, nearly double the current domestic production capacity (See: Figure 2). Depending on yields, the United States would require between 42,000 and 250,000 additional acres of production to make up for a lack of Mexican tomatoes. That is the equivalent to the land area of up to six times the size of Washington, D.C. dedicated to new fresh tomato production. Shifting to reliance on domestic tomatoes would mean replacing existing vegetable or fruit production somewhere in the United States, an arduous and costly process.

Figure 2: Mexico as a Percentage of Fresh Tomato Imports and Total Fresh Tomato Supply

Source: U.S. Department of Agriculture; Dataweb

Tomato Tariff Cost Scenarios

The overall cost associated with a tariff on fresh Mexican tomatoes will depend on the passthrough from businesses and whether U.S. grocers, producers, and distributors raise prices to meet consumer expectations. In 2024, the United States imported just over 4.2 billion pounds of fresh Mexican tomatoes valued at $3.1 billion. A 21-percent tariff, factoring in evasion and other offsets, would raise roughly $346 million in government revenue annually. This is equivalent to an 8-cent per pound cost increase or an 11 percent hike in the average cost of tomatoes imported from Mexico. Given that Mexico accounts for 61 percent of the total U.S. supply, this comes out to a 7-percent overall increase in the price of fresh tomatoes on average within the U.S. market. This estimate is partially based on the fact fruits and vegetables are often aggregated together before distribution to grocery stores and end consumers, meaning U.S. tomatoes and Mexican tomatoes may be mixed together. The costs for specific regions, consumers, and firms will differ based on the degree of their import reliance.

While the above scenario deals with the increase in costs that will be passed to consumers and businesses, the end price for fresh tomatoes may rise to a greater extent. If U.S. consumers expect tomato prices to rise by around 21 percent, U.S. businesses selling tomatoes may raise prices to match consumer expectations, including domestic tomato producers that are not hit with added tariff costs. This would further add to the inflation of fresh tomato prices, potentially increasing the price per pound of tomatoes by 15 cents. Firms would be further incentivized to increase prices in order to avoid profit margin decay. For instance, if a firm buys a pound of Mexican tomatoes for 74 cents and sells them for $1.70, their margin (excluding all other costs) is 131 percent. Add an 8-cent tariff cost and the margin erodes to 108 percent if the firm fully absorbs the cost or 117 percent even if it passes the 8 cents fully to the consumer. To maintain a 131-percent profit margin, the company would have to raise the consumer price to $1.89, representing an 11-percent increase in fresh tomato prices.

Protections Are Already in Place

Disregarding the costs associated with such a tariff, the basis of this antidumping case rests on the conclusion that Mexican tomato producers are undercutting the U.S. market and taking market share. While it is true that market share for domestic producers has declined over the past few decades, it is difficult to make the case that Mexico is flooding the United States with excessively underpriced tomatoes. Notably, the TSA already accounts for this by essentially setting a minimum price for fresh tomato imports from Mexico to prevent Mexican exporters from undercutting U.S. tomato producers. As such, the most likely rationale behind this move is that the Trump Administration would like to replace the import price controls to receive more tariff revenue.