The Shipment

November 20, 2025

A Frantic Flurry of Frameworks

Concepts of Trade Agreements

What’s Happening: The White House announced multiple trade frameworks over the past week with Switzerland, Liechtenstein, El Salvador, Argentina, Guatemala, and Ecuador. Additional details on the previously announced investment deal with Saudi Arabia and trade deal with South Korea were also released on the White House website. On Monday, India announced an agreement to import more U.S. energy products, specifically liquified petroleum gas (LPG), likely in the hopes of reaching a trade deal that eases U.S. tariffs. Furthermore, Treasury Secretary Bessent stated that the United States and China may reach a formalized trade agreement by Thanksgiving. In the meantime, Bessent said the administration simply has to trust that the Chinese government will keep its word, despite reports that China’s critical mineral exports and soybean purchases are falling short of last month’s handshake deal.

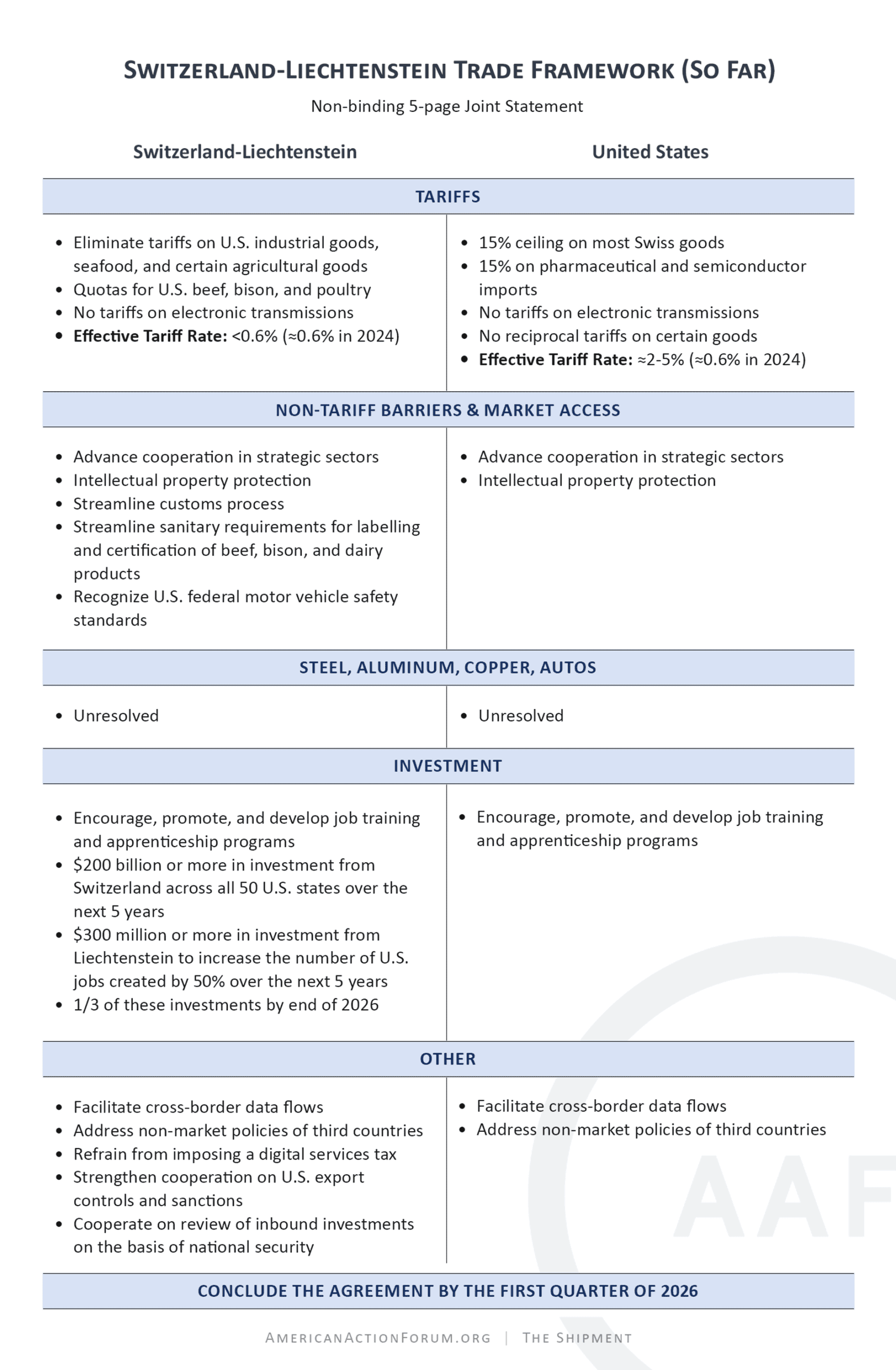

Why It Matters: The recent deluge of announced trade deals – specifically in Central and South America – can best be described in one word: rushed. None of the new trade frameworks from this past week is a formal trade agreement, with each joint statement claiming that a finalized deal will follow in the coming weeks. For example, the Switzerland-Liechtenstein deal, which pledges over $200 billion in investments in the United States, will not be concluded until the first quarter of 2026. This implies that although these agreements have been published and grabbed headlines, the details may still be under negotiation. The likelihood of fully implementing the investments within these deals remains in question. One positive result stemming partially from these negotiations but primarily from domestic pressure to lower prices is the elimination of International Emergency Economic Powers Act (IEEPA) tariffs on certain imports. According to an executive order released November 14, certain agricultural products – including coffee, tea, fruits, beef, and fertilizers – will be exempted from all IEEPA tariffs. The Shipment estimates that this will impact at least $51.6 billion of imports.

Floating in the background of these trade frameworks is the Supreme Court case against President Trump’s use of IEEPA to impose wide-ranging tariffs. It is likely that the Trump Administration is trying to publish as many trade fact sheets and joint statements as possible before the Supreme Court releases its final decision. Assuming the Court strikes down IEEPA tariffs, the administration’s trade agenda certainly would be set back while alternative tariff options are developed. Notably, the Trump Administration would almost certainly blame the Court for any trade-deal failures – such as countries or companies not making agreed-upon investments or reforms – rather than acknowledging the frameworks were flimsy in the first place. The same strategy applies to using the end of IEEPA tariffs as an explanation for any future economic downturn rather than accepting the fact that tariff policy has had numerous negative economic impacts.

Looking Ahead: Future deals on the radar include a formally signed agreement with China that could come as soon as next week, as well as a possible trade framework with India, given the recent progress on energy. With the Supreme Court potentially releasing a decision in the IEEPA case within the next few months, the administration will likely expedite any ongoing talks to publish more frameworks and trumpet the apparent success of its tariff policies.

A Whole Lot of Deals

Switzerland-Liechtenstein: In this trade framework, Switzerland commits to invest at least $200 billion, while Liechtenstein plans to invest $300 million over the next 5 years. In exchange, the United States will lower its tariff from 39 percent to 15 percent on most imports. Other aspects include working on intellectual property rights, streamlining the customs processes for U.S. exports, recognizing U.S. federal motor vehicle safety standards, and developing additional job training programs for U.S. workers.

El Salvador: In this trade framework, El Salvador commits to streamline regulatory requirements for U.S. exports – specifically pharmaceuticals and medical devices – while also agreeing to remove import restrictions on remanufactured goods, accept U.S. automobile standards, and accept other certificates issued by U.S. regulatory authorities to lower non-tariff barriers (NTBs). Other aspects include working on intellectual property and labor rights, combatting illegal logging/fishing/mining, refraining from imposing a digital services tax, and addressing non-market policies domestically and abroad.

Guatemala: In this trade framework, Guatemala commits to streamline regulatory requirements for U.S. exports – specifically pharmaceuticals and medical devices – while also agreeing to remove import restrictions on remanufactured goods, accept U.S. automobile standards, and accept other certificates issued by U.S. regulatory authorities to lower NTBs. Other aspects include working on intellectual property and labor rights, combatting illegal logging/fishing/mining, refraining from imposing a digital services tax, and addressing non-market policies domestically and abroad.

Ecuador: In this trade framework, Ecuador commits to reducing tariffs on U.S. machinery, health products, chemicals, vehicles, and certain agricultural products, while the United States agrees to remove IEEPA tariffs on certain goods that cannot be grown, mined, or naturally produced in sufficient quantities. Ecuador commits to reform import licensing for U.S. agricultural products, end pre-shipment inspection mandates, address intellectual property rights, prohibit imports produced by forced labor, and combat illegal logging. Additionally, Ecuador will not introduce discriminatory barriers to services or impose a digital services tax.

Argentina: In this trade framework, Argentina commits to provide preferential market access for U.S. exports including medicines, chemicals, machinery, information technology, medical devices, vehicles, and a range of agricultural products. The United States will remove IEEPA tariffs on certain unavailable natural resources and non-patented articles for use in pharmaceutical applications. Argentina also agrees to phase out its statistical tax for U.S. goods, accept U.S. federal motor vehicle safety/emission standards, accept U.S. Food and Drug Administration certificates, and simplify product registration for U.S. beef and pork products. Other aspects include working on intellectual property and labor rights, investing in critical minerals, combatting illegal logging, addressing non-market policies, and stabilizing the global soybean trade.

India: India announced that its state-run oil companies will source approximately 10 percent of its LPG from the United States each year. This follows months of trade tensions between India and the United States over India’s purchases of Russian crude oil. Indian officials also report that a trade deal between the two countries is in its final stages, with India already set to benefit from the recent agricultural product tariff exemptions announced by the United States.

Saudi Arabia: According to the White House, Saudi Arabia agrees to expand its investment commitments in the United States to almost $1 trillion and to recognize motor vehicles and parts complying with U.S. standards as complying with its own requirements. As part of the U.S.-Saudi Strategic Defense Agreement, U.S. defense firms will enjoy easier operations in Saudi Arabia as well as new funds from Saudi Arabia to reduce costs. Saudi Arabia also signed a Critical Minerals Framework, an Artificial Intelligence Memorandum of Understanding, and a Joint Declaration on the Completion of Negotiations on Civil Nuclear Energy Cooperation, alongside agreeing to purchase around 300 U.S. tanks.

South Korea: The White House recently released a joint fact sheet with the details of the Korea Strategic Trade Investment Deal. Korea commits to eliminating the cap on U.S.-originating vehicles and reducing regulatory burdens for U.S. automotive exports. As part of the deal, the United States will remove reciprocal tariffs on Korea for certain products. Other aspects of the deal include commitments by the government of South Korea to lower NTBs and non-discrimination. The deal comes alongside massive investment commitments from South Korea, ranging from aircraft to natural gas.