The Shipment

November 13, 2025

China Export Controls and Tariff Shenanigans

(Not So) Fun Fact: The final U.S. penny was pressed at the Philadelphia Mint yesterday following President Trump’s order to stop production, leaving approximately 250 billion pennies in circulation.

Updates on the U.S.-China Trade War

What’s Happening: Over the past week, the United States and China have rolled back many of the trade war escalations introduced last month, fulfilling the de-escalatory agreement between President Trump and Leader Xi. China’s Ministry of Commerce has officially reversed its export controls on certain rare earths and suspended the 15–24 percent retaliatory tariffs on certain U.S. imports. The reversed export controls include rare-earth related technologies and equipment, superhard materials (diamond products), and lithium battery items. China also announced that it would suspend its export restrictions on gallium, germanium, antimony, and other superhard materials for U.S. military users, which it put in place in December 2024. Finally, China has imposed new export controls on 13 different precursor chemicals used to produce fentanyl, specifically targeting the United States, Canada, and Mexico. In exchange, the United States has backed off the 100-percent tariff threat, reduced the fentanyl-related tariff from 20–10 percent, suspended higher “Liberation Day” tariffs, and removed Chinese addresses and companies from the U.S. Entity List. Additionally, Section 301 tariff exclusions on more than 150 products set to expire November 29 will be extended for a year, although this has not yet been implemented. Both countries have also put a hold on the escalating feud over ship construction and cargo ships. Each country’s port fees on the other’s ships have been discontinued for one year, with China reversing its sanctions on five U.S. shipbuilder subsidiaries and the United States pausing its Section 301 investigation into Chinese shipbuilding.

Why It Matters: Based on the concrete actions taken by both the United States and China, it appears the two countries have reached an understanding that a hot trade war is in no one’s best interest. The deal between Trump and Xi – as the Shipment noted at the time – represents a crucial truce for U.S.-China relations that provides greater certainty and stability for U.S. businesses and consumers. It is important to remember, however, that this agreement for a one-year pause in tensions is not a formal trade agreement. It has not been signed by either party and will likely only remain intact as long as Trump and Xi are on good terms. The shift back to a cold trade war should not be viewed as substantial progress toward a better economic relationship but instead through the lens of strategic necessity. The United States and its allies do not have the extracting, manufacturing, or refining capacity to meet domestic demand for critical minerals and battery components necessary to ensure national security. The process to reduce reliance on China for strategic industries will take many years, which means that importing certain goods from China is unavoidable in the short to medium term. China, meanwhile, needs access to the largest market in the world to ease concerns of slowing economic growth and to combat worsening deflation. While China is expanding its trade with other countries to fill the potential U.S. void, this process also takes time. A full-stop end to the U.S.-China relationship would send both economies into turmoil and would be especially damaging to the millions of Chinese manufacturing workers that have already experienced declining wages as a result of the trade war.

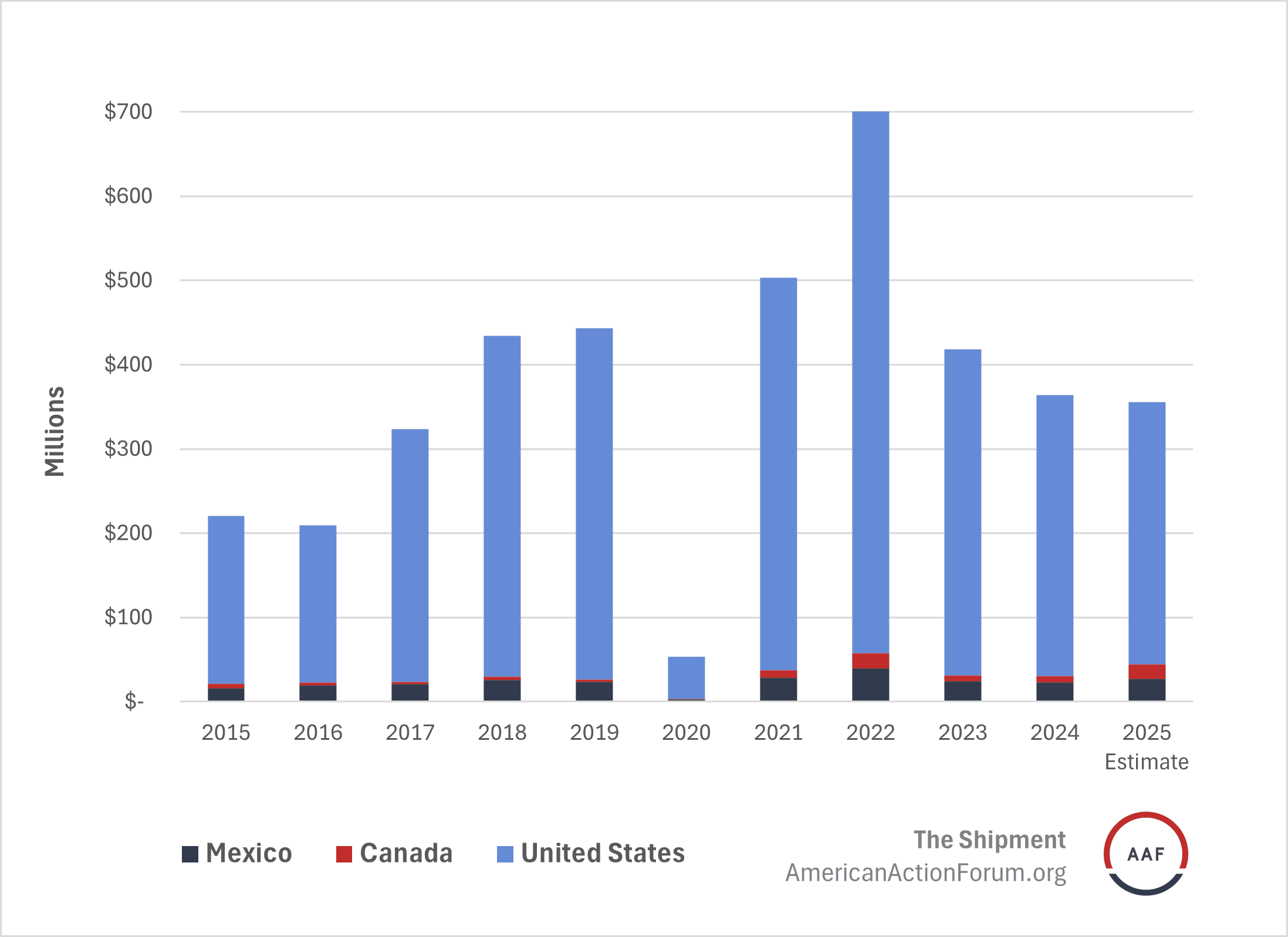

Shifting gears, perhaps the biggest news from China’s recent announcements are the export controls on 13 precursor chemicals used in the fentanyl-making process. This move will require new export licenses for these chemicals in the hopes of cracking down on the downstream flow of fentanyl into the United States, which is responsible for close to 70 percent of all U.S. overdose deaths. The National Narcotics Commission in China has also issued a direct notice to Chinese companies to verify foreign purchases of precursors and halt any transactions with buyers that falsify information. These export controls may have implications for the U.S. health care system and the Trump Administration’s efforts to bring back domestic drug manufacturing. While the listed precursors cover two different fentanyl-pathway families, the export controls also include the “salts” of the chemicals which are used to synthesize various inorganic compounds in the medical industry. This may have downstream effects on research and development (R&D), lab synthesis, and active pharmaceutical ingredients (APIs), all of which rely on precursors. The new controls and administrative oversight will likely slow down the importation and production of APIs and other intermediates used for medications and R&D. Only time will tell what the impacts of this policy will be, but any significant economic impacts are unlikely as companies simply must adjust to the new compliance measures.

Looking Ahead: The next step for the United States and China – one that would truly solidify easing tensions – is the signing of a comprehensive trade agreement. In the aftermath of the handshake deal, Treasury Secretary Bessent said that a signed trade agreement could come within a week, although it has now been two weeks with no formally signed deal in sight. There is also the possibility that the remaining 10-percent fentanyl-related tariff on China could be dropped if enough progress is made between the two countries. The Shipment does not expect this tariff to end any time soon as the Trump Administration will use the tariff removal as leverage for other concessions. (Note, this tariff could be dropped in November 2026 in order to extend the one-year trade truce and export controls.) For now, the trade relationship between the two largest economies will continue to chug along, albeit with occasional bumps in the road as each recognizes the other as a geopolitical and economic rival. The current moment is comparable to Rocky Balboa and Ivan Drago smiling and shaking hands despite both boxers being in the ring and the audience fully understanding what comes next.

Figure 1: Chinese Exports of Precursor Chemicals ($ Millions)

Source: General Administration of Customs of the People’s Republic of China (Commodity Code 29333990)

Tariff Stimulus Checks: How to Interfere With the Supreme Court

What’s Happening: This week Treasury Secretary Bessent offered details on President Trump’s proposed $2,000 tariff dividends for Americans making below $100,000. The president has floated this idea for months, stating back in July that there is “so much money coming in, we’re thinking about a little rebate but the big thing we want to do is pay down the debt.” He has since reconfirmed his intentions repeatedly after the Supreme Court heard oral arguments against the International Emergency Economic Powers Act (IEEPA) tariffs. According to Secretary Bessent, the tariff dividends could take the form of a direct payment or tax rebate. In either case, this proposal would require approval from Congress and would likely face scrutiny from both parties. Senator Josh Hawley has introduced the American Worker Rebate Act, which would send tax rebates starting at $600 per adult and dependent child, with the amount decreasing for taxpayers making above $150,000.

Why It Matters: There are two main issues with the administration’s current tariff dividend proposal. The first is the cost of the policy. Erica York, vice president of the Tax Foundation, estimates the rebate program to cost about $300 billion but total tariff revenues to reach $163 billion in 2025 and around $215 billion in 2026. As of November, the Bipartisan Policy Center estimates gross tariff revenue to be $228 billion while the Shipment’s updated estimate is around $250 billion, assuming current tariffs are in place for a full year. Assuming all tariff revenue is used for rebates, this means the administration will not be able to use tariffs to address the widening U.S. budget deficit or send economic assistance to U.S. farmers hurt by the various trade wars. The administration announced $12 billion in aid for U.S. farmers with another package potentially on the way.

The second issue with the tariff rebate policy is its blatant attempt at interfering with the Supreme Court case against IEEPA tariffs. In the event the Supreme Court rules against the president’s use of IEEPA to impose tariffs (see more here) the vast majority of all tariff revenue collected in 2025 will likely be refunded to importers. The Trump Administration has ramped up its tariff dividend rhetoric in recent days to hedge against a decision that does not rule in its favor. Rather than headlines solely being about tens of billions of dollars going back to U.S. firms, reactions are now more likely to be mixed as the administration can say that the Court struck down billions of dollars that would have been sent to the American people. Shifting the conversation to tariff rebates undoubtedly changes the public perception of the Court case as a ruling against IEEPA may be framed as a ruling against sending aid to low-income workers. It also bolsters the administration’s argument regarding the economic national security threat caused by striking IEEPA down.

Looking Ahead: The only way a tariff rebate policy would work is through widespread congressional support, similar to the stimulus checks sent out during the COVID pandemic. This means that any attempt to formulate a plan, debate a bill, and eventually pass legislation would take months. The Supreme Court is expected to have a final decision on IEEPA tariffs early next year and may expedite the release of the decision by the end of this year. The likelihood that $2,000 tariff dividends would be sent out before the IEEPA decision seems low, with the final decision almost certainly impacting any momentum the rebate has. Sending out tariff dividends before the Supreme Court makes its final ruling would put the federal government in a tough situation, as it would pay hundreds of billions of dollars to taxpayers in “tariff rebates” while also potentially being required to pay back most of the tariff revenue it has collected this year. This would spark major concerns over the budget deficit and U.S. debt, but allow the Trump Administration to blame any fallout on IEEPA tariffs being struck down.