The Shipment

February 5, 2026

India Deal and the Underrated Importance of Services

(Not So) Fun Fact: The European Parliament remains divided on the implementation of the U.S.-EU trade deal but is expected to hold a vote on the deal on February 24.

The India Trade Deal Finally Arrives

What’s Happening: On Monday, President Trump announced via Truth Social that a trade deal had been reached with India. According to the post, India has agreed to stop buying Russian oil and instead will purchase more U.S. and Venezuelan oil. This implies that the 25-percent tariff imposed on India for Russian oil purchases will be eliminated. Additionally, the United States has agreed to reduce its “Liberation Day” tariff from 25 to 18 percent while India commits to buying over $500 billion worth of U.S. products. India will also work to reduce tariff and non-tariff barriers, although no specifics were mentioned. Prime Minister Modi of India posted on X that he looks forwarding to working with the president going forward but provided no additional details.

Why It Matters: After months of waiting, the India trade deal marks a rather significant reduction in U.S. tariffs, bringing the tariff rate on Indian imports from 50 to 18 percent, (still far above the roughly 2 percent level where it stood before President Trump took office). This reduces annualized tariff costs by roughly $10 billion according to the Shipment’s calculations. Regarding the $500 billion “Buy American” commitment, it is unclear what India will be purchasing and over what time frame since in a typical year the country imports about $90–$100 billion from the United States. The U.S. energy component will be particularly important to watch as this may tie closely into future U.S. operations in Venezuela, as well as relations between Russia and India. Russia exports about a million barrels of oil to India every day, offering a substantial discount of up to $20 per barrel. If India were to fully halt oil purchases this would be a substantial blow to the Russian economy and a major tailwind for U.S. energy companies.

As predicted last week, the timing of the deal is no coincidence as it comes just a few days after the historic trade agreement between the European Union (EU) and India. In that free trade agreement, nearly all tariffs between the two trading blocs were reduced or eliminated, with specifics on what barriers will be removed provided in detailed fact sheets. Meanwhile, the White House has yet to publish anything that makes the U.S.-India deal even remotely official, nor is the deal likely to be submitted to Congress for a vote to ratify an agreement.

Looking Ahead: The Shipment eagerly awaits a fact sheet or executive order that sheds insight into the specifics of the India trade deal. Notably, there was no mention of investment into the United States by Indian companies, meaning the agreement will likely primarily deal with pushing U.S. exports and tackling the high barriers into the Indian market. If past deals are any indication, this will likely focus on lowering non-tariff barriers to U.S. agricultural and vehicle exports. It would also not be shocking if the sale of military equipment and Boeing planes were to be included as well.

Let’s Look at U.S. Service Exports

What’s Happening: When it comes to international trade and tariff policy, President Trump and his trade team often focus on the import and export of physical goods rather than services and digital products. There are several likely reasons for this, ranging from a focus on the U.S. trade deficit in goods, to the prioritization of creating U.S. manufacturing jobs – not to mention the fact it is easier to tax a camera than it is a movie production. The focus on goods, however, leaves out one of the important strengths of the United States, which is the export of services. For the last 54 years, the United States has maintained a trade surplus in services and in 2024, nearly 80 percent of the U.S. workforce was employed in services rather than manufacturing. Furthermore, close to 80 percent of the value added within the U.S. economy stems from service industries.

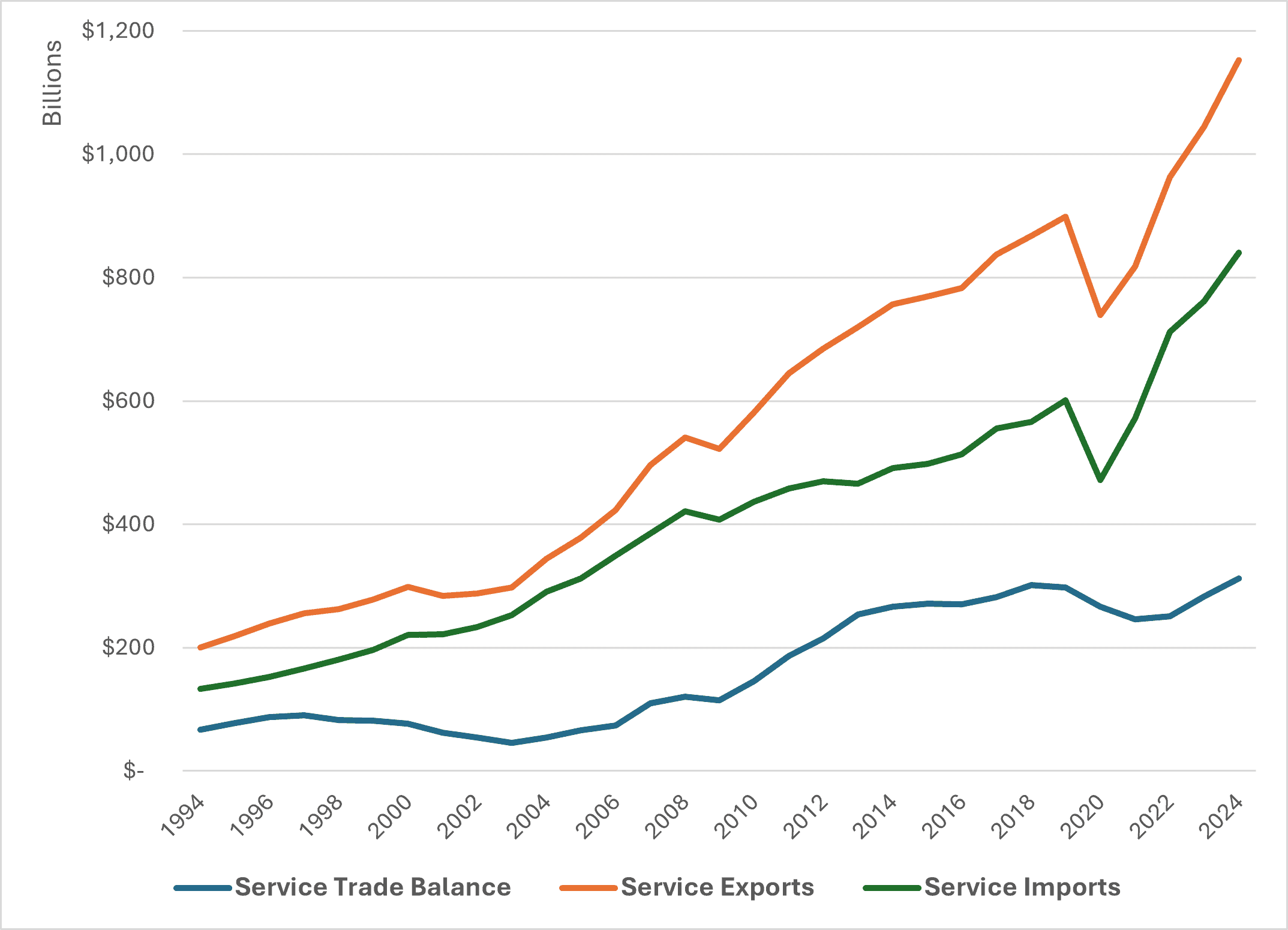

Why It Matters: In 2024, the United States exported over $1.1 trillion worth of services and had a services surplus of over $300 billion. Service exports account for a substantial portion of total exports with nearly every major U.S. trade partner, with the United States exporting more services than any other country in the world. Approximately 23 percent of these service exports include business services such as consulting, research and development, accounting, and advertising. The other major categories include travel, financial services, and charges for the use of U.S. intellectual property, which includes patents and licenses. Between the first and third quarter of 2025, service exports grew by $61 billion, with every major export category (except for government services) expanding. Imports grew at a similar rate, which may point to the relatively insulated position of services when assessing the impact of trade wars – at least so far.

It is important to consider the trade in services for a few reasons. The first is simply that the United States – as with all developed countries – has moved from manufacturing to services as the primary economic driver over the last few decades. This is reflected in the share of employment, gross domestic product, and innovation that can be attributed to services rather than manufacturing. The second is that – as these data illustrate – the United States dominates global services and holds a comparative advantage over other countries. Look no further than the world’s largest technology, banking, consulting, insurance, entertainment, and travel companies – nearly all of them are from the United States. This highlights a critical fact: Services are vulnerable to geopolitics and trade wars even if there has not yet been a direct retaliatory tariff. During trade tensions with the EU, the bloc threatened retaliatory measures against U.S. services that would restrict U.S. market access, meaning economic attacks on U.S. services are possible. The indirect impact of global consumers buying fewer U.S. products also impacts service exports. This appears to be the case for the U.S. travel industry as exports fell over 4 percent in the aftermath of “Liberation Day” between the second and third quarter of 2025 and fell 3 percent year over year. This tracks with other reporting that Canadians are boycotting vacations to the United States and data showing a nearly 8 percent drop in 2025 passenger traffic to the United States from Canada. If trends like this continue, it is the equivalent of billions in lost economic activity or a sort of “invisible” tariff that hurts the U.S. economy.

Looking Ahead: It is unlikely that the Trump Administration will shift its focus from manufacturing, mining, and energy any time soon. It may be important to remind the administration, however, that paying attention to services as well as goods could help in achieving their goal of boosting total exports. This means working to expand market access in other countries not just for agricultural or industrial products, but for U.S. companies that provide services from technology to banking. Given the advantages the United States holds in many of these arenas, getting foreign governments and companies to utilize these services will likely be an easier task than attempting to sell more beef or coal. Boosting service exports will better help the administration’s goal of reducing trade deficits due to the far greater value add these services provide.

Figure 1: Change in Service Export Value (Q1 through Q3 2024 and 2025, $ Millions)

Source: Bureau of Economic Analysis

Figure 2: U.S. Service Exports, Imports, and Trade Balance Since 1994 ($ Billions)

Source: Bureau of Economic Analysis