The Shipment

December 4, 2025

U.S.-UK Pharmaceutical Deal

(Not So) Fun Fact: The U.S.-based wholesale retailer Costco has filed a lawsuit against the Trump Administration to receive tariff refunds in the event the Supreme Court strikes down the International Emergency Economic Powers Act tariffs.

An Agreement in Principle With the UK

What’s Happening: On Monday, the United States Trade Representative (USTR), Department of Commerce, and Department of Health and Human Services announced an agreement on pharmaceutical pricing with the United Kingdom (UK). The UK’s National Health Service (NHS) has agreed to increase the net price it pays for new medicines by 25 percent and reduce the repayment rate owed by companies under the Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG). In exchange, the United States will exempt the UK from future Section 232 tariffs on pharmaceuticals, pharmaceutical ingredients, and medical technology as well as prevent any Section 301 investigations from targeting the UK pharmaceutical industry. This latest announcement follows up on the U.S.-UK Economic Prosperity Deal published on May 8, which included a 10-percent baseline tariff on imports from the UK as well as concessions on steel, aluminum, and automobile Section 232 tariffs. That agreement also stated that both countries would negotiate preferential treatment on pharmaceuticals and ingredients, with the UK agreeing to “improve the overall environment for pharmaceutical companies.”

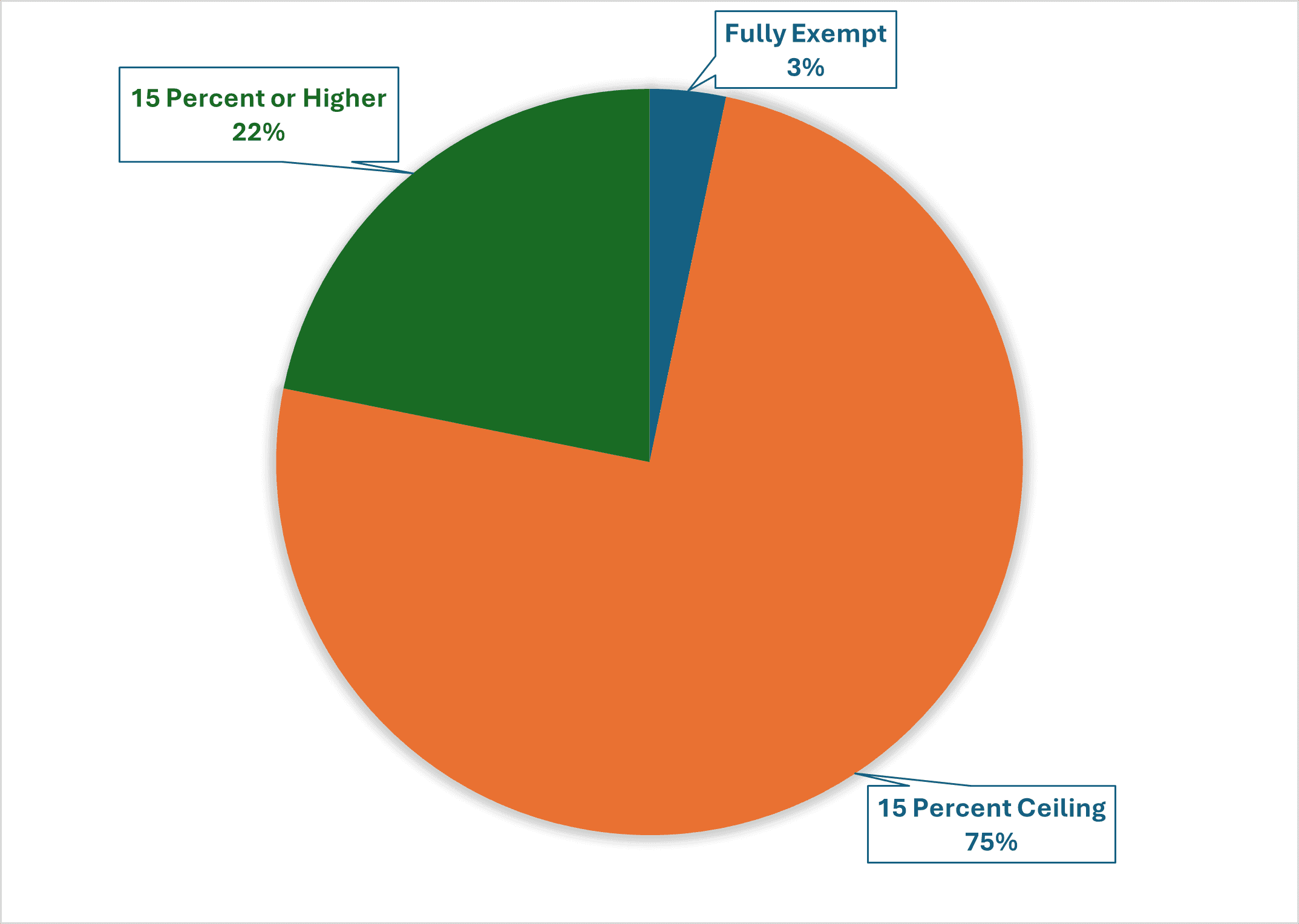

Why It Matters: In 2024, the United States imported approximately $212 billion in pharmaceutical products and pharmaceutical ingredients, with UK imports totaling close to $7 billion. While this deal will reduce expected tariff costs, it exempts just 3 percent of all U.S. pharma imports. The remaining 97 percent of such imports – excluding generics – will be subject to tariffs ranging from 15 percent to as high as 100 percent according to President Trump’s past threats. Currently, the European Union, Japan, South Korea, Switzerland, and Liechtenstein have secured trade deals that limit pharma tariffs to 15 percent, accounting for 75 percent of all U.S. pharma imports (See Figure 1). Assuming these Section 232 tariffs are implemented as threatened, the Shipment estimates an effective tariff rate of 13 percent on pharma products (although it will likely be far lower once generic pharmaceutical exemptions are factored in). This elevated tariff rate would drastically increase costs within the health care and medical industries, which have incurred $294 million in tariff costs between January and August 2025 (there were $0 tariffs paid in 2024).

The agreement will also impact the UK’s health care system as the NHS has agreed to increase the net price paid for branded medicines by 25 percent, which could increase NHS spending on medicines from 9–12 percent of its budget. Perhaps the biggest news, however, is the planned reduction of the VPAG in 2026 from 23–15 percent. The VPAG acts as a sales tax or rebate paid by drugmakers to the NHS if a company exceeds its allowed sales growth. For example, if a company’s allowed sales are $20 billion but actual sales reach $22 billion, then that company’s repayment/rebate rate will be around 9 percent to collect the excess sales revenue. Lowering the rebate is a win for the pharmaceutical industry as its overall sales should effectively face a lower sales tax. This could have positive spillover effects for the U.S. health care system as companies that are able to earn more in the UK may be able to lower prices in the United States. That said, it would be just a drop in the bucket for the administration’s overall goal of reducing the share of global health care costs borne by the United States.

Looking Ahead: The “Agreement in Principle with the United Kingdom on Pharmaceutical Pricing” may indicate that deals with other major trade partners are on the way. The Trump Administration has repeatedly expressed dissatisfaction with other countries – particularly those in the European Union – that pay far less for pharmaceuticals compared to many in the United States. Whether the claim that other countries are freeloaders of U.S. health care spending and drug innovation is accurate won’t make a difference. It is clear that the administration will use trade as a weapon in its arsenal, meaning other countries will have to provide concessions of some sort if they want lower tariffs.

Figure 1: U.S. Pharmaceutical Imports by Trade Partner Section 232 Tariff Rate

Source: Dataweb; Annex II (2024 data, specific generic products will be subject to exemptions which will increase the fully exempt category going forward.)