Week in Regulation

February 11, 2019

Major Tax Rule Swings the Regulatory Budget

Last week marked yet another net-regulatory week in the pages of the Federal Register. A tax rule out of the Internal Revenue Service (IRS) drove most of the new costs. The most notable deregulatory action was a Department of Agriculture (USDA) measure on “Eliminating Unnecessary Requirements for Hog Carcass Cleaning.” Between both proposed and final rules last week, agencies published $11.4 billion in net costs, and increased paperwork burdens by 27.1 million hours.

REGULATORY TOPLINES

- New Proposed Rules: 48

- New Final Rules: 73

- 2019 Total Pages: 3,082

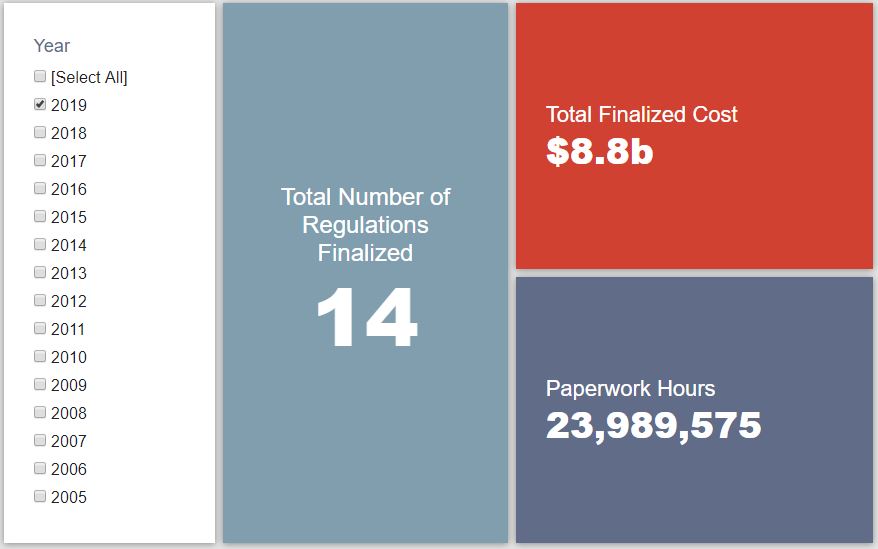

- 2019 Final Rule Costs: $8.8 Billion

- 2019 Proposed Rule Costs: $2.9 Billion

TRACKING THE REGULATORY BUDGET

The most significant IRS rule of the week finalized certain compliance requirements for the “Qualified Business Income Deduction” under the recent tax reform law. IRS estimates that the rule would bring approximately 25 million hours of paperwork and $1.4 billion in costs each year ($9.6 billion when converted to present value). Such a sum causes a substantial swing in the fiscal year (FY) 2019 regulatory budget established under Executive Order (EO) 13,771. There is, however, a caveat. IRS notes that the rule will also “reduce overall costs for taxpayers because some taxpayers would otherwise restructure their business arrangements in order to receive the benefit of the deduction.” The agency does not quantify these reductions. Furthermore, IRS deems this a “regulatory action” under EO 13,771, and thus the estimated costs still theoretically outweigh such savings.

Having handled tax regulations, our attention now turns to hog slaughtering. The deregulatory action out of USDA finalizes changes to hog carcass cleaning requirements. The primary amendment involves “removing the provision requiring the cleaning of hog carcasses before any incision is made preceding evisceration.” USDA estimates that this could save affected establishments roughly $11.8 million annually (or roughly $83 million in present value savings).

So far in FY 2019 (which began on October 1, 2018), there have been 28 deregulatory actions (per the rubric created EO 13,771 and the administration’s subsequent guidance document) against 11 rules that increase costs and fall under the EO’s reach. Combined, these actions yield quantified net costs of roughly $10.2 billion. This, however, includes the caveat regarding the baseline in USDA’s “National Bioengineered Food Disclosure Standard.” If one considers that rule to actually be deregulatory, the administration-wide net total is approximately $3.5 billion in net costs. The administration’s cumulative savings goal for FY 2019 is approximately $18 billion.

THIS WEEK’S REGULATORY PICTURE

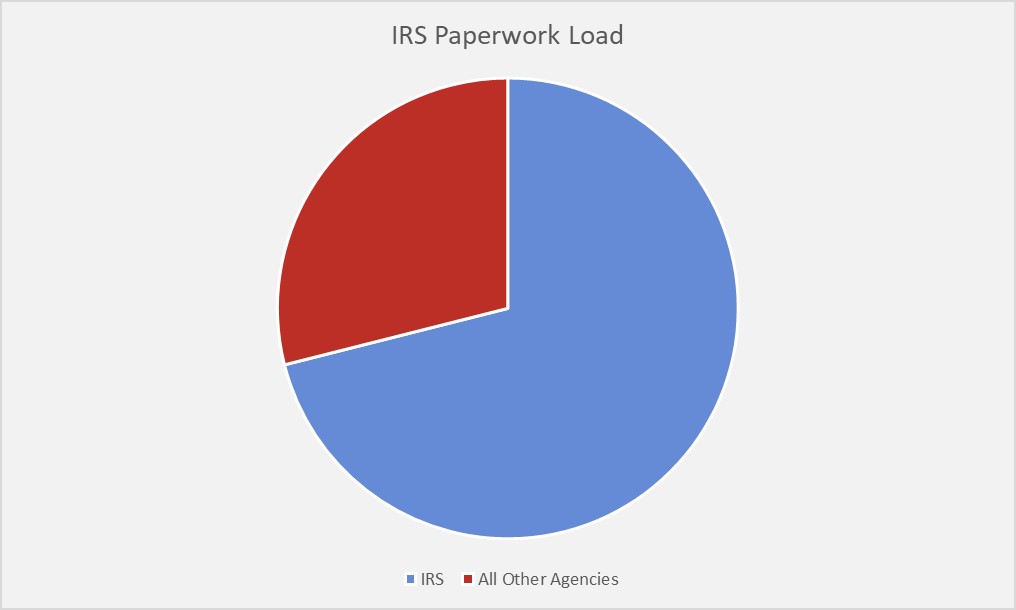

One can describe “regulatory policy” in many ways: mundane, opaque, monotonous, complex, legalistic. The list goes on. In order to help provide a clearer and more straight-forward view into this world, the American Action Forum (AAF) will seek to provide a brief illustration of a notable regulatory trend we have identified in a given week. This week’s entry: a look at how and why tax filing requirements dominate the country’s paperwork load.

As of last Friday, the total amount of paperwork across all agencies amounted to roughly 11.3 billion hours. The IRS alone is responsible for nearly ¾ of that total, clocking in at nearly 8.1 billion hours. For instance, the various forms required for the “U. S. Business Income Tax Return” take up more than 3.1 billion hours annually with $51.1 billion in estimated costs. Additionally, tax filings can often be extraordinarily complicated. The average IRS paperwork filing takes a little more than 2 hours (per this data). The per response average across all other agencies filings? Less than 2 minutes. Considering how broadly tax regulations affect the country, it’s easy to see how a single set of requirements could swing the overall totals.

TOTAL BURDENS

Since January 1, the federal government has published $11.7 billion in net costs (with $8.8 billion in finalized costs) and 23.6 million hours of net paperwork burden increases (including roughly 24 million hours from final rules). Click here for the latest Reg Rodeo findings.