Week in Regulation

April 15, 2019

Proposed Rule on Joint Employer Status Drops

Aside from two notable actions, last week’s regulatory activity was relatively ho-hum. In the pages of the Federal Register, the most significant rulemaking was a Department of Labor (DOL) proposal regarding “joint employer” status. Outside of the Federal Register, the Office of Management and Budget produced a memo regarding cost-benefit standards for independent agencies. Further details on that can be found here. Between both proposed and final rules last week, agencies published $389.9 million in total net costs and added 336,533 hours of new paperwork.

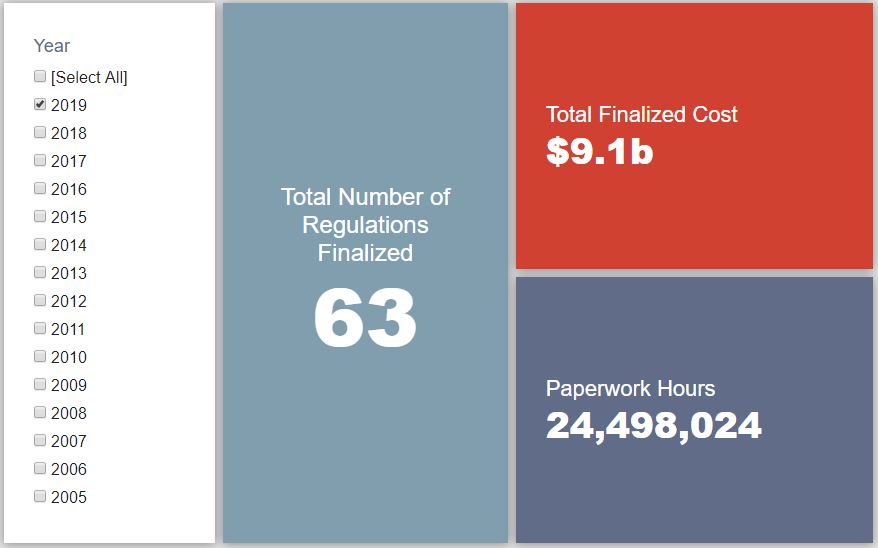

REGULATORY TOPLINES

- New Proposed Rules: 45

- New Final Rules: 66

- 2019 Total Pages: 15,048

- 2019 Final Rule Costs: $9.1 Billion

- 2019 Proposed Rule Costs: $5.5 Billion

TRACKING THE REGULATORY BUDGET

The DOL proposed rule seeks “to update and clarify the [Department of Labor’s] interpretation of joint employer status under the Fair Labor Standards Act.” It establishes a four-part test that looks at whether the employer in question: “Hires or fires the employee; Supervises and controls the employee’s work schedule or conditions of employment; Determines the employee’s rate and method of payment; and Maintains the employee’s employment records.” DOL has put this rulemaking forward as a response to actions under the Obama Administration that applied a more expansive interpretation of joint employer status.

The proposal is, in its current form, a curious case for cost-benefit analysis and regulatory budgeting. DOL deems it to be a deregulatory action under Executive Order (EO) 13,771, but in terms of quantified costs and benefits, it brings up to $412.1 million in regulatory familiarization costs. These costs do not yet apply to the fiscal year (FY) 2019 budget given its proposed rule status. Due to a lack of “data on the number of joint employers, and the number of joint employer situations that could be affected,” the agency discusses its burden-reducing aspects in qualitative terms, noting how a more consistent standard could help businesses’ long term planning and reduce their exposure to litigation. Interested parties have until June 10 to provide comments. Perhaps the public input process will provide DOL the data it requires to justify the rulemaking’s EO 13,771 status on a monetized basis.

In terms of final rules that did apply to the FY 2019 budget, there was one regulatory action and one deregulatory action. Both, however, were rather minimal in the overall scheme of things. The regulatory action was a Food and Drug Administration rule on the approval process for “Topical Antimicrobial Drug Products for Over-the-Counter Human Use” that brought nearly $1.8 million in costs. The deregulatory action was a Department of Defense measure to consolidate its Privacy Program, producing roughly $910,000 in total savings.

So far in FY 2019 (which began on October 1, 2018), there have been 39 deregulatory actions (per the rubric created by EO 13,771 and the administration’s subsequent guidance document) against 18 rules that increase costs and fall under the EO’s reach. Combined, these actions yield quantified net costs of roughly $10.1 billion. This total, however, includes the caveat regarding the baseline in the Department of Agriculture’s “National Bioengineered Food Disclosure Standard.” If one considers that rule to be deregulatory, the administration-wide net total is approximately $3.4 billion in net costs. The administration’s cumulative savings goal for FY 2019 is approximately $18 billion.

THIS WEEK’S REGULATORY PICTURE

One can describe “regulatory policy” in many ways: mundane, opaque, monotonous, complex, legalistic. The list goes on. In order to help provide a clearer and more straight-forward view into this world, the American Action Forum (AAF) will seek to provide a brief illustration of a notable regulatory trend we have identified in a given week. This week’s entry: the paperwork burden imposed by the Internal Revenue Service (IRS).

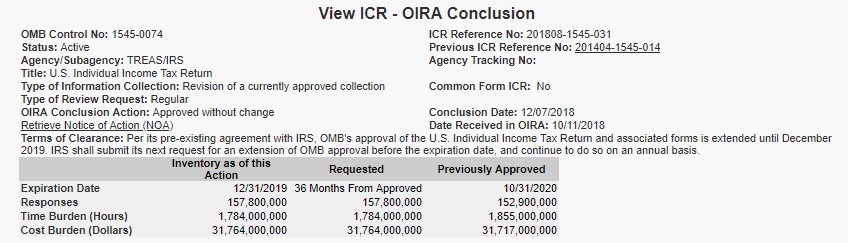

Many Americans likely spent part of this week scrambling to file their individual income tax returns ahead of the April 15 deadline. AAF released research showing that the annual cost of complying with all IRS paperwork is a projected $197.3 billion. This projection relies on Paperwork Reduction Act (PRA) data from OIRA.

The image above shows the PRA data for the U.S. Individual Income Tax Return, which more than 150 million filers submit annually. The return costs Americans a collective 1.8 billion hours per year, which OIRA values at $31.8 billion. Astoundingly, this return is only the second-most burdensome collection attributed to the IRS. The U.S. Business Income Tax Return accounts for 3.2 billion hours and $58.1 billion annually.

Compared to this time last year, two of the three major IRS paperwork burden metrics – cost and hours – remained steady. The total number of forms attributable to the IRS jumped double digits for the second straight year. There are now 1,337 unique forms from the IRS. Initial findings from the research suggest the Tax Cuts and Jobs Act has had little impact on the IRS’s paperwork burden so far.

TOTAL BURDENS

Since January 1, the federal government has published $4.6 billion in net costs (with $9.1 billion in finalized costs) and 25.2 million hours of net paperwork burden increases (including roughly 24.5 million hours from final rules). Click here for the latest Reg Rodeo findings.