Weekly Checkup

June 7, 2017

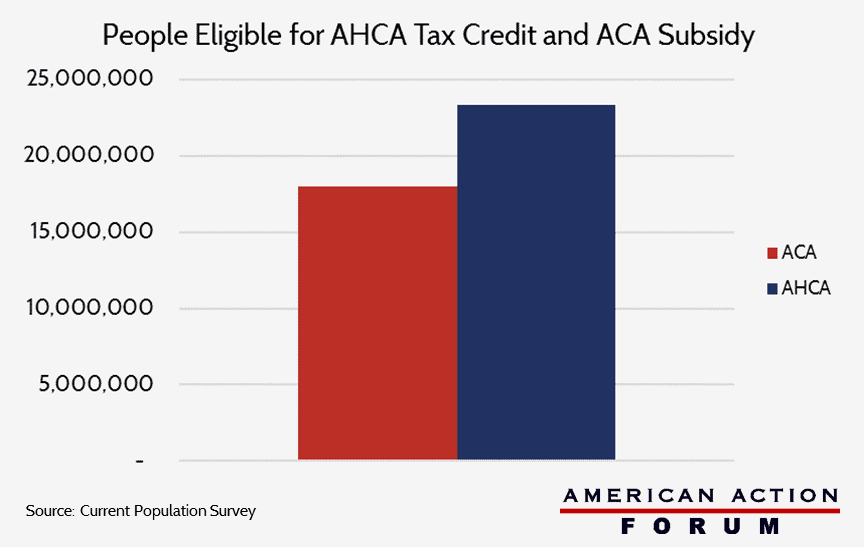

ACA and AHCA: Tax Credit Eligibility Differences

Among the current policies that the American Health Care Act (AHCA) would alter is the structure and eligibility of premium subsidies for the individual market. The AHCA replaces premium subsidies with an age-adjusted tax credit that is available to a wider range of incomes, including those who are currently in the so-called “coverage gap.” However, the tax credit retains the same basic eligibility determinations that currently constrain the premium subsidy. Generally, consumers that have access to public health insurance or were offered insurance through their employer are ineligible, along with undocumented immigrants and incarcerated individuals.[1],[2] Using the 2016 March supplement of the Current Population Survey, it was found that roughly 23.3 million people would be eligible some sort of tax credit under the AHCA—roughly 5.3 million people more than are currently eligible for premium subsidies provided by the Affordable Care Act.[3]

[1] https://www.congress.gov/115/bills/hr1628/BILLS-115hr1628eh.pdf

[2] The Kaiser Family Foundation’s estimates for illegal immigrants were used for this exercise and are available at: http://kff.org/health-reform/issue-brief/estimates-of-eligibility-for-aca-coverage-among-the-uninsured-in-2016/

[3] The March 2016 Current Population Survey (CPS) data and the 2016 ASEC March supplement were used in the calculation of each credit.