Weekly Checkup

June 22, 2017

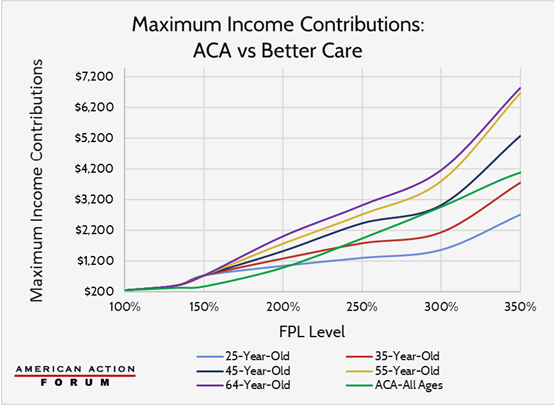

Comparing Income Contribution Levels of the ACA and Better Care

Earlier this morning the Senate released their discussion draft of the “Better Care Reconciliation Act of 2017,” their own updated version of the American Health Care Act (AHCA). So, what are the differences between the Senate’s tax credit and the Affordable Care Act’s (ACA)? First, the bill provides an extra adjustment for age to incentivize younger, healthier individuals to enroll in coverage; creating a healthier risk pool. Second, the credit phases out earlier—at 350 percent of the Federal Poverty Level (FPL). Third, this earlier phase out of the credit for higher earner allows credits to be made available to everyone below 133 percent, thereby filling the ACA’s coverage gap that impacted roughly 2.6 million low income Americans.[1] The graph below illustrates the difference between the Senate bill’s credits and the ACA’s.

[1] http://www.kff.org/health-reform/issue-brief/estimates-of-eligibility-for-aca-coverage-among-the-uninsured-in-2016/