Weekly Checkup

September 7, 2018

The Financial Crisis and Your Health Insurance Premiums

You’ll be unsurprised to learn that policymakers, health insurers, and consumers worry a fair amount about health insurance premiums. As a result, those in health policy circles spend a significant amount of time thinking about what drives health insurance premiums and what can be done to reduce them. Sometimes events totally outside of one policy silo, however, sneak over and gum things up in another. Such is the case with Dodd-Frank and health insurance premiums.

In the aftermath of the financial crisis, there were efforts on both sides of the Atlantic to prevent similar troubles from afflicting the financial sector in the future, with the United States passing the Dodd-Frank financial reform act. Thomas Wade, AAF’s director of financial services policy, has written a helpful piece explaining the process by which the United States and Europe have sought to align regulatory frameworks but, in so doing, may have done U.S. health insurers a disservice.

Health insurance as it exists in the United States doesn’t have a direct corollary in most EU countries. Further, health insurance functions differently than other forms of insurance, and the industry is not dependent on investment performance or large capital holdings to pay out claims. This is where Dodd-Frank comes into play—read Wade’s piece for a more detailed exposition of the history. For our purposes, though, the primary issue is something called “group capital requirements,” which the Federal Insurance Office—established by Dodd-Frank—is implementing as part of an agreement with European regulators.

A capital requirement is simply the amount of reserve capital an entity is required to keep to ensure it can meet its obligations and does not become insolvent. But group capital requirements are problematic for health insurers. Wade explains that the group capital requirement being demanded by EU officials, in the case of health insurers, would “also presumably factor in non-health subsidiaries. Extremely low risk health-related service entities – for example, those that provide medical IT – will also be assessed as part of this calculation. Overnight, health insurers will appear to be undercapitalized for entirely artificial reasons.”

The implications of this should be clear: Costs for U.S. insurers will rise, and those costs will be passed along in the form of higher premiums to consumers. This tradeoff might be worthwhile if it made sense for health insurers to be subject to a group capital requirement, but it doesn’t. The present situation is being driven by a combination of lack of understanding of the U.S. health care system across the Atlantic, and an apparent lack of awareness among U.S. regulators of the implications of the policy for health insurance.

Chart Review

Jonathan Keisling, Health Care Policy Analyst

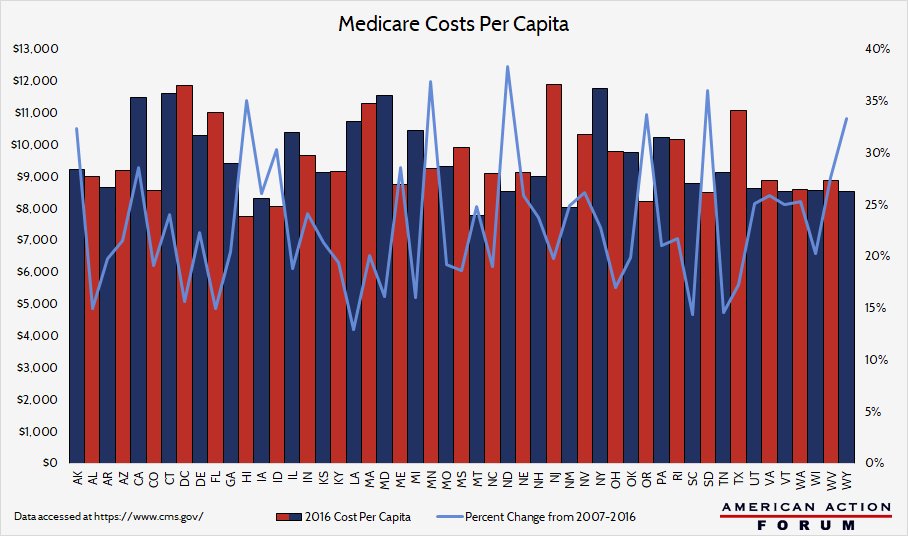

Policymakers have long faced the problem of geographic variation in health care costs. The graph below provides an overview of the geographic variation of health care costs by looking at each state’s Medicare costs per capita. New Jersey has the highest costs per capita and Hawaii has the lowest. While a useful starting point, this approach could understate or overstate costs, as the numbers reflect both costs and need—thus, New Jersey could have expensive care or a needy population, or (more likely) a mix of both. This graph indicates that several mid-Atlantic and New England states and California have high relative costs, but the data merit further inquiry.

From Team Health

Research: Understanding The Social Determinants Of Health

The United States overall takes a medicalized approach to health care, emphasizing medical treatment over other factors that influence health. Deputy Director of Health Care Policy Tara O’Neill Hayes and Rosie Delk examine the various “social determinants” of health and look at their implications for public policy.

Worth a Look

FierceHealthcare: Montana Health Co-op notches a victory in lawsuit over cost-sharing subsidies

Wall Street Journal: Walgreens to Offer Allergy Treatment Auvi-Q as EpiPen Shortage Persists

Axios: Tennessee Blues to stop covering OxyContin