Weekly Checkup

June 13, 2017

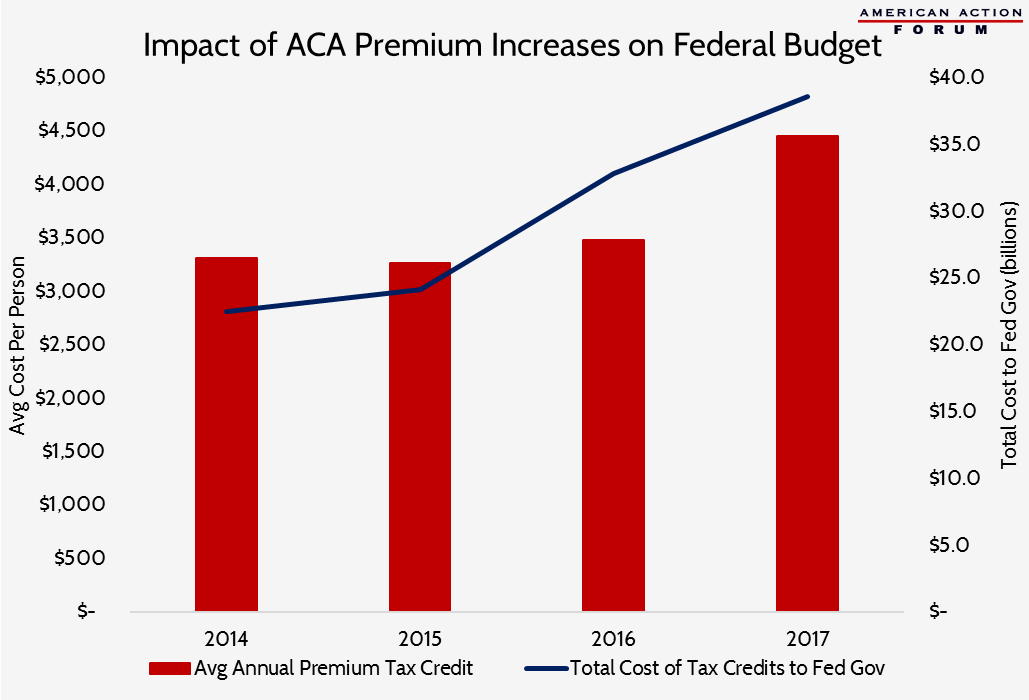

Impact of ACA Premium Increases on Federal Budget

Yesterday, the Centers for Medicare and Medicaid Services (CMS) released an updated report of effectuated enrollment in the Affordable Care Act (ACA) insurance exchanges. At the end of December 2016, 9.1 million individuals were enrolled in an exchange plan; as of March 15, 2017, effectuated enrollment stood at 10.3 million. Effectuated enrollment refers to the number of individuals who have not only selected a plan but have also paid their premiums. Each year, several million individuals initially select a plan but fail to pay for it, ultimately resulting in them losing their coverage. The Congressional Budget Office originally projected exchange enrollment would reach 21 million in 2016 and 23 million in 2017—more than double the number who actually enrolled. According to exit surveys conducted in 2016 regarding why individuals dropped their exchange coverage, 46 percent do so because of a lack of affordable options. In 2017, premiums in the individual market increased by 25 percent, on average. Because premium tax credits are tied to the cost of the plans available, the average tax credit increased by nearly $1,000 this year, resulting in an estimated annual total cost to the federal government of $38.6 billion. By the end of 2017, taxpayers will have spent more than $118 billion on ACA premium subsidies, and approximately $25 billion on cost-sharing reduction (CSR) subsidies.