Weekly Checkup

January 31, 2020

Inconsistency and Hypocrisy on an International Price Index

Next week is shaping up to be a big one in American politics: impeachment fallout, the Iowa caucuses, and the State of the Union address. We don’t know what the president will say when he stands in the same chamber where he was just impeached, but it’s likely that health care, and specifically drug prices, will be on the agenda. Rumors are swirling that the Trump Administration is rushing to propose rulemaking implementing its international price index (IPI) price-fixing scheme before or soon after the speech—potentially disrupting the chances of a legislative deal on drug prices. Yet beyond stymieing Congress, such a move would be inconsistent with the administration’s past statements on a similar Democratic proposal.

At the start of this year, the table for any drug-pricing action seemed set: The end-of-year spending package extended a number of federal health programs until May, intentionally creating an opportunity for must-pass legislation to which a deal on drug prices—and possibly surprise medical bills—could be attached. The menu for a deal was well established: The Grassley/Wyden bill; H.R. 3, the Pelosi-crafted drug legislation that passed the House last year; a package of health policies from the Senate HELP Committee that included a number of drug provisions; and some late entrants in the form of House Republicans’ H.R. 19 and a Senate bill mirroring much of it. But in the wings all along was the Trump Administration’s much-discussed IPI proposal.

Back in 2018, the administration issued a notice of proposed rulemaking spelling out a price-fixing scheme for drugs purchased through Medicare Part B. The American Action Forum (AAF) has written extensively about IPI, but in effect, the proposal would import foreign price controls on drugs and apply them to Medicare Part B. There are myriad issues with the specifics of the proposal, but of note, AAF has estimated the potential impact on revenues for the pharmaceutical industry at the equivalent of the development costs of three new drugs per year. Over 10 years this lost revenue could result in upwards of 30 fewer new medications. The policy is without a doubt anathema to most conservatives, but the Trump Administration has highly touted it.

Speaker Pelosi included a similar proposal—the average international market price (AIM)—in H.R. 3. Pelosi’s proposal is certainly more concerning: She would extend this price-fixing scheme to the entire U.S. pharmaceutical market—including commercial insurers—so the impact on innovation is substantially higher. But conceptually the two proposals aren’t that different.

So it’s awkward that the White House issued a statement of administration policy last year opposing H.R. 3, largely citing the AIM provisions. In the statement, the administration argued that H.R. 3 poses a threat to “continued medical innovation [and] will harm American patients in ways that far outweigh any benefits.” It further criticized H.R. 3 on the grounds that it “could lead to as many as 100 fewer drugs entering the United States market over the next decade” and “would reduce American’s average life expectancy by about four months.” The statement also argued the financial cost of worse health outcomes as a result of H.R. 3 could outstrip the bill’s estimated savings. The administration’s statement concludes, “Heavy-handed government intervention may reduce drug prices in the short term, but these savings are not worth the long-term cost of American patients losing access to new lifesaving treatments.”

Ultimately the most substantive difference between Pelosi’s AIM plan and the Trump Administration’s IPI proposal is a matter of scale. H.R. 3 applies to more of the U.S. drug market, but the two plans pull similar levers. It is simply not intellectually honest for the administration to push forward with IPI based on its own criticism of H.R. 3.

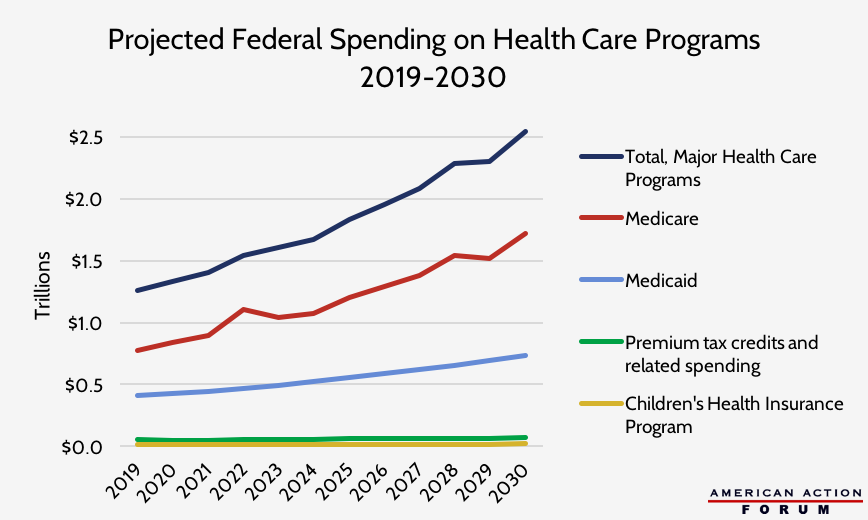

Chart Review: Projecting Federal Health Spending

Margaret Barnhorst, Health Care Policy Intern

The Congressional Budget Office’s (CBO) latest Budget and Economic Outlook projects that federal spending on major health care programs will more than double over the next 10 years. In 2019, federal spending on major health care programs was $1.3 trillion, and this sum will rise to $2.5 trillion by 2030. Outlays for major health care programs were 5.4 percent of gross domestic product (GDP) in 2019, and this rate will rise to 7.0 percent of GDP in 2030, driven mainly by Medicare. Both rising health care costs and an aging population are driving the growth in mandatory spending on federal health programs. CBO projects these spending trends will continue in the future under current law, with federal spending on health care programs reaching 9 percent of GDP by 2050.

Source: CBO’s Budget and Economic Outlook: 2020 to 2030

Worth a Look

New York Times: Trump Administration Unveils a Major Shift in Medicaid

Axios: Opioid death rate in the U.S. decreased in 2018