Weekly Checkup

April 9, 2021

March-In Rights and Drug Development

Back in January, before former President Trump left office, the National Institute of Standards and Technology (NIST) issued a proposed rule that would clarify the circumstances under which the federal government can exercise “march in” rights and seize a drug maker’s intellectual property (IP). The comment period on this proposed rule closed this week, and there is significant interest on the part of both progressive lawmakers and drug makers in how the Biden Administration will proceed. It’s worth reviewing the history and intent behind these march-in rights before assessing the value of this rule and the impact of withdrawing it.

Back in 1980, Congress passed the Bayh-Dole Act for the express purpose of more effectively commercializing federally funded research. Specifically, Bayh-Dole allows private entities to retain ownership of products they developed through the contracted use of federal patents, but this right of ownership is predicated on the condition that the product of the research is made available to the public on “reasonable terms.” In recent years there has been debate about the definition of “reasonable terms” and whether the price of an invention, specifically a pharmacological treatment, developed using federal patents licensed under Bayh-Dole could be used to justify the federal government exercising its march-in rights. Many on the left see Bayh-Dole’s march-in rights as a tool the federal government can and should use to constrain drug costs, arguing that if the government determines a treatment’s price to be too high, it can and should confiscate the IP and arrange for the drug to be manufactured and brought to market at a lower price. It should be noted, however, that both of the law’s original sponsors have stated that price was not intended to be a basis for march-in rights.

This debate is part of a larger argument over whether federal financing of basic research that serves as a foundation for many new medical treatments entitles the government to restrict the prices of those drugs. Determining exactly how much the federal government contributed toward the cost of a particular medication is difficult, but one 2019 study suggests that the National Institutes of Health (NIH) provided $100 billion in research funding that directly contributed to the development of 210 new drugs approved by the Food and Drug Administration between 2010 and 2016. At the same time, calculating total private sector spending on research and development (R&D) of new medical treatments is also difficult, but one estimate for total pharmaceutical industry R&D spending in 2010 alone was $67.4 billion, while total spending on R&D in 2019 is estimated to have been $186 billion. And a report released just this week, the Congressional Budget Office (CBO) found that R&D spending just by PhRMA member companies totaled $83 billion in 2019. For comparison, the entire NIH operating budget in 2019 was $39 billion.

Progressives are eager to focus on the important role of federally funded basic research in undergirding drug development as a justification for heavy-handed federal price controls, but they imply that research is a larger piece of the cost of development than it likely is. Based on the estimates above and assuming that industry R&D spending was flat from 2010 to 2016, which it certainly wasn’t, NIH research would have been equivalent to 21 percent of what the drug industry spent to develop new treatments over the same period.

Getting back to NIST and Bayh-Dole, the proposed rulemaking would clarify that, in fact, price alone is not a justification for the government to exercise march-in rights under the “reasonable terms” requirement. Thirty-seven Senate and House Democrats have written to the Biden Administration calling on them to withdraw the proposed rule. They are likely to find a friendly audience as Health and Human Services Secretary Xavier Becerra has himself previously advocated for the use of march-in rights.

Whatever the Biden Administration decides about the NIST rule, Bayh-Dole was enacted to enhance commercialization of publicly funded research. Using it to extract price concessions from drug makers is the opposite of that intent and risks upsetting an innovative partnership that has, among other things, allowed for the rapid development of COVID-19 vaccines over the past year.

The Impact of Sugar-Sweetened Beverage Taxes

Alexis Williams, Human Welfare Policy Intern

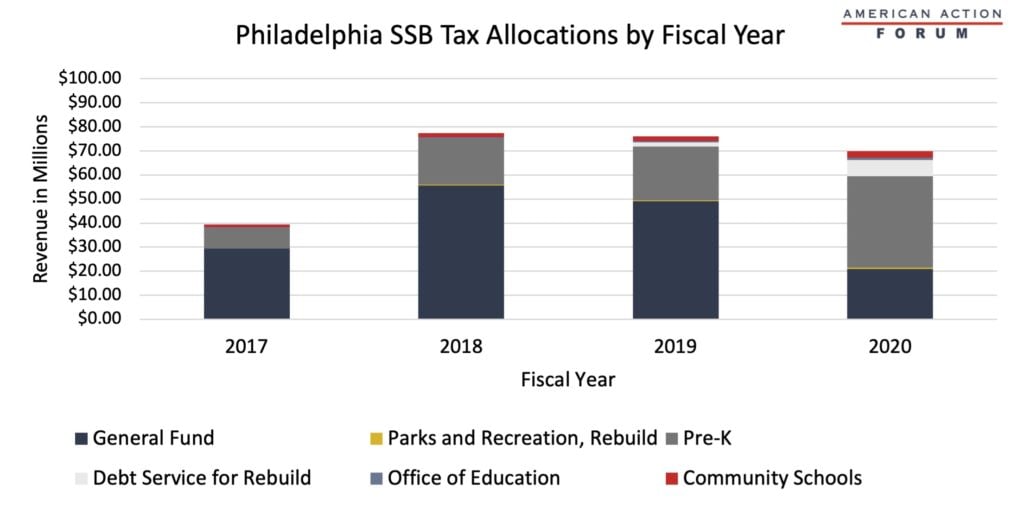

In recent years, several cities such as Boulder, San Francisco, Albany, Oakland, and Philadelphia implemented the Sugar-Sweetened Beverage (SSB) tax to combat the consumption of sugar. The World Health Organization recommends SBB taxes to prevent obesity and tooth decay and to reduce the consumption of sugar in adults and children. Obesity is associated with leading causes of death in the United States such as diabetes, heart disease, stroke, and some types of cancer. Additionally, minority populations make up a majority of those deaths, and these health issues contribute to health disparities in minority communities. Yet it is not obvious that these taxes either reduce consumption substantially or generate revenue to support the communities most impacted by obesity. When Philadelphia mandated the SBB tax, the city made nearly $40 million in tax revenue in its first year alone. The city reached its highest revenue year in 2018, making over $77 million, and on average made $70 million over the four-year span. The fact that SSB tax revenue has not dropped substantially, as the chart below shows, suggests that consumption is remaining high despite the tax. It does not appear the city targeted these revenues to relevant areas, either. As the chart shows, a majority of the funds raised through the SSB tax in Philadelphia have been directed to the General Fund. In the last four years, the General Fund received $156 million while Community Schools, Parks and Recreation and the Office of Education received $13 million collectively.

Source: Philadelphia Office of the Controller

Tracking COVID-19 Cases and Vaccinations

Ashley Brooks, Health Care Policy Intern

To track the progress in vaccinations, the Weekly Checkup will compile the most relevant statistics for the week, with the seven-day period ending on the Wednesday of each week.

| Week Ending: | New COVID-19 Cases: 7-day average |

Newly Fully Vaccinated: 7-Day Average |

Daily Deaths: 7-Day Average |

|

April 7, 2021 |

64,151 |

1,048,483 |

710 |

|

March 31, 2021 |

62,869 |

1,261,712 |

894 |

|

March 24, 2021 |

57,137 |

902,368 |

942 |

|

March 17, 2021 |

53,305 |

964,554 |

1,027 |

|

March 10, 2021 |

54,983 |

912,502 |

1,426 |

|

March 3, 2021 |

61,970 |

881,242 |

1,781 |

|

Feb. 24, 2021 |

66,506 |

819,443 |

2,036 |

|

Feb. 17, 2021 |

76,602 |

724,196 |

2,138 |

|

Feb. 10, 2021 |

103,485 |

679,341 |

2,782 |

|

Feb. 3, 2021 |

134,394 |

468,181 |

3,014 |

|

Jan. 27, 2021 |

161,941 |

363,306 |

3,301 |

Sources: Centers for Disease Control and Prevention Trends in COVID-19 Cases and Deaths in the US, and Trends in COVID-19 Vaccinations in the US

Note: The U.S. population is 330,188,834.

Worth a Look

Wall Street Journal: The People in This Medical Research Are Fake. The Innovations Are Real.

The Hill: Biden rescinds Trump-approved Medicaid work requirements in Michigan, Wisconsin