Weekly Checkup

June 29, 2018

Short-Term Insurance Scoring Roundup

In February, the Trump Administration released its proposed rule on short-term limited-duration insurance (STLDI) plans for health care. The rule would change the legal duration of STLDI plans from three months to 364 days, allowing them to function like traditional insurance. This rule, partnered with the individual mandate penalty of $0 beginning in 2019, will likely produce observable effects for the non-group insurance marketplace. STLDI plans do not need to comply with the Affordable Care Act’s insurance market reforms and therefore feature a narrower range of benefits partnered with premiums that are significantly lower on average.

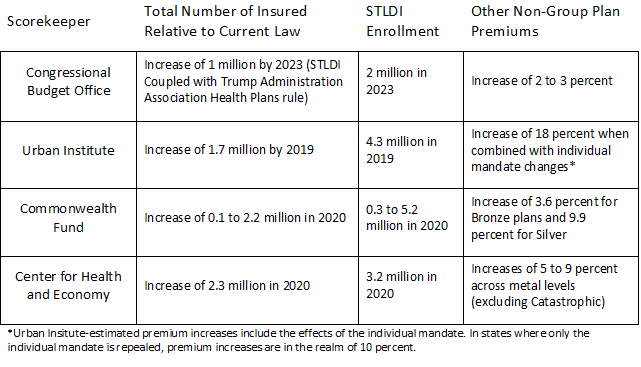

Multiple scorekeepers have weighed in on what effects the proposed rule might have.

Each of the analyses in the table above had its own set of assumptions and objectives. The Congressional Budget Office noted its results within its most recent baseline update. The Urban Institute and the Commonwealth Fund sought to analyze the STLDI rule, but they both also included in their analyses the combined effects of the new individual mandate penalty and the STLDI rule. Meanwhile, the Center for Health and Economy already included the new mandate penalty in their baseline and only considered the effects of the STLDI rule.

Correctly predicting the future is hard in general, and scoring STLDI plans presents its own peculiar challenges. The scorekeepers point out that this rule will affect every level of the insurance marketplace. Factors that could change include: insurers’ decisions to offer qualified health plans, insurers’ rate setting, risk-pool make up, consumer behavior, and STLDI plan designs themselves. Each score deals with these uncertainties differently, either by providing a range of outcomes or by outlining their assumptions.

What can be learned from the analyses? Despite the differences in the aims of each score and the magnitudes of its predictions, there seems to be a consensus that, by virtue of their low premiums, STLDI plans will be attractive to consumers, and thus enrollment will likely be in the millions. Each scorekeeper concludes that both those currently insured and the uninsured will purchase STLDI plans, and that premiums will rise in other non-group plans because some of those currently insured will shift into STLDI plans. Yet even though premiums for the rest of the non-group marketplace will rise, each scorekeeper expects non-group enrollment to increase overall.

Whether or not these outcomes ultimately prove good for consumers and the market, the administration’s new regulation on STLDI plans will be consequential.

Worth a Look

Health Affairs: Learning From Waiver States: Coverage Effects Under Indiana’s HIP Medicaid Expansion

Genetic Engineering and Biotechnology News: Cancer Metastasis Hobbled by New Compound

Axios: Kentucky and Florida insurers seek ACA rate hikes