Weekly Checkup

July 9, 2021

Who’s Afraid of the Big Bad Price Transparency?

One of the few health care initiatives of the Trump Administration that has remained intact under President Biden is the 2019 price transparency rules from the Centers for Medicare and Medicaid Services. To summarize, hospitals have to post their rates for a given set of services, including rates negotiated with insurers. This rule went into effect on January 1, 2021 for hospitals, with a similar rule for insurers set to go into effect in 2022. This rare bout of bipartisanship is fueled by the conservative belief that transparency in markets leads to better, more economical decisions by consumers, while progressives worry that a lack of transparency fosters price gouging. Despite the bipartisan popularity of this rule, hospitals have put a substantial amount of effort into fighting its implementation.

As my colleague Christopher Holt has noted previously, price transparency is not the silver bullet its proponents have proclaimed it to be. Insured patients are limited to providers that are in-network and to the rates their insurers have negotiated. Patients paying cash might theoretically see more benefit from price transparency, but the ability of a single patient to negotiate with a hospital’s team of lawyers is notoriously limited. Additionally, price transparency may bring prices across hospitals closer together, but that doesn’t mean they’ll settle at the lowest price. Price transparency is thus unlikely to affect hospital revenues in a serious way. So why have hospitals put so much effort – from massive court challenges to hiding the pricing data from search engines to flat out non-compliance by 44 percent of short-term, rural, and children’s hospitals – into fighting this rule?

The answer is simple: Hospitals fear the political fallout. A series of Wall Street Journal articles looking at the new data from the transparency rule have found that many hospitals were charging uninsured patients significantly more than rates provided to insurance companies, Medicare, or Medicaid. This revelation doesn’t come as a surprise to the health industry; insurers and government payers bring volume and negotiate discounts for bringing that volume. But the extent of the difference – fees for uninsured care were on average 3.6 times greater than those paid by Medicare Advantage – is likely going to deliver a black eye to hospitals in the court of public opinion. Within the health care industry, hospitals are more often seen as one of the good guys: They deliver your babies, treat your cancer, and generally seek to improve your health. Insurers just show up on your doorstep with a bill.

This new price transparency rule might make that image a little harder to maintain. If consumers start to notice their insurer isn’t at fault for the high cost of health care, they might begin to question other hospital practices that usually lack scrutiny – such as all that consolidation during the last couple of decades.

Video: Medicaid and CHIP Enrollment

AAF’s Director of Health Care Policy Christopher Holt explains why increased enrollment in safety net programs such as Medicaid and the Children’s Health Insurance Program (CHIP) isn’t necessarily a good thing.

Chart Review: Hospital Consolidation

Jake Griffin, Health Care Policy Intern

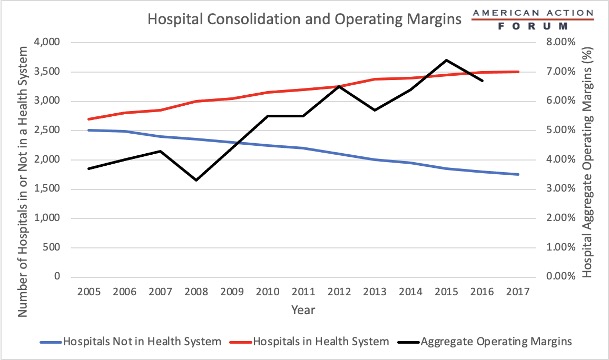

The health care system in the United States is full of concentrated markets due to both vertical and horizontal consolidation. For instance, three pharmacy benefit manager firms now account for over 77 percent of all managed prescription claims. As the graph below shows, hospitals are experiencing a similar dynamic. The number of hospitals independent of health systems has steadily decreased between 2005-2017, with two-thirds of hospitals being a part of a larger system in 2017. Hospital aggregate operating margins have also increased overall during this period. The American Hospital Association claims that mergers in the hospital sector reduce patient costs, noting that research studies purposefully ignore the extensive impact of commercial insurance consolidation on increasing costs for hospitals. All told, the impact of hospital consolidation on patient care is mixed. While hospitals in health systems have access to more resources and technologies, research points to independent hospitals being better able to provide efficient care. Due to the financial impact of COVID-19 on smaller hospitals, hospital consolidation will likely continue to persist in the near future.

Sources: Kaiser and American Hospital Association

Tracking COVID-19 Cases and Vaccinations

Jake Griffin, Health Care Policy Intern

To track the progress in vaccinations, the Weekly Checkup will compile the most relevant statistics for the week, with the seven-day period ending on the Wednesday of each week.

| Week Ending: | New COVID-19 Cases: 7-day average | Newly Fully Vaccinated: 7-Day Average |

Daily Deaths: 7-Day Average |

| 7-Jul-21 | 14,884 | 175,560 | 153 |

| 30-Jun-21 | 12,832 | 311,203 | 205 |

| 23-Jun-21 | 11,616 | 399,592 | 244 |

| 16-Jun-21 | 12,307 | 618,928 | 293 |

| 9-Jun-21 | 15,374 | 723,585 | 353 |

| 2-Jun-21 | 14,987 | 517,046 | 387 |

| 26-May-21 | 22,270 | 814,771 | 458 |

| 19-May-21 | 27,911 | 1,057,665 | 524 |

| 12-May-21 | 34,803 | 1,269,784 | 565 |

| 5-May-21 | 45,357 | 1,464,311 | 595 |

| 28-Apr-21 | 52,145 | 1,499,399 | 625 |

| 21-Apr-21 | 60,941 | 1,519,569 | 638 |

| 14-Apr-21 | 68,423 | 1,771,170 | 641 |

| 7-Apr-21 | 64,037 | 1,595,390 | 625 |

| 31-Mar-21 | 63,845 | 1,382,384 | 731 |

| 24-Mar-21 | 56,779 | 970,350 | 731 |

| 17-Mar-21 | 53,190 | 1,030,847 | 876 |

| 10-Mar-21 | 53,999 | 960,164 | 1,147 |

| 3-Mar-21 | 60,977 | 919,119 | 1,406 |

| 24-Feb-21 | 64,222 | 849,023 | 1,779 |

| 17-Feb-21 | 73,722 | 747,414 | 1,941 |

| 10-Feb-21 | 99,868 | 704,795 | 2,376 |

| 3-Feb-21 | 128,982 | 487,284 | 2,726 |

| 27-Jan-21 | 159,005 | 338,317 | 3,167 |

Sources: Centers for Disease Control and Prevention Trends in COVID-19 Cases and Deaths in the US, and Trends in COVID-19 Vaccinations in the US.

Note: The U.S. population is 332,495,629.

Worth a Look

Kaiser Health News: Rural Ambulance Services Are in Jeopardy as Volunteers Age and Expenses Mount

Reuters: U.S. cases rising, mostly among unvaccinated – health officials