Insight

May 26, 2016

The U.S. Isn’t Losing at Trade

Presidential hopefuls on both the right and left share a common disdain for U.S. trade policy. Donald Trump and Bernie Sanders built their campaigns on anti-free trade rhetoric, both suggesting that trade has been “disastrous” for the country. Hilary Clinton, although less forceful in her opposition, has also come out against several major U.S. trade agreements. These candidates argue that opening up our nation to trade harms the economy and U.S. workers who must compete with foreign labor. Donald Trump in particular contends that trade is a competition, one that the U.S. is losing, because of our trade deficit with China, Japan, and Mexico.

These statements ignore the across-the-board benefits of economic growth generated by trade. They also disregard the dynamic nature of the labor market and its ability to adjust to trade by creating new, specialized, higher-paying jobs. Contrary to what Donald Trump may believe, the trade balance is not a measure of winners and losers; it is the difference between imports and exports. A trade surplus indicates that a country exports more than it imports, while a trade deficit means that imports exceed exports.

In trade, there is a common tendency to view exports as “good” and imports as “bad.” The problem with this understanding is that it discounts the value of imports. As economist Milton Friedman explained, “we cannot eat, wear, or enjoy the goods we send abroad … exports are the price we pay to get imports.”

Trade gives consumers and businesses access to goods and necessary inputs of production that are not produced in the U.S. Furthermore, goods imported from other countries are often available to consumers at lower prices than they would be if those goods were made in America. If the U.S. were to stop importing altogether and instead manufactured all goods at home, it might have a very large trade surplus. However, the cost of production would significantly increase and consumer prices would rise dramatically.

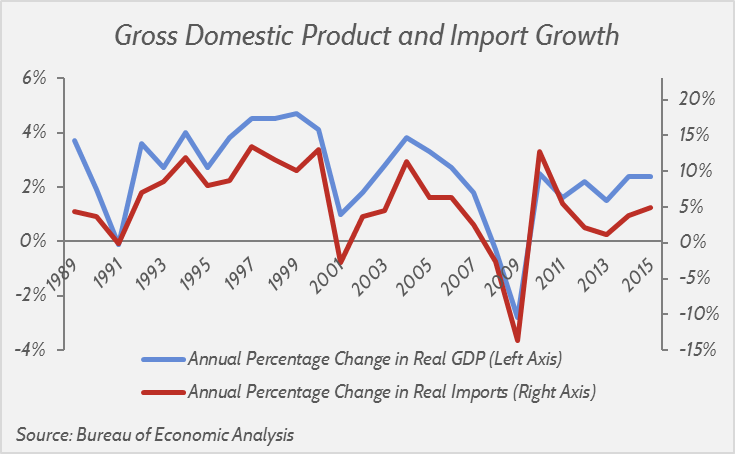

If imports are indeed valuable, we should expect the number of imports to rise in periods of strong economic growth. The chart below shows that this is exactly the case. Over time, growth in imports closely mirrors growth in Gross Domestic Product (GDP).

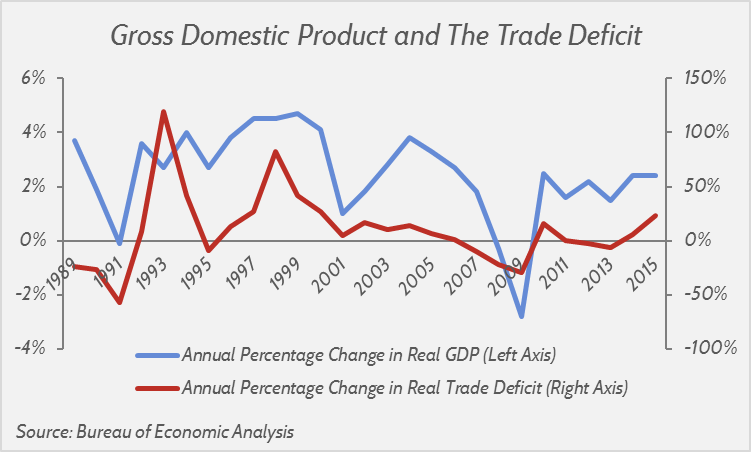

The above chart verifies that imports are not a weakness but a strength. As American citizens become wealthier, demand for imports rise. Conversely, import levels fall in times of economic decline. This drives a similar pattern in the trade balance, shown below.

The U.S. is a net importer, meaning it consistently imports more than it exports. However, just like the value of imports, the magnitude of its trade deficit varies with the state of our economy. This remains true regardless of how many trade agreements the U.S. signs. From 1989 to 2015 (pictured in the above charts), the U.S. entered into 13 trade agreements with 19 countries. These agreements did generate a rise in imports, but the resulting growth in the trade deficit did not harm the economy.

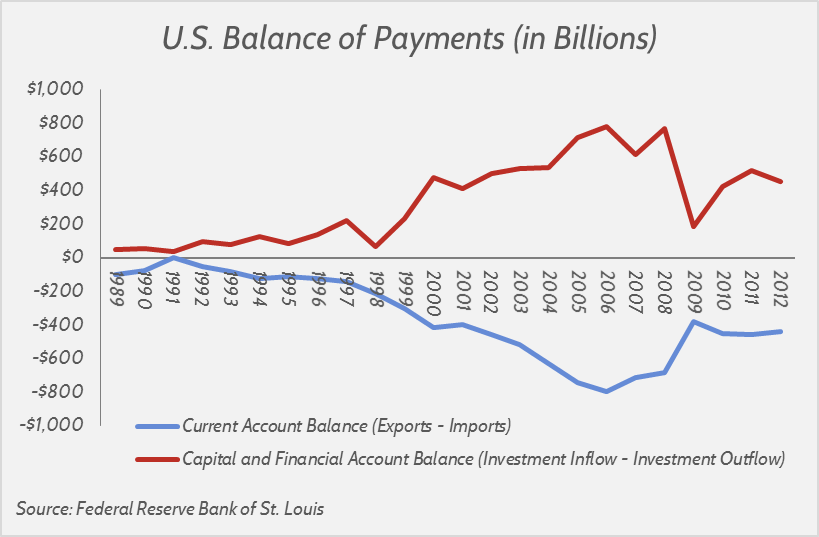

While the trade deficit does mean that the U.S. buys more goods and services than it sells, there is another component of trade that is often overlooked. The trade deficit is measured within the current account. The current account by definition must balance with the capital and financial accounts. It works like this: after U.S. firms import from abroad, foreign firms are left with U.S. dollars. To make a profit, those dollars are then invested back into U.S. assets such as real estate, stocks, bonds, and government securities. That inflow of investment creates a surplus in the capital and financial accounts. It would be wrong to talk about the trade deficit without also noting the corresponding investment surplus.

Prominent politicians have described the trade deficit as evidence that trade weakens the U.S. economy. The actual evidence, however, disproves this rhetoric. Both imports and exports contribute to economic growth; one should not be valued over the other.